How To Register Sole Proprietorship In Ohio

If you are a sole proprietor use the information in the chart below to help you determine some of the forms that you may be required to file. For a sole proprietor the legal name of the business is your personal full legal name.

How To Set Up A Sole Proprietorship In Ohio Sole Proprietorship Ohio Sole

How To Set Up A Sole Proprietorship In Ohio Sole Proprietorship Ohio Sole

Most commonly this is done by publishing your DBA and provide the proof of publication to local government.

How to register sole proprietorship in ohio. Where in the Ohio Revised Code ORC does it say I have to register as a sole proprietor. First register with the Ohio Secretary of State. Broad St 16th Floor Columbus Ohio 43215 or by email.

The process for how to change from sole proprietorship to LLC in Ohio is fairly simple. Registration information as well as forms are available online or at 877 SOS-FILE. You must file formation documents with the state of Ohio for this type of business using a Statement of Partnership Authority.

Contact the Internal Revenue Service to learn additional information and an. However if you are the sole member of a domestic limited liability company LLC you are not a sole proprietor if you elect to treat the LLC as a corporation. To determine which taxes your sole proprietorship is required to pay youll first need to register with the Ohio Department of Taxation either by phone or.

A sole proprietor is someone who owns an unincorporated business by himself or herself. If youre a Sole Proprietor you need a DBA to register your business name. If you use a business name that.

If applying online isnt an option you can also complete an EIN application by mail or fax by sending Form SS-4 to the IRS fax number 855-641-6935. Get started Starting at 99. START YOUR BUSINESS WITH CONFIDENCE.

You should have their full legal name address and Social Security. By default sole proprietorships operate as the same name as the owner while general partnerships must include the surnames of all the partners. The name reservation will hold a name for up to 180 days at a cost of 39.

Ohio law does not require that a sole proprietorship must register with the Secretary of State. File a Fictitious Business Name. To establish a sole proprietorship in Ohio heres everything you need to know.

Warning No content found for. Call the Ohio New Hire Reporting Center at 888-872-1490 to report your new hire. You register your business online on the Ohio Business Gateway Electronic Filing page.

You can do this in person at the Ohio Secretary of States office or by mail at the Secretary of State Business Services Division at 180 E. Obtain a federal Employer Identification Number EIN. However an individual may create and own an LLC or corporation.

You can even get an EIN over the phone if the company was formed outside the US. Choose a Business Name. In Ohio a sole proprietor may use his or her own given name or may use a fictitious or trade name.

If you plan to us a. File Form IT-1 with the Department of Taxation. Place a request to register the trade name.

A sole proprietorship is a separate type of business entity with separate legal characteristics. DBA is an abbreviation for doing business as Well prepare and file all required documents to start your Ohio DBA. Take care of the following.

Any entity planning to transact business in Ohio using a name other than their personal name must register with the Secretary of State. All you need to do is file the correct paperwork with the state and meet a few basic requirements and you can form your new limited liability company. A general partnership has two or more owners.

File Form UCO-1 with the Department of. You can register your DBA with the state using the online facility of Ohio Secretory of State. To register a name the Trade Name Registration Application Form 534A along with the 39 filing fee should be sent to the Ohio Secretary of State.

If there is a name you want but are not ready to register the LLC you can file the Name Reservation form Form 534B. You also need to file a paper registration in the county where you plan to do business. A DBA doing business as name can also be used by a sole proprietor but it must be registered with the Secretary of State to ensure that the name is not currently in use by any.

Benefits of LLCs and Sole Proprietorships. If you plan to collect sales tax or hire employees for the sole proprietorship you must register with the Ohio Department of Taxation.

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

Registering Your Business In Ohio Ohio Business Ohio State

Registering Your Business In Ohio Ohio Business Ohio State

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

The Ultimate Revelation Of Tx Sos Business Search Tx Sos Business Search Https Businessneat Com The Ultimat Texas Business Llc Business Business Investment

The Ultimate Revelation Of Tx Sos Business Search Tx Sos Business Search Https Businessneat Com The Ultimat Texas Business Llc Business Business Investment

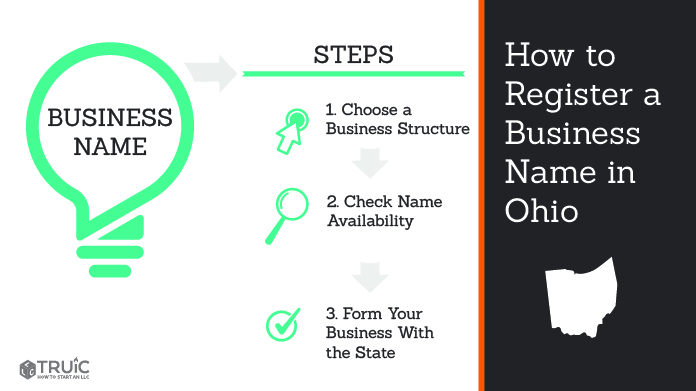

How To Register A Business Name In Ohio How To Start An Llc

How To Register A Business Name In Ohio How To Start An Llc

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

Register Texas Fictitious Business Name Texas Trade Name Texas Dba Sole Proprietorship Business Names Radial Arm Saw

Register Texas Fictitious Business Name Texas Trade Name Texas Dba Sole Proprietorship Business Names Radial Arm Saw

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

Sole Proprietorship Business Do You Have Any 10 Questions Based On A Sole Proprietorship Business Sole Proprietorship Sole Proprietor Sole

Sole Proprietorship Business Do You Have Any 10 Questions Based On A Sole Proprietorship Business Sole Proprietorship Sole Proprietor Sole

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Form An Ohio Llc Startingyourbusiness Com

How To Form An Ohio Llc Startingyourbusiness Com

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps