How To Get A Replacement 1099 Form

If you are deaf or hard of hearing call our toll-free TTY number 1-800-325-0778 between 800 am. Using your online my Social Security account.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

My Social Security account you should access your online account and go to Replacement Documents to view and print your.

How to get a replacement 1099 form. Go online and get a replacement form with a my Social Security account. How to request your 1099-R tax form by mail. Retirees and survivors must visit a different website to get their replacement tax documents.

Every worker in the United States should create a my Social Security account. Sign in to your account click on Documents in the menu and then click the 1099-R tile. Request a duplicate tax-filing statement 1099R.

You can retrieve missing forms 1099-INT Interest Income and 1099-DIV Dividends and Distributions by requesting them from the bank or financial institution that issued them. Or SSA-1042S simply go online and get an instant printable replacement form with a. A replacement SSA-1099 or SSA-1042S is generally available for the previous tax year after February 1.

There is a form available at. Contact the IRS at 800-829-1040 for assistance if you have not received the form by February 15. If you did not receive a 1099-G tax form because your address is not updated in your account you may request a new 1099-G and get your address changed at desazgov1099G-Report.

An SSA-1099 is a tax form the SSA mails each year in January to people who receive Social Security benefits. To replace a lost Form 1099-INT ask the bank or other financial institution that issued it to send you another copy. If you dont already have an account you can create.

Your customer or the issuer is required to keep copies of the 1099s it gives out to non-employees. Youll want to ask for a copy of the one they already sent you. Use Services Online Retirement Services to.

If you did not receive your SSA-1099 or have misplaced it you can get a replacement online if you have a My Social Security account. If you have questions or need help understanding how to request your replacement SSA-1099 or SSA-1042S online call our toll-free number at 1-800-772-1213 or visit your Social Security office. Contact the payer or institution and ask a representative if your Form 1099 has been sent if you are expecting a Form 1099 and have not received it by January 31.

If you are deaf or hard of hearing call our toll-free TTY number 1-800-325-0778 between 800 am. Start change or stop Federal and State income tax withholdings. Well send your tax form to the address we have on file.

The deadline for most forms 1099 is January 31st so if you havent received them by that date you may need to wait a couple more days. If you currently live in the United States and you need a replacement form SSA-1099 or SSA-1042S we have a new way for you to get an instant replacement quickly and easily beginning February 1st by. The transcript should include all of the income that you had as long as it was reported to the IRS.

Replacements of 1099 forms can be sent back to calendar year 2005. Step 3 Obtain the necessary 1099 information through an alternative method. It shows the total amount of benefits you received from Social Security in the previous year so you know how much Social Security income to report to IRS on your tax return.

My Social Security account at wwwsocialsecuritygovmyaccount. If you are looking for 1099s from earlier years you can contact the IRS and order a wage and income transcript. Get A Replacement W-2 or 1099R.

A Wage and Income Transcript from the IRS will have the information from all 1099-INT forms that were issued to you but in a different format. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS. Change your Personal Identification Number PIN for accessing our automated systems.

Change your mailing address. Establish change or stop an allotment to an organization. If you currently live in the United States and need a replacement form SSA-1099 or SSA-1042S we have a way for you to get a replacement quickly and easily.

Producers needing a replacement 1099G can either contact their county office for assistance or call the Farm Service Agencys FSA Kansas City Office using our toll free number 1-866-729-9705. If you have questions or need help understanding how to request your replacement SSA-1099 or SSA-1042S online call our toll-free number at 1-800-772-1213 or visit your Social Security office. Youll be able to access your form and save a printable copy.

Sign in to your account and click the link for Replacement Documents. In the form insert your new address and click the box under the address line. How To Get A Replacement 1099 Calling your client is usually the easiest way to get a copy of a lost Form 1099.

If you already have a. You can verify or change your mailing address by clicking on Profile in the menu and then clicking on.

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Irs Introduces New Ish Form To Replace Parts Of Form 1099 Misc Taxgirl

Irs Introduces New Ish Form To Replace Parts Of Form 1099 Misc Taxgirl

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

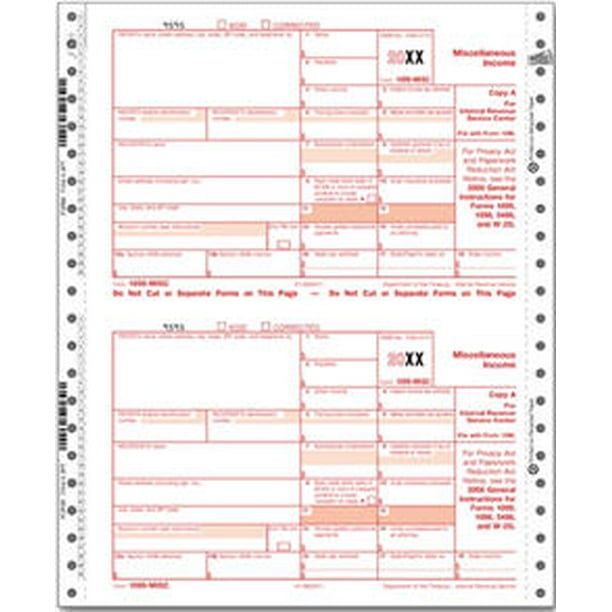

Irs Approved 1099 Misc 4 Part Continuous Tax Form Walmart Com Walmart Com

Irs Approved 1099 Misc 4 Part Continuous Tax Form Walmart Com Walmart Com

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

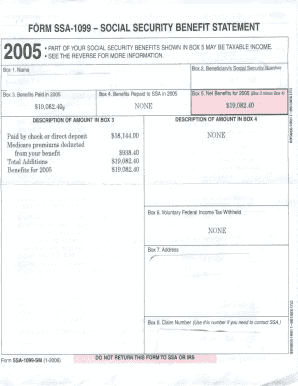

Ssa 1099 Fill Out And Sign Printable Pdf Template Signnow

Ssa 1099 Fill Out And Sign Printable Pdf Template Signnow

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

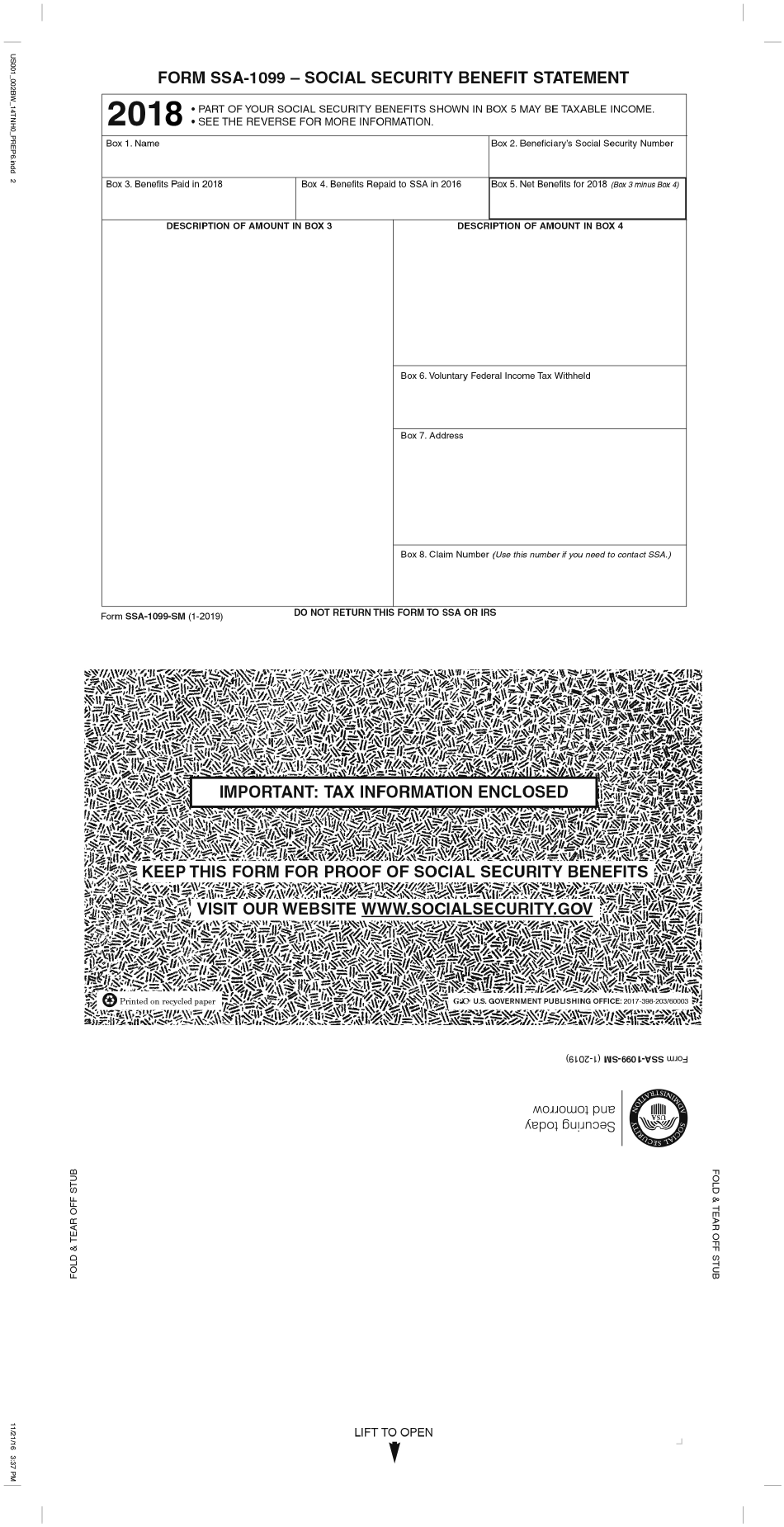

Form Ssa 1099 Download Printable Pdf Or Fill Online Social Security Benefit Statement 2018 Templateroller

Form Ssa 1099 Download Printable Pdf Or Fill Online Social Security Benefit Statement 2018 Templateroller

1099 Nec Form Copy B C 2 3up Discount Tax Forms

1099 Nec Form Copy B C 2 3up Discount Tax Forms

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Understanding 1099 Form Samples

Understanding 1099 Form Samples

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

Taxes 1099 R Public Employee Retirement System Of Idaho

Taxes 1099 R Public Employee Retirement System Of Idaho

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc