Does Mileage Reimbursement Count As Income

Therefore if your actual expenses exceed the standard IRS rate you should itemize your deductions to deduct the excess. The IRS requires employers to maintain proof of reimbursement expenses deducted on company tax returns.

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Is A Car Allowance Or Mileage Reimbursement Taxable Income

While it is permitted to reimburse employees at any rate reimbursements in.

Does mileage reimbursement count as income. In particular you seek clarification of 4161123b3 which reads in part We include less than you actually receive if part of the payment is for an expense you had in getting the payment ow we count unearned income provides when a Supplementål Securi 416. If your employer reimburses mileage they can use a reimbursement rate thats higher or lower than the federal guidelines. Is mileage reimbursement required by law.

Care or reimbursement for costs incurred for such care under the Child Care and Development Block Grant Act of 1990 42 USC. Just know that any reimbursement above the standard mileage rates is taxable. If the employee receives expense reimbursement from the employer and cannot provide receipts or other documentation to back up the reimbursement the IRS will consider the reimbursement taxable income for the employee.

Nonetheless states like California and Massachusetts do have a mileage reimbursement rate rule. Meal and entertainment expenses are only reimbursable if it can be demonstrated they had a clear business purpose. Answer The mileage tax deduction rules generally allow you to claim 0575 per mile in 2020 if you are self-employed.

Mileage reimbursement In California is critical. The IRS sets a standard mileage reimbursement rate. If its not an accountable plan the mileage reimbursement can count as taxable wages.

N Earned income tax credit EITC refund payments received on or after January 1 1991 including advanced earned income credit payments 26 USC. State unemployment insurance departments consider earnings to be reportable income for both figuring initial benefits and deducting part-time work and other earnings from weekly benefits. To have the reimbursement not hit their tax reporting first they must have provided substantial documentation and the payer must then make a full accounting of it on the business return.

Although you will pay income tax on your reimbursements you can deduct all mileage expenses despite receiving reimbursements. There is no required mileage reimbursement rate companies have to pay. Since an independent contractor is deemed to have their own business that expense is theirs to deduct.

You can claim 17. In the case of mileage reimbursement the dollar amount received is not taxable as income as long as it does not exceed the IRS limit which is 55 cents per mile in 2009. It depends on your employers reimbursement arrangement based on the two IRS allowable accountable and non-accountable plans.

Mileage accrued when driving to and from doctor visits the pharmacy and the hospital can all count toward a medical deduction. You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons. Reimbursements based on the federal mileage.

For 2020 the federal mileage rate is 0575 cents per mile. The non-accountable plan counts the money as income. You will need to pay income tax on it and theres always the possibly it pushes you into a higher tax bracket.

Payments by an employer that are reimbursement specifically for travel expenses of the employee and are so identified by the employer at the time of payment. Taxable income can be reduced especially when it comes to mileage reimbursement. Standard mileage reimbursement rate is exceeded.

If the mileage is a valid business expense and has not passed this test the person deducts the mileage. The IRS hasnt set any official mileage reimbursement rules. After all there are several things the IRS classifies as taxable income including things like lottery winnings and jury duty fees.

A reimbursement that results in a taxable benefit to the individual under the Income Tax Act the ITA is in reality remuneration or income of the individual. For figuring base pay earnings is straightforward -- the full amount of compensation that your former employer paid you. A car allowance is considered as taxable income but the mileage driven may be tax-deductible.

The following types of earnings income or losses do not count as earnings from employment or self-employment under the earnings test. But theres a silver lining. Of the Code of Federal Regulations 4161123 How we count unearned income.

Get every deduction you deserve TurboTax Deluxe searches more than 350 tax deductions and credits so you get your maximum refund guaranteed. Here at Motus we understand that taxable income is a tricky thing to wrap your head around. As income the payment is not subject to the GSTHST and hence not eligible for purposes of determining an input tax credit ITC or rebate entitlement under the Act.

Note that for reimbursements above the IRS mileage rate the IRS considers the excess as taxable income.

Mileage Reimbursement Rules For Uber Drivers And Turo Owners

Mileage Reimbursement Rules For Uber Drivers And Turo Owners

The Basics Of Employee Mileage Reimbursement Law Companymileage

The Basics Of Employee Mileage Reimbursement Law Companymileage

How Much To Reimburse For Employee Mileage Timesheets Com

How Much To Reimburse For Employee Mileage Timesheets Com

What Do Most Companies Pay For Mileage Reimbursement

What Do Most Companies Pay For Mileage Reimbursement

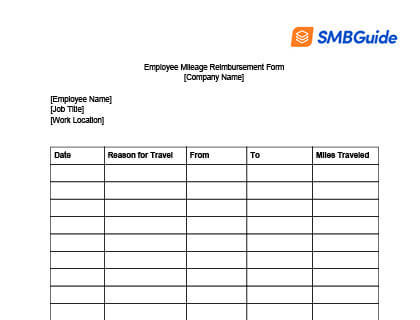

Mileage Reimbursement For Employees Info Free Download

Mileage Reimbursement For Employees Info Free Download

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

Taking A Mileage Deduction After Reimbursement Mileiq

Taking A Mileage Deduction After Reimbursement Mileiq

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

How To Record Mileage Help Center

How To Record Mileage Help Center

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Mileage Reimbursement For Employees Considered Taxable Wages

Mileage Reimbursement For Employees Considered Taxable Wages

Is A Mileage Reimbursement Taxable

Is A Mileage Reimbursement Taxable

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

%20(1).jpeg) 2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

Policy Considerations For Mileage Reimbursement I T E I Fyle

Policy Considerations For Mileage Reimbursement I T E I Fyle

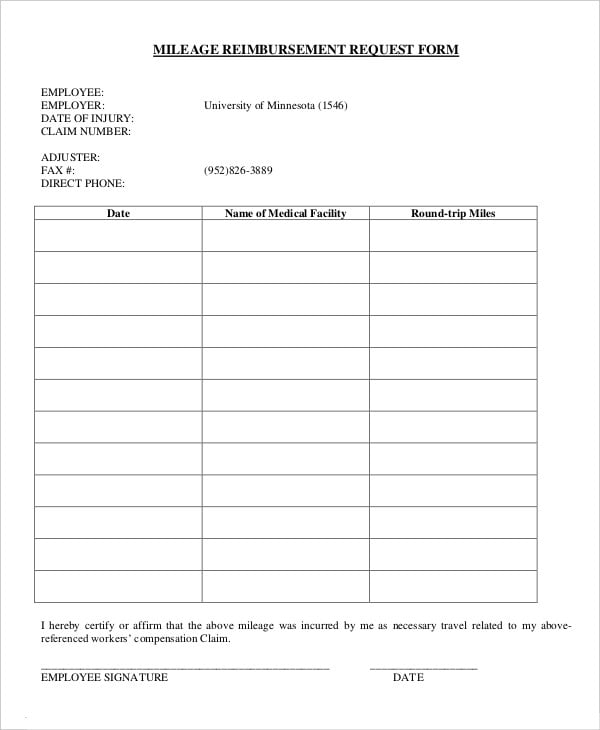

Mileage Reimbursement Form 9 Free Sample Example Format Free Premium Templates

Mileage Reimbursement Form 9 Free Sample Example Format Free Premium Templates