Business License Sole Proprietorship Nyc

Please note that the database does not include corporate or other business entity assumed names filed pursuant to General Business Law 130. Choose a Business Name.

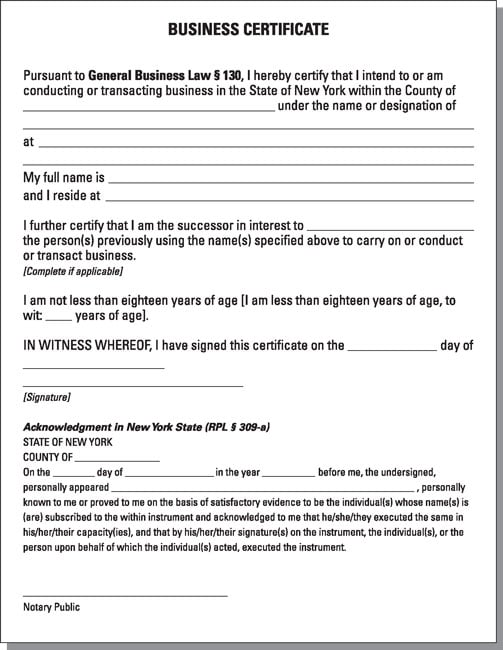

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Most small businesses need a combination of licenses and permits from both federal and state agencies.

Business license sole proprietorship nyc. In New York a sole proprietor may use his or her own given name or may use a trade name. Assumed name filings are filed and maintained by the Division of Corporations for corporations limited liability companies and limited partnerships. Pick a business name.

The requirements and fees vary based on your business activities location and government rules. For sole proprietors and general partnerships and the filing fee depends on the county in which you are filing the form. Income attributable to a business trade profession or occupation carried on in New York State.

New York State registration requirements include. Sole Proprietorship A sole proprietorship is the simplest and most common structure chosen to start a business. Corporations Limited Liability Companies and Limited Partnerships register with New York State.

In New York City the fees are as follows. To establish a sole proprietorship in New York heres everything you need to know. As a sole proprietorship you can use either the IRS Tax Identification number ITIN or Social Security number SSN.

You will need to register your General Partnership or Sole Proprietorship with the County Clerk in the county where you will be doing business. Select the identification number type and enter the number. To become a sole proprietor in New York a business owner need do little else but obtain the licenses and permits necessary to operate the business.

Enter the Home Address of the sole proprietor. File a Fictitious Business Name. An Assumed Name Certificate must be filed with the clerk of the countyies in which the business is conducted ONLY IF you are operating under a name other than the proprietors no formation document is required.

A sole proprietorship is a business run by an executive owner. New York State accepts registrations for all Corporations Limited Liability Companies and Limited Partnerships. Personal liability is full- a sole proprietor is personally responsible for all debts of his or her business.

New York source income-sole proprietorships and partnerships As a sole proprietor or partnership your New York source income includes. How to Become a New York Sole Proprietor DBA Acquisition. This is required when the business is hiring employees.

General Partnerships and Sole Proprietorships register with the appropriate County Clerk. If you use a business name that is different from your. Sole proprietors are synonymous with their businesses meaning the business and the owner are viewed as one in the same.

The owner is liable for all business operations. A doing business as DBA name is a crucial part of many sole proprietorships as it enables you to use. A legal name is the name under which your business incorporated in New York State.

County Filing Fee Bronx 100 Brooklyn Kings County 120 Manhattan New York County 100 Staten Island Richmond County 120 Queens 100. File a name certificate with the office of the county clerk. This rule differs for sole proprietorships and general partnerships.

Where you register depends on the type of business you have. You are entitled to all profits and are responsible for all your businesss debts losses and liabilities. It is an unincorporated business owned and run by one individual with no distinction between the business and you the owner.

Get free legal advice to help you file your paperwork. Sole proprietors without employees usually dont need to acquire a federal tax ID. The four steps to establish a New York sole proprietorship include the following.

A sole proprietor is a person that does business as himself. Like other businesses such as a partnership or an LLC a sole proprietor needs to have a license to. If you use a trade name you will likely need a Certificate of Assumed Name.

Partnerships must register with the County Clerks Office where the business is located. A sole proprietorship under a name other than your own such as a trade name or an assumed name or doing business as must register with the County Clerks Office where the business is located.

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Form Mv 521 Driving School License Application New York Free Download

Form Mv 521 Driving School License Application New York Free Download

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

How To Register A Business Name In New York Starting A Business In New York Youtube

How To Register A Business Name In New York Starting A Business In New York Youtube

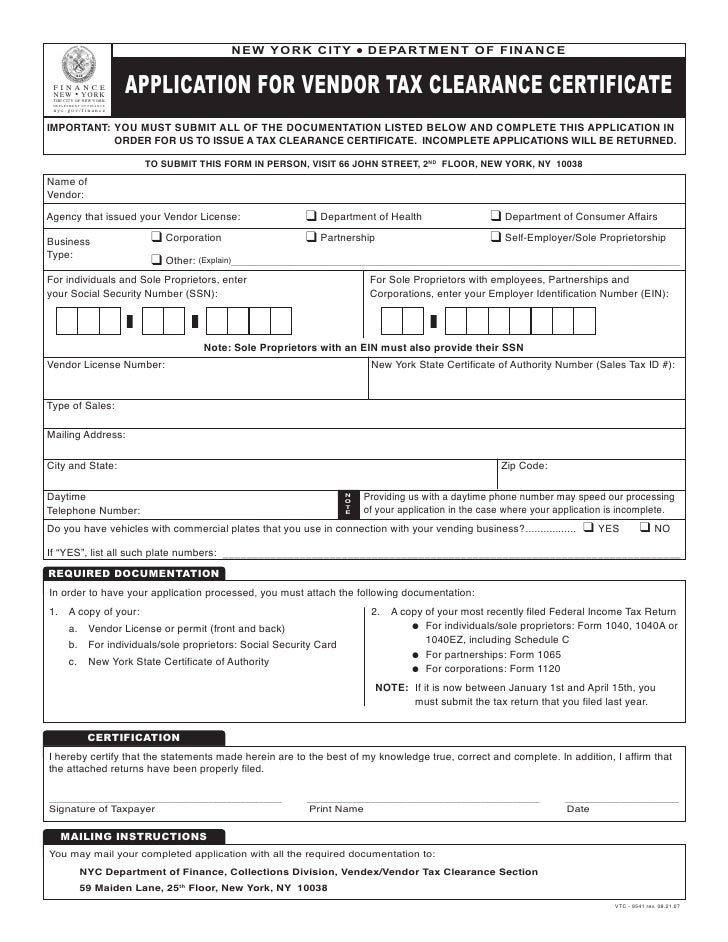

Vendor Tax Clearance Certificate

Vendor Tax Clearance Certificate

New York Certificate Of Authority Foreign New York Corporation

How To Start A Sole Proprietorship In New York Legalzoom Com

How To Start A Sole Proprietorship In New York Legalzoom Com

3 Reasons Sole Proprietors Should Avoid Dbas

3 Reasons Sole Proprietors Should Avoid Dbas

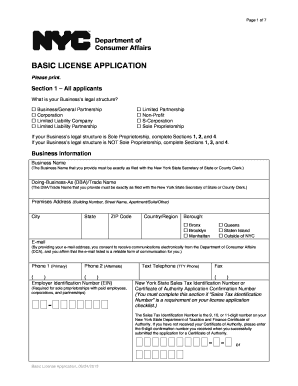

Basic License Application Fill Online Printable Fillable Blank Pdffiller

Basic License Application Fill Online Printable Fillable Blank Pdffiller

Certificate Of Discontinuance Of Business Fill Online Printable Fillable Blank Pdffiller

Certificate Of Discontinuance Of Business Fill Online Printable Fillable Blank Pdffiller

Limited Liability Companies Frequently Asked Questions Nys Dos

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Sole Proprietorship And Your Import Export Business Dummies

Sole Proprietorship And Your Import Export Business Dummies

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Incorporate In New York Do Business The Right Way

Https Www1 Nyc Gov Assets Finance Downloads Pdf 14pdf Business Tax Forms Dof 1 2014 Pdf

Https Www Citybarjusticecenter Org Wp Content Uploads 2016 09 Cbjc Nelp Sole Proprietorship Fact Sheet Pdf