Business Tax Registration Certificate Uk

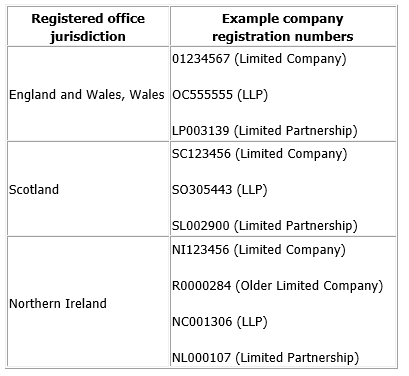

HMRC is working to resolve this issue and the target date is August 2019. Consist of 8 numbers or 2 letters followed by 6 numbers.

Uk Defers 30bn Vat Payments 2021 Repayment Schedule

Uk Defers 30bn Vat Payments 2021 Repayment Schedule

Your company number will.

Business tax registration certificate uk. This system will allow you to register your business and remit the appropriate permitlicense fees and receive a confirmation number for your filing. In the meantime it is recommended that a copy of the VAT registration certificate is printed before a business signs up to MTD for VAT. Business tax Construction Industry Scheme CIS.

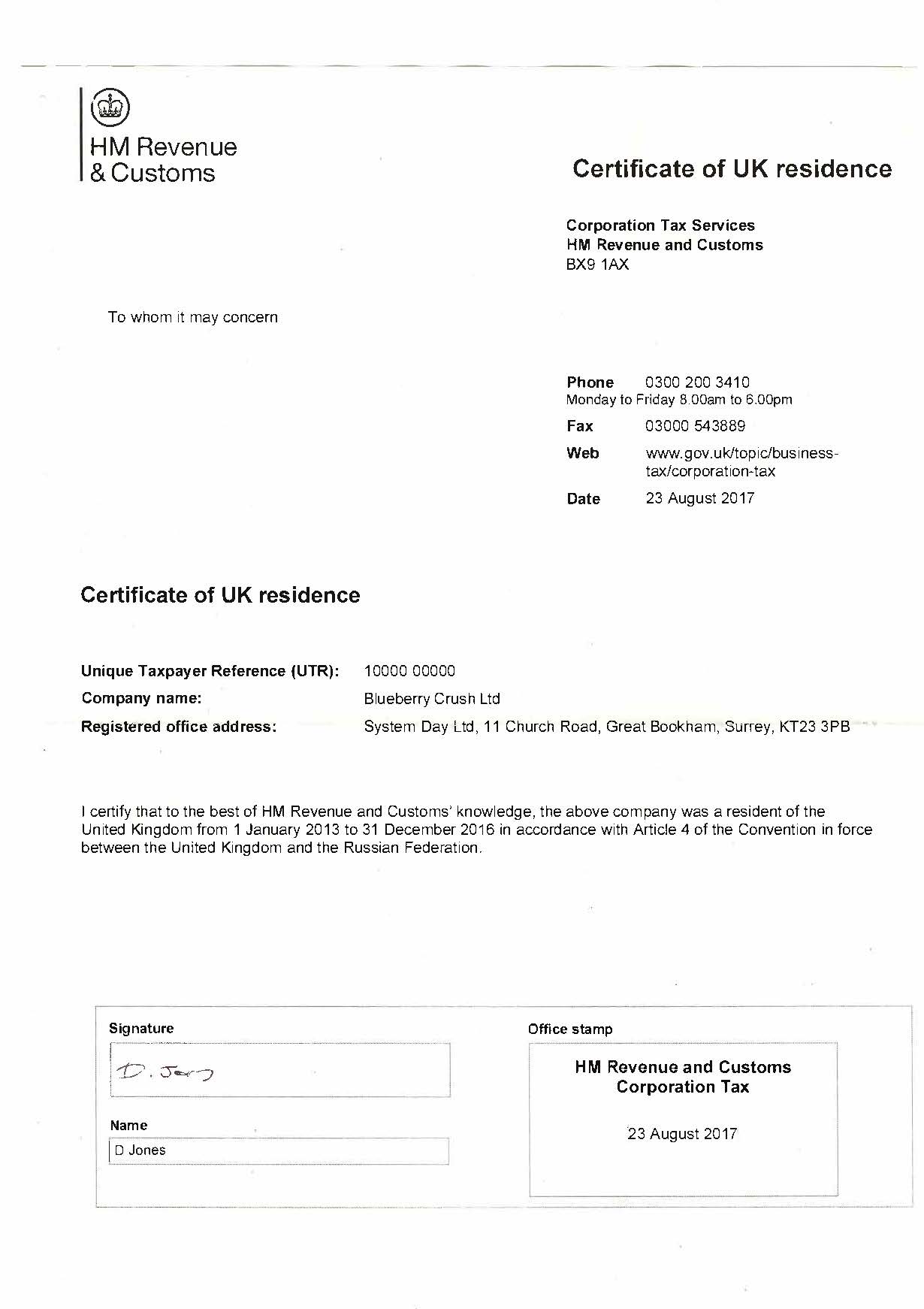

A Business Tax Certificate or business license is an official government business registration that authorizes your business to legally operate at the location. When you register youll be sent a VAT registration. The French tax office will require the appropriate forms to be completed and submitted with the following documentation.

The cheapest way to register a business is through the Companies House where it costs 20 payable to Companies House. The spanish university is asking for the certificate before they pay out as they would be in trouble if they paid at the lower rate without a cert. Overview You must register your business for VAT with HM Revenue and Customs HMRC if its VAT taxable turnover is more than 85000.

To help us improve GOVUK wed like to know more about your visit today. VAT registration certificates cannot currently be viewed online either by businesses or agents. The reason is if they have a certificate to prove this the withholding tax is reducedremoved.

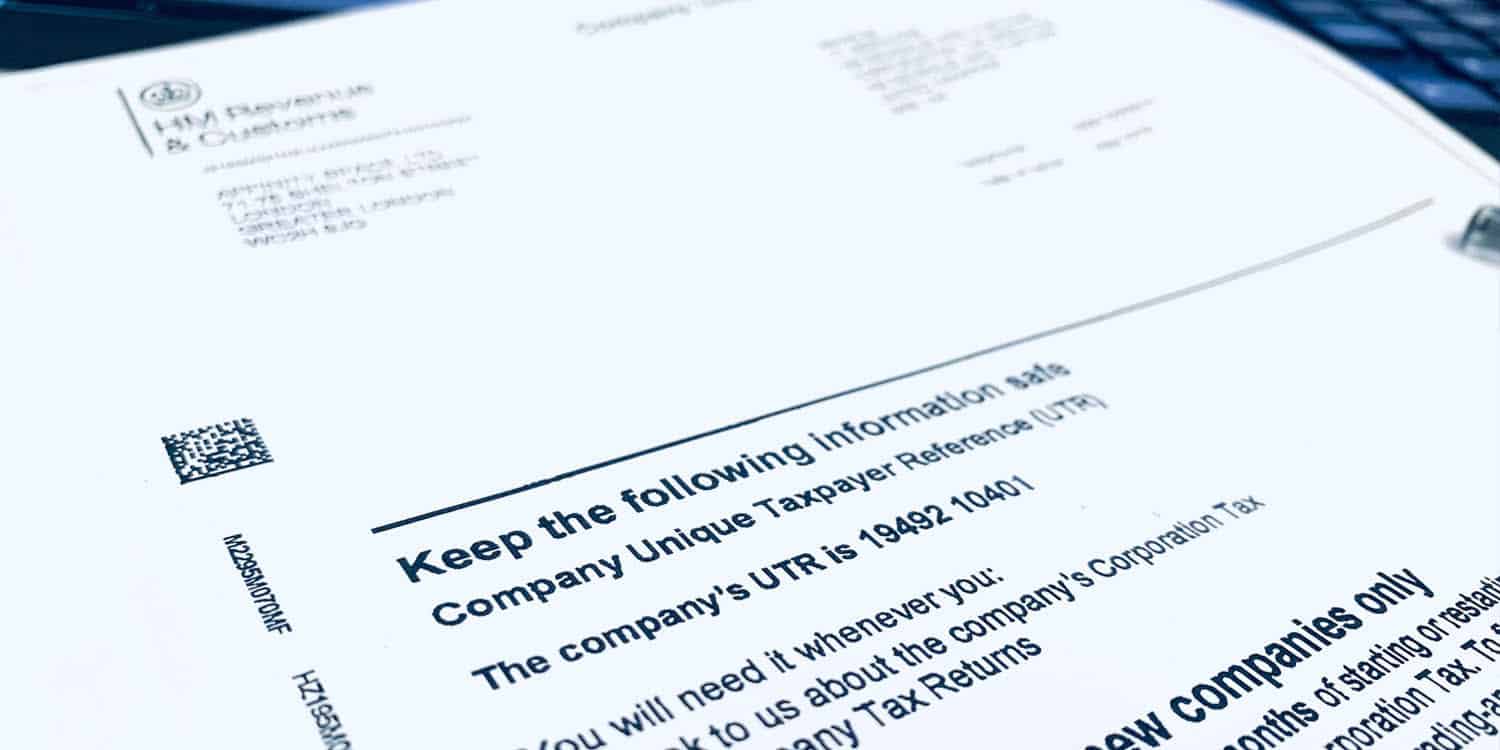

0123456789 and is issued by HMRC to anyone in the UK who completes a tax self-assessment. If youve already registered sign in to HMRC. The initial Business Tax Registration BTR fee of 20 covers a period of two years.

It allows your business to buy or rent property or services tax-free when the property or service is resold or re-rented. The renewal fee applies to all persons holding permits or certificates subject to the BTR provisions. A company UTR number comprises 10 digits eg.

Register for Corporation Tax Most companies register for Corporation Tax and PAYE as an employer at the same time as registering with Companies House. Online Business Registration System Welcome to the Online Business Registration System. In UK Companies TAX registration is your corporation tax reference AKA Unique Tax ReferenceUTR It gets automatically issued once you register a company with Companies House Revenue then issue a letter every year asking you to fill in.

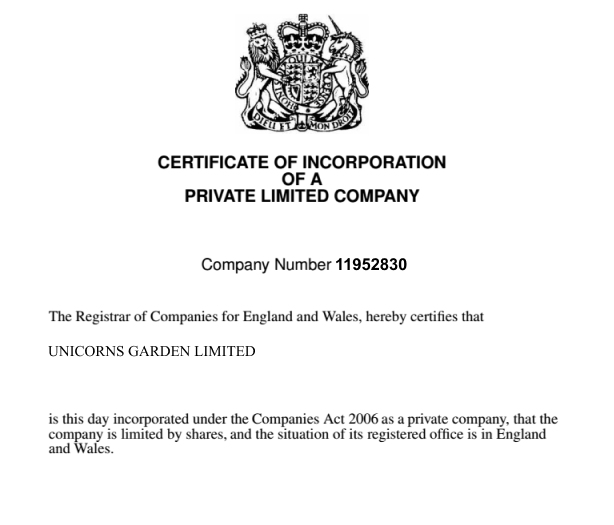

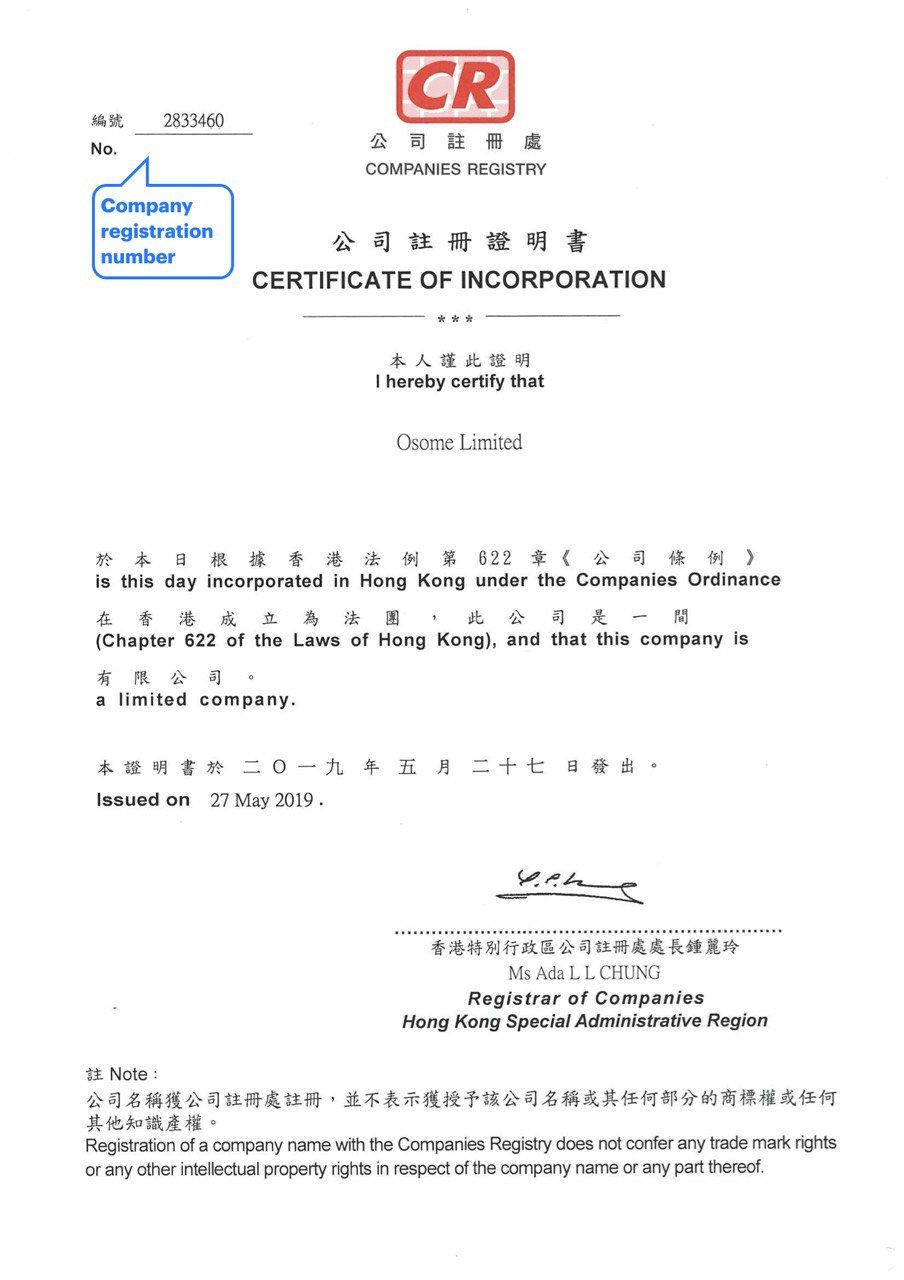

This certificate includes a few elements that explain a few things about the company. The company registration number or CRN. An extract from the companys national trade register.

Be used to identify your company and verify its legal existence. It does whether your business is a store commercial street mobile online or home business. At the end of that period a 10 BTR renewal fee applies for the next two-year period.

The company registration number is a unique combination of 8 characters issued by Companies House upon the successful incorporation of a new limited company in the UK. My BTR Certificate expires at. If youre a UK business registered for VAT that has paid VAT in another country and want to claim a VAT refund from the tax authority in that country you may have to provide them with proof about.

A sales tax certificate may also be called a resale certificate resellers permit resellers license or a tax-exempt certificate depending on your state. Alternatively you can get a same-day registration service for 50. The certificate is required to prove the taxpayer is resident and subject to tax in the UK.

First of all it contains a VAT registration number of VRN. UTR stands for Unique Taxpayer Reference. As the name suggests this is a simple identifier that provides information about the.

If you require witnesses for form 12 this is around 10. We can freely say that the VAT registration certificate serves as an official confirmation that comes from HMRC that your business is registered for Value Added Tax. See the Companies House website for a.

Well send you a link to a feedback form. VAT certificate to prove the business is registered for VAT elsewhere in the EU if appropriate.

Https Ec Europa Eu Taxation Customs Tin Pdf En Tin Subject Sheet 3 Examples En Pdf

Company Registration Number Crn For The Uk Explained Talk Business

Company Registration Number Crn For The Uk Explained Talk Business

Https Ec Europa Eu Taxation Customs Tin Pdf En Tin Subject Sheet 3 Examples En Pdf

What Is A Business Registration Certificate Kloss Stenger Gormley Llp

What Is A Business Registration Certificate Kloss Stenger Gormley Llp

Tax Id Issue Letter Ein Assignment Letter Tax Irs Federal Business Fake Organization Company Confirmation Letter Doctors Note Template Bank Statement

Tax Id Issue Letter Ein Assignment Letter Tax Irs Federal Business Fake Organization Company Confirmation Letter Doctors Note Template Bank Statement

Registered Address Services With Free Mail Forwarding Registered Address Ltd Business Address And Virtual Office Services London

Registered Address Services With Free Mail Forwarding Registered Address Ltd Business Address And Virtual Office Services London

Where To Find The Company Registration Number Crn

Where To Find The Company Registration Number Crn

Where Can I Find My Company Registration Number Crn

Where Can I Find My Company Registration Number Crn

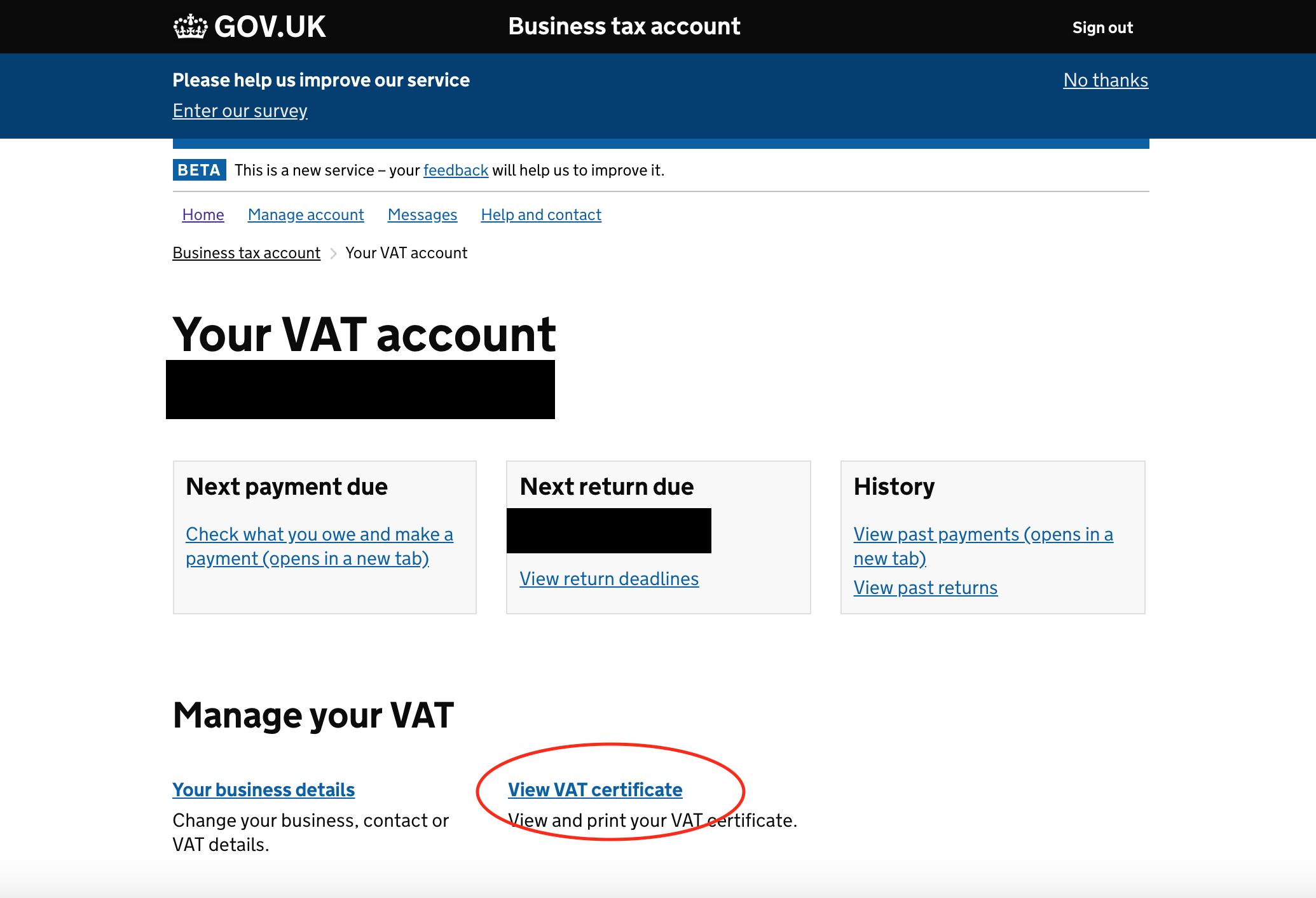

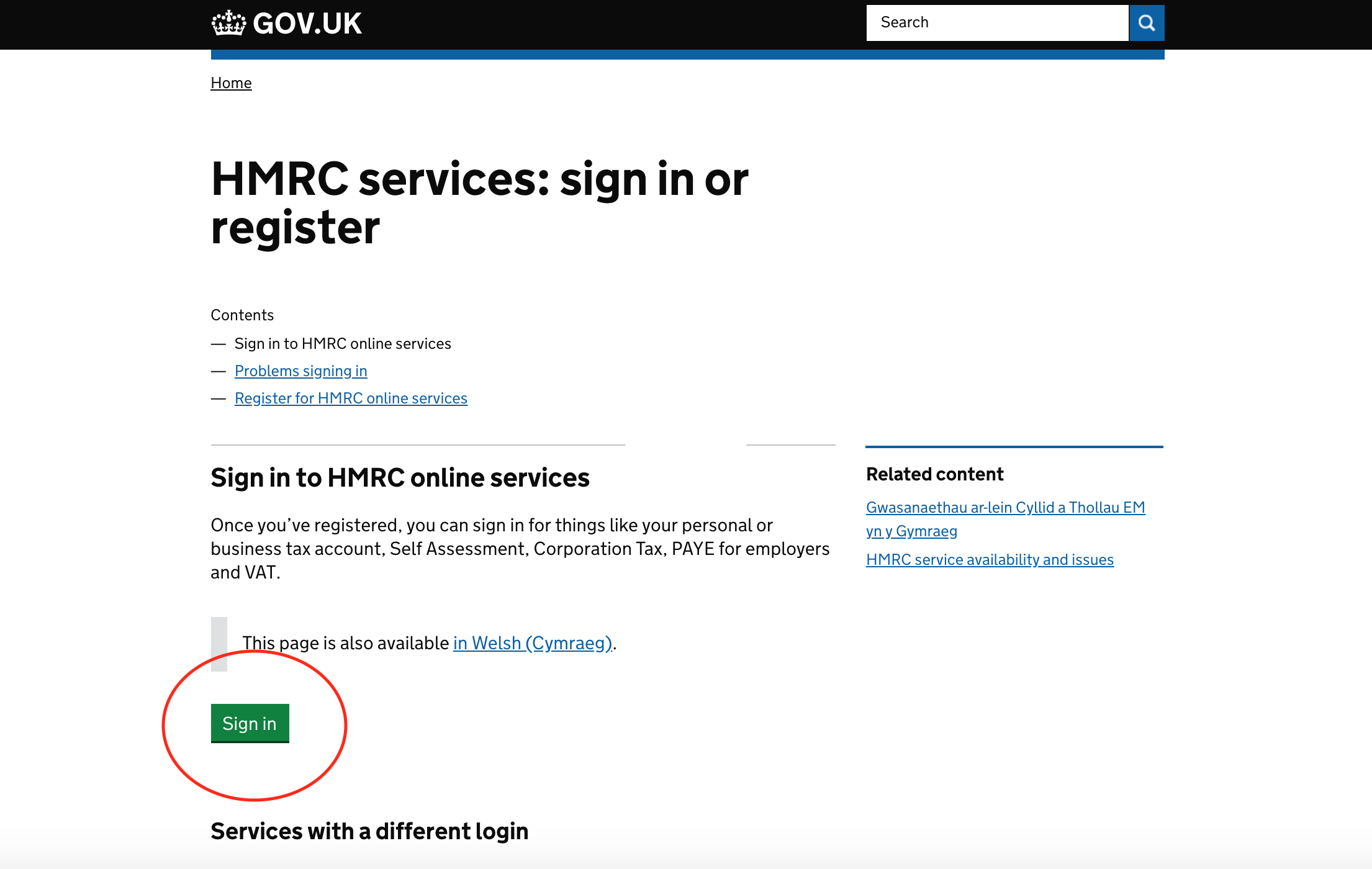

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

Business Registration Number In Hong Kong Definition Examples

Business Registration Number In Hong Kong Definition Examples

What You Need To Know When Applying For Your Uk Ancestry Visa

What You Need To Know When Applying For Your Uk Ancestry Visa

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

Company Registration Number Crn For The Uk Explained Talk Business

Company Registration Number Crn For The Uk Explained Talk Business

Company Registration Number What Is It

Company Registration Number What Is It

How To View Your Vat Certificate In 2020 Mtd Hellotax Blog

How To View Your Vat Certificate In 2020 Mtd Hellotax Blog

How To Get A Replacement Certificate Of Incorporation

How To Get A Replacement Certificate Of Incorporation