How To Get My 1099 From Unemployment

20 hours agoThe Colorado Department of Labor and Employment says the most important and first step to take if you receive an inaccurate 1099-G or Reliacard and never filed for unemployment is. Will you owe Uncle Sam taxes for your unemployment benefits.

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

For Pandemic Unemployment Assistance PUA claimants the forms will also be available online in.

How to get my 1099 from unemployment. If we have your email address on file we have sent you via email the information for your 1099-G for 2020. If you have an eServices account youll be able to see it there as well. Look for the 1099-G form youll be getting online or in the mail.

1099-G information will also be available from the. You will find the 1099G in Uplink on your Correspondence page. You will need to add the payments from all forms when.

These forms will be mailed to the address that DES has on file for you. If you received unemployment compensation during the year you should receive Form 1099-G from your states unemployment office. If you have questions about your user name and password see our frequently asked questions for accessing online benefit services.

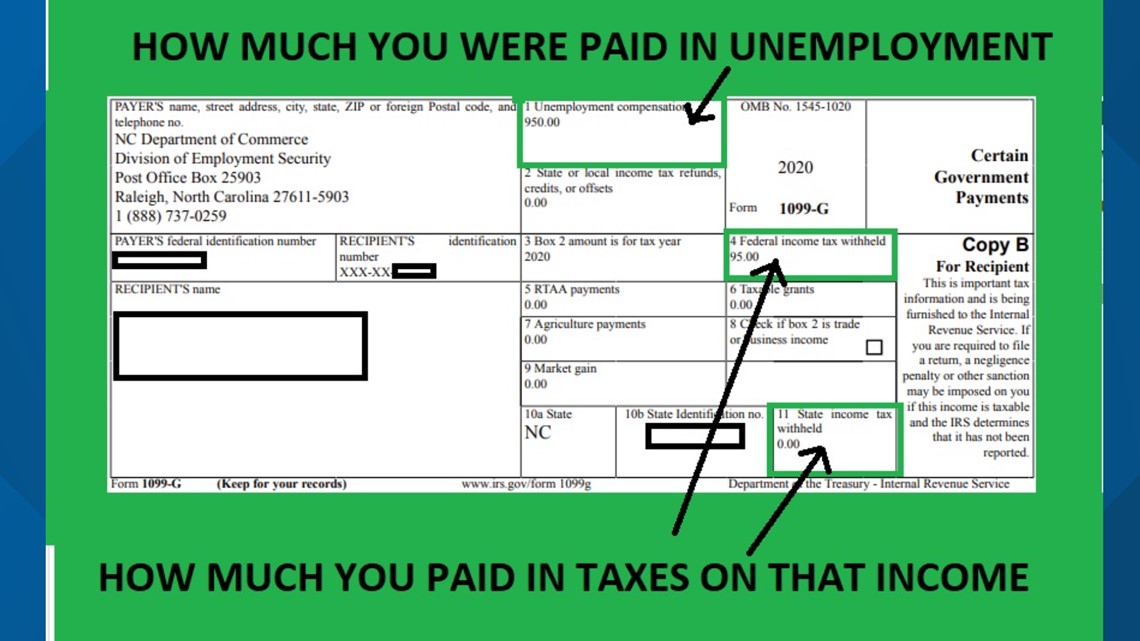

Your 1099-G will give you the information you need to accurately report your unemployment benefits on your state and federal tax returns including. You must update your mailing address by updating your personal information in the BEACON portal on the Maryland Unemployment Insurance for Claimants mobile app or by contacting a Claims Agent at 667-207-6520. UInv main page at uinvgov.

If you were a phone filer it will be mailed to you. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form. Applicant Services 1099 Information The 1099s reflecting unemployment benefits paid in 2020 will be mailed to the last address on file no later than January 29 2021.

Otherwise you may access your account using the Existing User Sign In link at uinvgov. Email alerts will be sent to the claimants that elected to receive electronic notifications advising that they can view and print their 1099G online. If you collected unemployment insurance last year you will need the 1099-G form from IDES to complete your federal and state tax returns.

PUA will be reported on a separate form from any UC including PEUC EB TRA that you may have received. After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. These instructions apply for claimants across all programs eg.

If you received an unemployment benefit payment at any point in 2020 we will provide you a tax document called the 1099-G. You can opt to receive your 1099-G electronically by providing your consent through the BEACON portal or mobile app. Instructions for the form can be found on the IRS website.

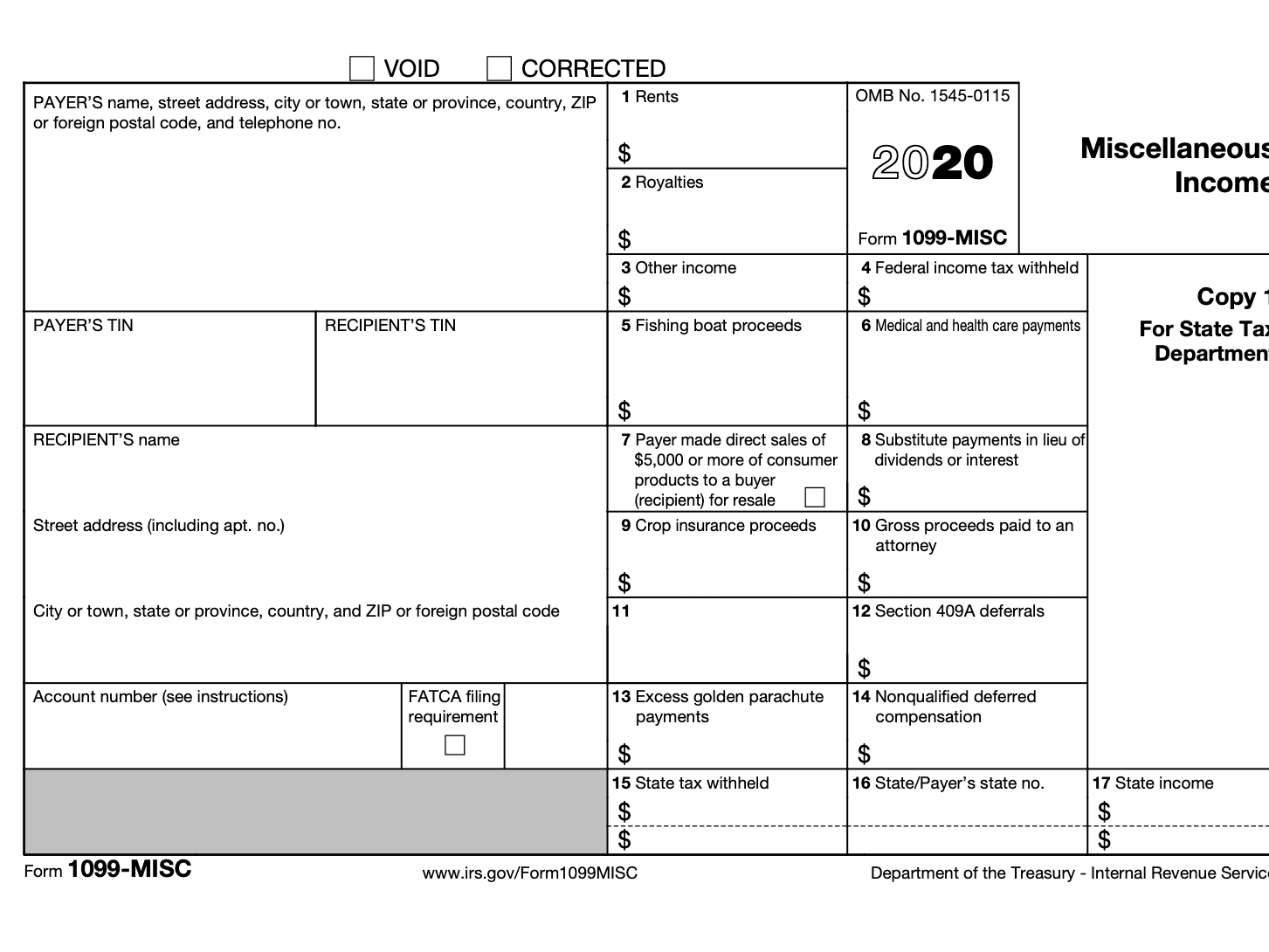

On your Claimant Homepage click the View my 1099G link found in the SMARTLINKS section at the bottom of the screen to view or print a. The 1099-G form is available as of January 2021. The 1099-G tax form is commonly used to report unemployment compensation.

RTAA benefits are also reported on a separate form. The total amount of unemployment benefits you were paid. Youll receive your 1099-G via mail.

Every year we send a 1099-G to people who received unemployment benefits. Unemployment is taxable income. Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms.

Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. No other 1099Gs will be mailed. You may access your IRS Form 1099-G for UI Payments for current and previous tax years on MyUI portal by entering your social security number and.

We also send this information to the IRS. How Do I Receive a Copy of My 1099G Tax Statement. If you dont have eServices account and want to hear the amounts on your 1099-G you can get this info from our automated claims line.

It is possible you may receive more than one 1099-G form.

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Printable 1099 G Form Get 2020 Blank And Fill It

Printable 1099 G Form Get 2020 Blank And Fill It

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Florida Residents Report Problems Accessing 1099 G Form Youtube

Florida Residents Report Problems Accessing 1099 G Form Youtube

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

Unemployment Benefits Are Taxable Look For A 1099 G Form Weareiowa Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Weareiowa Com