How To Calculate Turnover For Jobkeeper

This concession contained in the ATOs turnover test guidance is caveated by the statement that as a practical matter the ATO expects that taxpayers will use the GST reporting method that it normally uses for its JobKeeper turnover calculations. Businesses must use the same type of GST turnover calculation cash or accrual for both their nominated and comparison period.

Covid 19 The Federal Government Has Introduced The Jobkeeper Scheme To Assist Employers Coronavirus Covid 19 Australia

Covid 19 The Federal Government Has Introduced The Jobkeeper Scheme To Assist Employers Coronavirus Covid 19 Australia

Original decline in turnover test this is tested during enrolment and therefore you may have already satisfied this actual decline in turnover test for the relevant period if seeking payments under the JobKeeper extension period from 28 September 2020.

How to calculate turnover for jobkeeper. With calculating turnover for JobKeeper what is the best process to use. If a business does not meet the turnover test as at 30 March 2020 the business can start receiving the JobKeeper Payment at a later time once the turnover test has been met. 30 fall in turnover for an aggregated turnover of 1 billion or less 50 fall in turnover for an aggregated turnover of more than 1 billion or.

This is relevant for large business groupslisted companies. Identify the relevant comparison period. One of the key conditions to access the Jobkeeper payment is a decline in turnover of 30 or more for SMEs.

At the time you enrol in the JobKeeper payment scheme you need to confirm that your business in a relevant period has had or is likely to have a. Actual decline in turnover test. IT IS UNLIKELY THAT MY TURNOVER WILL DECREASE BY 30 PER CENT IN THE COMING MONTH BUT CAN I APPLY LATER IF MY TURNOVER DECREASES IN ONE OF THE SUBSEQUENT MONTHS.

There is also a modified basic test for group employer labour entities. Work out the relevant GST turnover. For JobKeeper fortnights from 28 September 2020 you will need to meet an actual decline in turnover test.

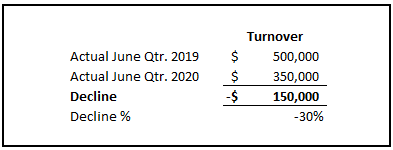

Practically this means comparing the monthly turnover for the same month in the previous financial year and determining whether the turnover has decreased by 30. Your business is not in one of the ineligible employer categories. Your actual supplies to date in the relevant month or quarter the supplies you are likely to make for the rest of the month or quarter.

Current GST turnover is the sum of the value of all taxable and GST-free supplies made during the period including any supplies made to other members of the same GST group. Those businesses with annual turnover greater than 1 billion must have experienced downturn of greater than 50 due to COVID-19 to be an eligible employer. The ATO notes that if a taxpayer normally accounts for GST on an accruals basis but calculates its JobKeeper turnover on a cash basis or.

Determine which shortfall percentage applies. You can satisfy the actual decline in turnover test in two ways the. The best report for calculating turnover would be a Profit and Loss report customised with a comparison period.

Determine if GST turnover has fallen by the specified shortfall percentage. In todays tutorial we cover how to calculate your GST turnover for JobKeeper registrationFor more information on what is included in GST turnover you can. Your current GST turnover for the relevant comparison period is the sum of the value of all taxable and GST-free supplies you made during that period.

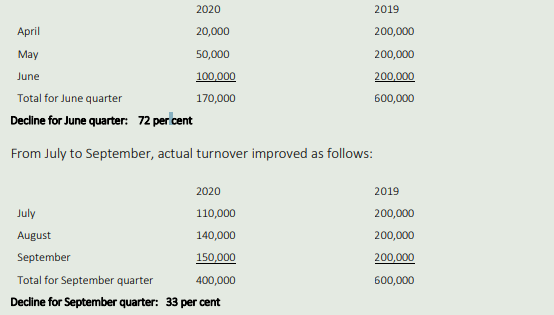

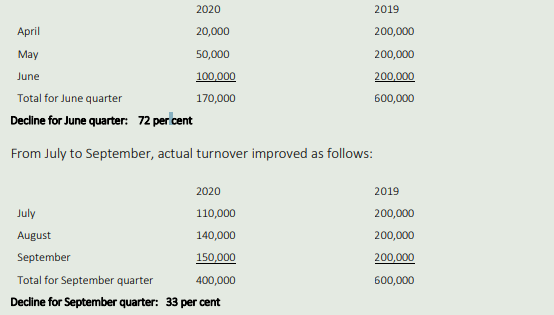

We have added a dedicated report that does this to assist with checking for JobKeeper eligibility which you can access by going to the Dashboard of your company editing the URL of the page to end with appjobkeeper and then selecting the Run report option in step 1. The turnover test period either one of the months from March to September 2020 or the June or September 2020 quarter has to be compared to the relevant period from 12 months earlier. For example if you qualify for the JobKeeper initiative in April 2020 the business monthly declaration will ask you to declare your GST turnover for April 2020 and the projected GST turnover for May 2020 - see example below.

Actual turnover will need to be reported to the ATO through your myGov account by the 7th of each month. If a business typically files on an accrual basis it will not be allowed to calculate GST turnover on a cash basis for the purposes of JobKeeper. Identify the test turnover period.

The actual decline in turnover test requires the employer to determine their current GST turnover for the relevant periods subject to the modifications in the JobKeeper rules. There have been 4 main modifications made to calculating GST turnover for job keeper. Projected GST turnover and current GST turnover are calculated for the relevant month or quarter being tested rather than for 12 months where an entity is part of a GST group the entity calculates its GST turnover as if it wasnt part of the group.

However to calculate your projected turnover you will need to calculate. When you assess your eligibility for the JobKeeper payment you are looking at your eligibility for a particular fortnight. Calculating Your Turnover for the JobKeeper Payment Scheme.

Your projected GST turnover during a turnover test period is the sum of the value of all taxable and GST-free supplies you have made or are likely to make during that period. Eligibility for the Federal Governments JobKeeper payments is dependent on an organisations ability to demonstrate a specific minimum decline in turnover d.

Check Actual Decline In Turnover Australian Taxation Office

Check Actual Decline In Turnover Australian Taxation Office

Jobkeeper 2 0 What We Know So Far Pmwplus

Jobkeeper 2 0 What We Know So Far Pmwplus

Step By Step Guide To Jobkeeper And Xero Digit

Step By Step Guide To Jobkeeper And Xero Digit

How To Calculate The Jobkeeper Alternative Tests

Calculating Jobkeeper Gst Turnover In Xero Youtube

Calculating Jobkeeper Gst Turnover In Xero Youtube

Step By Step Guide To Jobkeeper And Xero Digit

Step By Step Guide To Jobkeeper And Xero Digit

Https Rocg Com Wp Content Uploads Jk 2 Decline In Turnover Test 1 Pdf

Financial Relief Jobkeeper During Coronavirus Covid 19

Financial Relief Jobkeeper During Coronavirus Covid 19

Jobkeeper Payment What Business Owners Need To Know Walsh Accountants Gold Coast Accountants

Jobkeeper Payment What Business Owners Need To Know Walsh Accountants Gold Coast Accountants

Jobkeeper For Sole Traders How To Make A Business Monthly Declaration Airtax Help Centre

Jobkeeper For Sole Traders How To Make A Business Monthly Declaration Airtax Help Centre

Jobkeeper Determining Decline In Turnover Using Cash Or Accruals

Jobkeeper Determining Decline In Turnover Using Cash Or Accruals

Ato Changes Advice On Inclusion Of Jobkeeper For Calculation Of Aggregated Turnover Rsm Australia

Ato Changes Advice On Inclusion Of Jobkeeper For Calculation Of Aggregated Turnover Rsm Australia

Http Www Afta Com Au Uploads 847 Covid 19 Jobkeeper Enrolment Final 22 April 2020 Pdf

Calculating Jobkeeper Payment For Employers And Employees Rsm Australia

Calculating Jobkeeper Payment For Employers And Employees Rsm Australia

Calculating Jobkeeper Payment For Employers And Employees Rsm Australia

Calculating Jobkeeper Payment For Employers And Employees Rsm Australia

Pitcher Partners Jobkeeper 2 0 Calculating Gst Turnover And 10 Decline In Turnover Certificates Youtube

Pitcher Partners Jobkeeper 2 0 Calculating Gst Turnover And 10 Decline In Turnover Certificates Youtube