Business Tax License Orange County Florida

Dont forget to renew your business tax receipt All Business Tax Receipts expire September 30. Their phone number is 4078456200.

Http Www Edgewood Fl Gov Use 20permit 20and 20btr 20application 20and 20checklist 20application 20 20revised 206 19 2018 Pdf

Once the application has been processed a client service specialist will call to provide payment instructions 4.

Business tax license orange county florida. Business Licenses list the type of business ownership information and contact information. You must apply for new Local Business Tax Receipts in person at our downtown office 231 E Forsyth St. Orange City FL 32763 Attn.

Orange Avenue 16th Floor Orlando FL 32801. Permits Licenses Move your project ahead with Orange Countys One-Stop Permitting. Remember to display your local business tax receipt in open view.

Orange County Tax Collector SunTrust Building 200 S. The City of Orlando requires that those operating a business within the city limits obtain a business tax receipt business license from the City of Orlando Office of Permitting Services. The Orange County Business Tax Receipt Office will require approval from the Orange County Zoning Department 201 S.

Since 1999 the University of Central Florida Business Incubation Program has helped hundreds of early-stage businesses develop into financially stable companies by providing the tools training and. City Clerks Office or hand delivered to the City Clerks Office. Box 545100 Orlando FL 32851-5100.

When applying for a Use permit you must first apply at the Orange County Business Tax Receipt Office 200 S. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get an Orange County Florida Occupational License. Business Tax Department PO.

A Port Orange Business License Search provides valuable information on businesses in Port Orange Florida. 1500 for commercial location and 4000 for home business locations. An Orange County Florida Local Business Tax can only be obtained through an authorized government agency.

A business located within a municipality is required to obtain both a city receipt and a County receipt. Rosalind Avenue 1st Floor Orlando FL. Box 3715 West Palm Beach FL 33402-3715.

When payment is received your local business tax receipt will be mailed to you. Box 545100 Orlando FL 32854. You may want to contact the City of Orlando if you are not sure if your business is located within the city limits.

Find Port Orange Business Licenses. Before we issue a Local Business Tax Receipt a business must meet all required conditions. The metro OrlandoOrange County area is one of two communities in the world with a medical city including a state of the art VA medical center.

Business license records are kept by federal Florida State Orange County and local government offices. Business licenses include information about the type of business ownership and contact information. The public can rely on Business Licenses to find information about a business determine the ownership of a business or look up violations and complaints against a.

An Orange County Florida Occupational License can only be obtained through an authorized government agency. A Business License is required for any business owner business entity self-employed person or business organization based in or operating from Orange. The County issues local business tax receipts for one year beginning Oct.

A Orange County Business License Search allows the public to look up public business licenses in Orange County Florida. They are located at 400 South Orange Avenue on the first floor of City Hall. 1600 O rlando FL 32801.

It is the policy of Orange County to compute fees for the purpose of cost recovery. Suite 130 Jacksonville FL 32202. Users of this document are cautioned to consider its value only as a reference source and not as a legally binding document.

1 and expiring on Sept. The City of Orange has initiated a tax audit program utilizing information from the Franchise Tax Board to identify businesses that may not be reporting and paying their annual business taxes. Orange County Tax Collector or Scott Randolph PO.

The Orange County Tax Collectors Office is located on the 16th floor of the SunTrust Center at 200 South Orange Avenue Orlando. Nature of Business list all services provided. BUSINESS TAX RECEIPT DECLARATION.

Business fees such as solid waste charges and water utility fees appear separately on the Orange County website. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get an Orange County Florida Local Business Tax. Orange County Tax Collector PO.

How To Register For A Sales Tax Permit In Florida Taxvalet

How To Register For A Sales Tax Permit In Florida Taxvalet

Orange County Occupational License Fill Online Printable Fillable Blank Pdffiller

Orange County Occupational License Fill Online Printable Fillable Blank Pdffiller

How To Register For A Sales Tax Permit In Floridataxjar Blog

How To Register For A Sales Tax Permit In Floridataxjar Blog

What To Bring Orange County Tax Collector

What To Bring Orange County Tax Collector

Car Truck Trailer Purchase From Individual Florida Tax Collector Serving Sarasota County Barbara Ford Coates Sarasota County Florida State Florida

Car Truck Trailer Purchase From Individual Florida Tax Collector Serving Sarasota County Barbara Ford Coates Sarasota County Florida State Florida

Miami Dade Local Business Tax Financeviewer

Miami Dade Local Business Tax Financeviewer

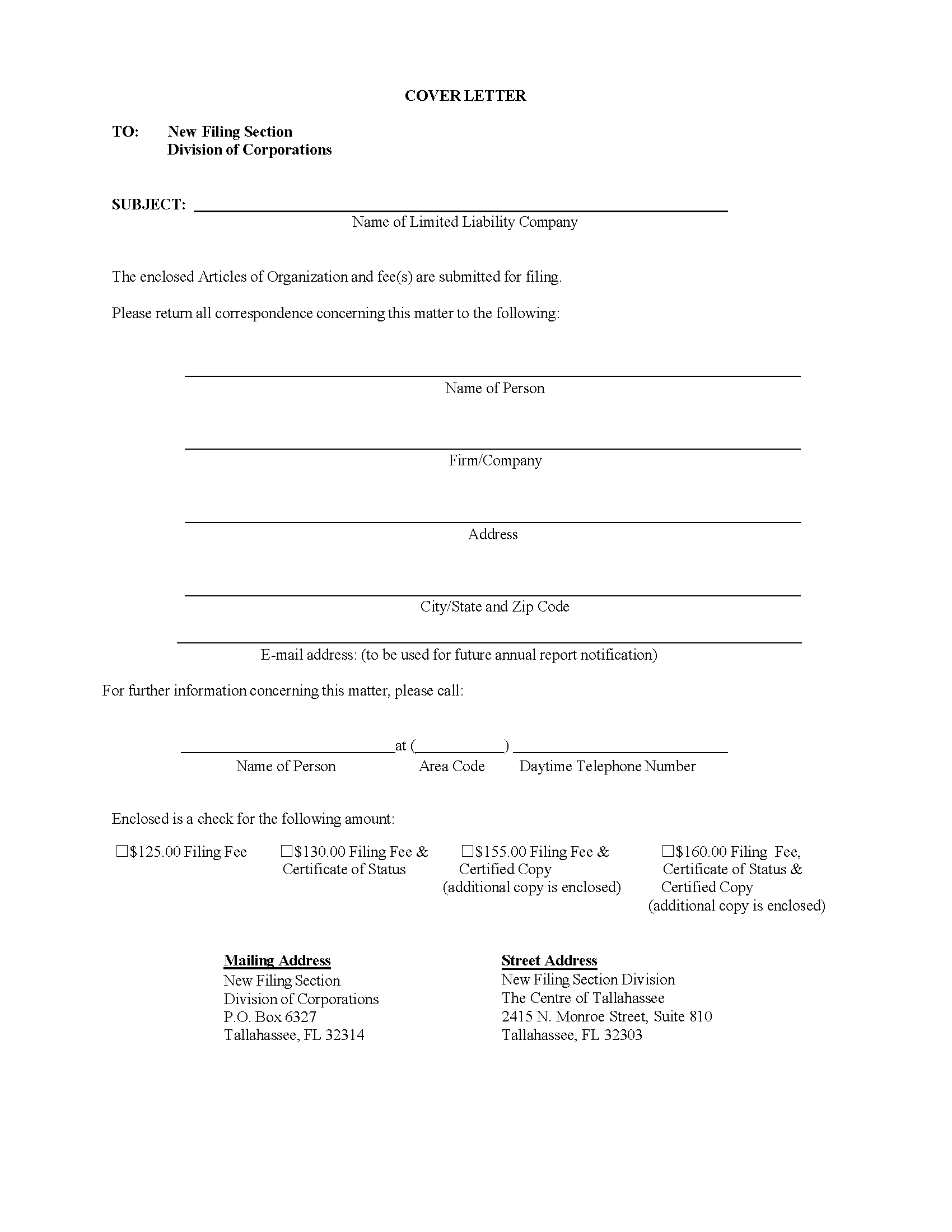

Llc Florida How To Start An Llc In Florida

Llc Florida How To Start An Llc In Florida

Miami Dade Local Business Tax Financeviewer

Business Tax Receipt How To Obtain One In 2021 The Blueprint

Business Tax Receipt How To Obtain One In 2021 The Blueprint

How To Register For A Sales Tax Permit In Florida Taxvalet

How To Register For A Sales Tax Permit In Florida Taxvalet

Https Www Orlando Gov Files Sharedassets Public Departments Edv Permitting Services Division Bld Btr Cou Final Application Pdf

Business Tax Receipt How To Obtain One In 2021 The Blueprint

Business Tax Receipt How To Obtain One In 2021 The Blueprint

Palm Beach County Business License Financeviewer

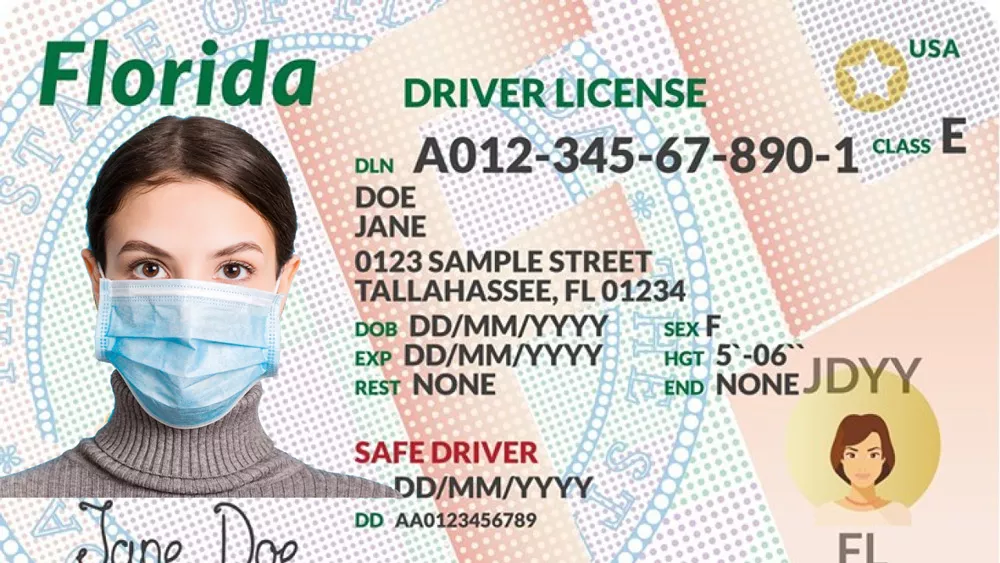

Getting A Driver S License In Florida Will Be Different During The Coronavirus Pandemic Blogs

Getting A Driver S License In Florida Will Be Different During The Coronavirus Pandemic Blogs

Bill Frederick Park At Turkey Lake Orlando City Orlando Florida City Orlando Florida

Bill Frederick Park At Turkey Lake Orlando City Orlando Florida City Orlando Florida

Vehicle Sales Purchases Orange County Tax Collector

Vehicle Sales Purchases Orange County Tax Collector