Do Corporations Receive A 1099 Nec

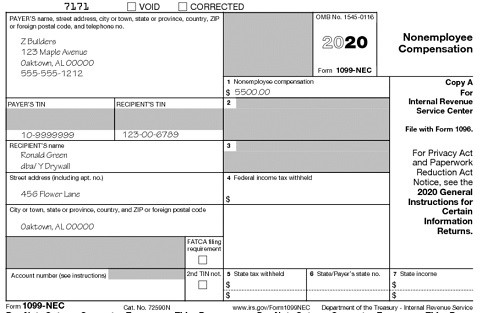

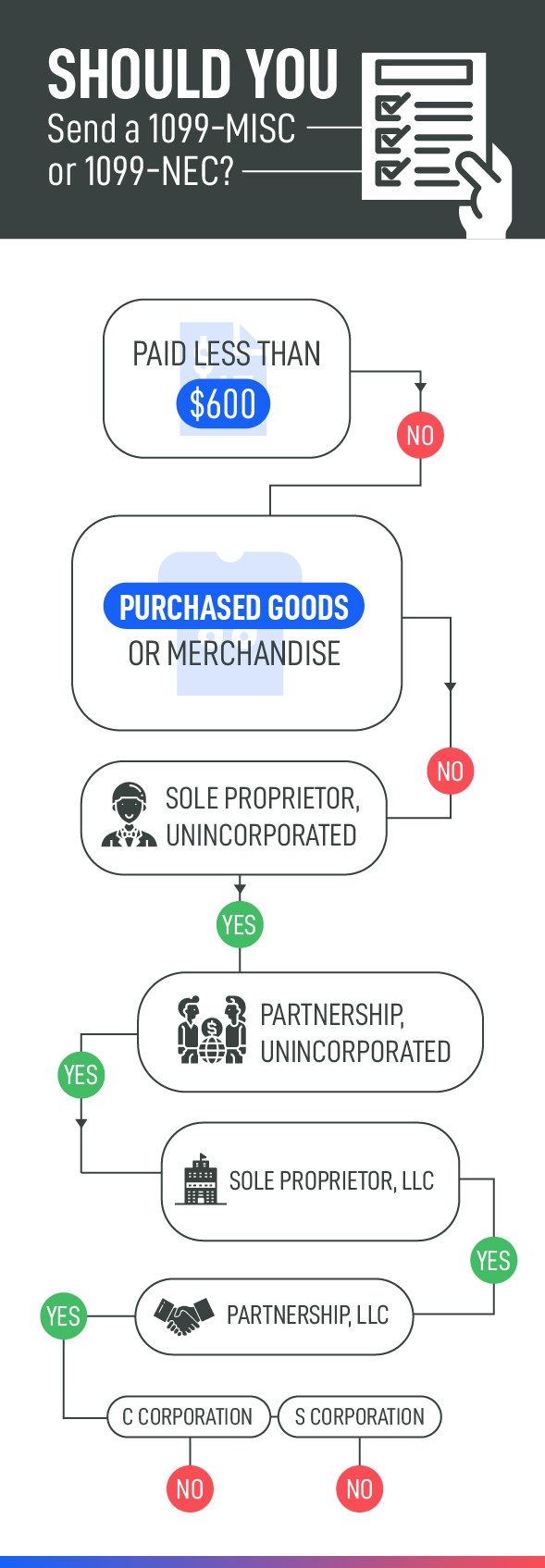

Generally payments made to corporations including limited liability companies LLCs taxed as corporations do not need to be reported on a Form 1099-MISC. A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made.

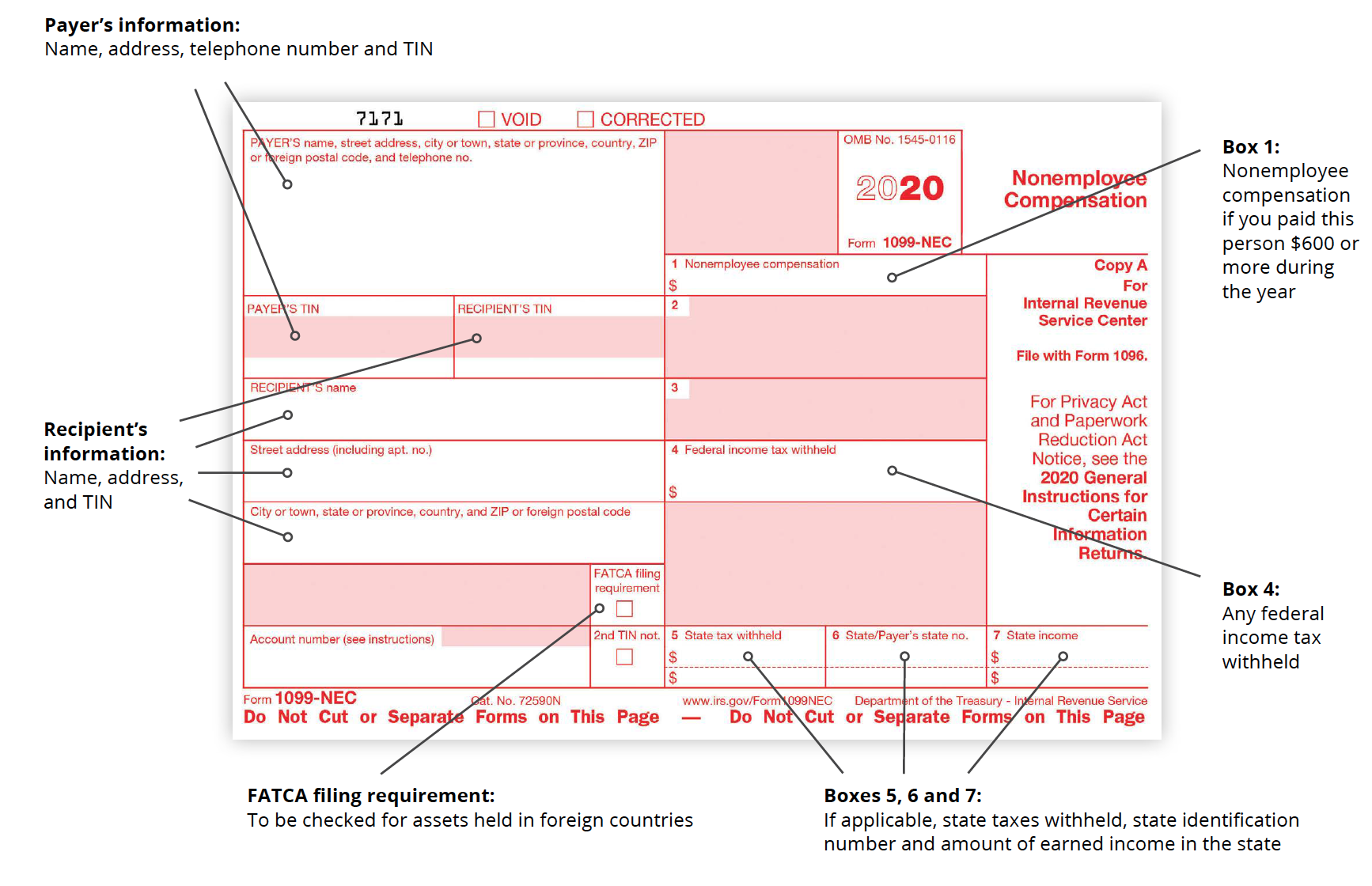

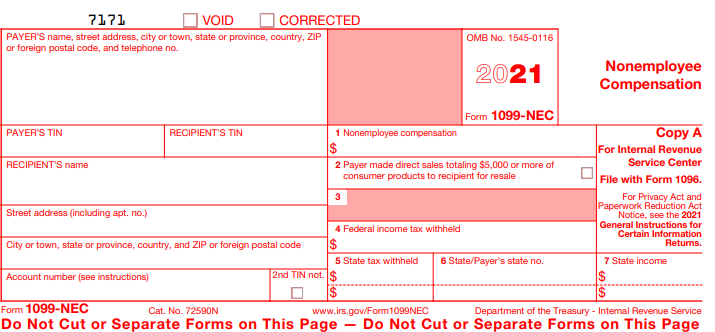

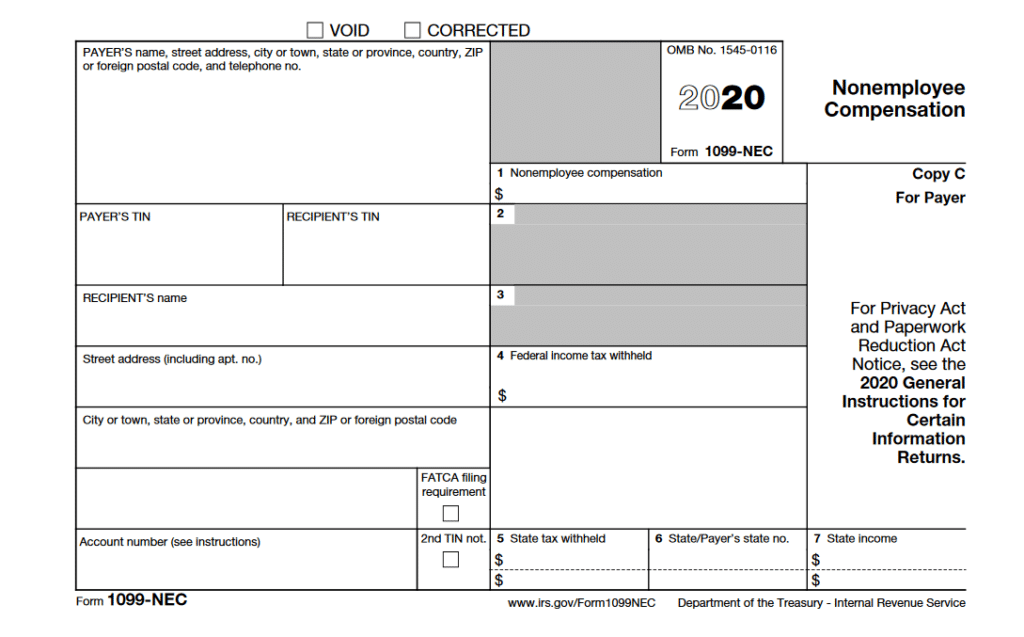

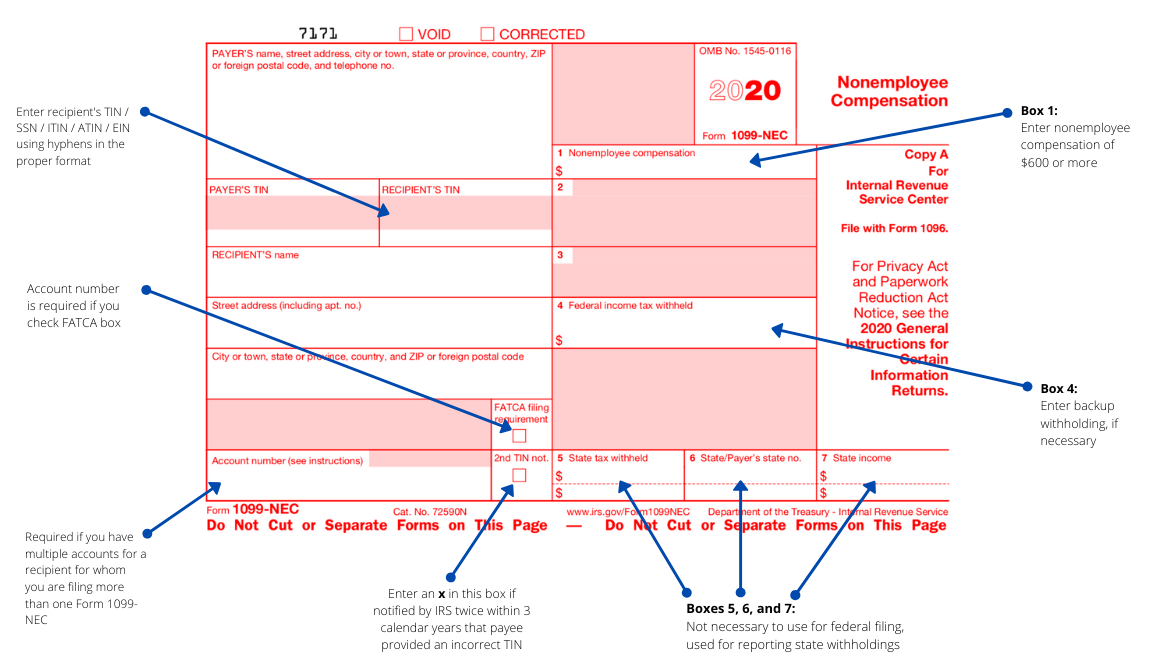

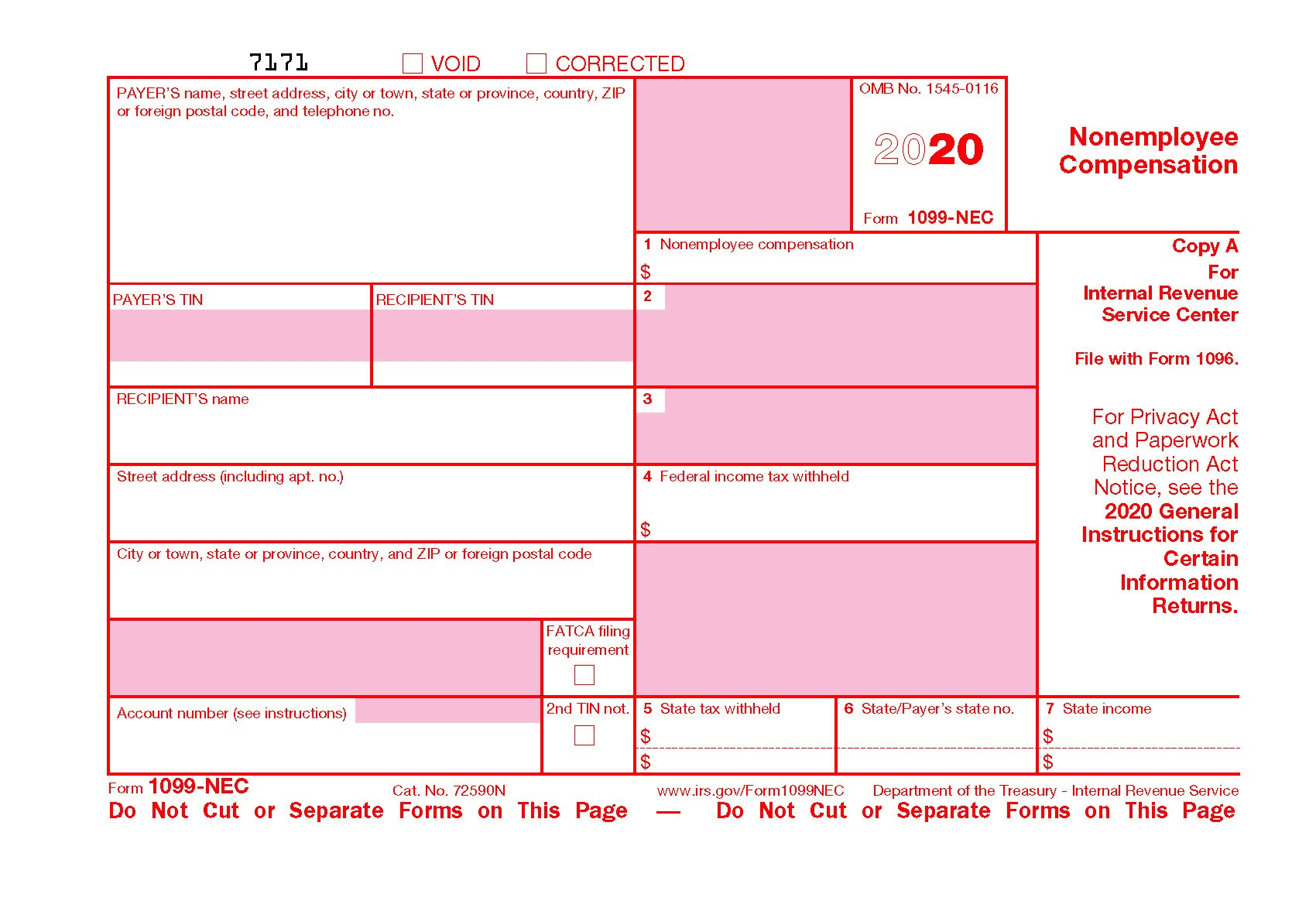

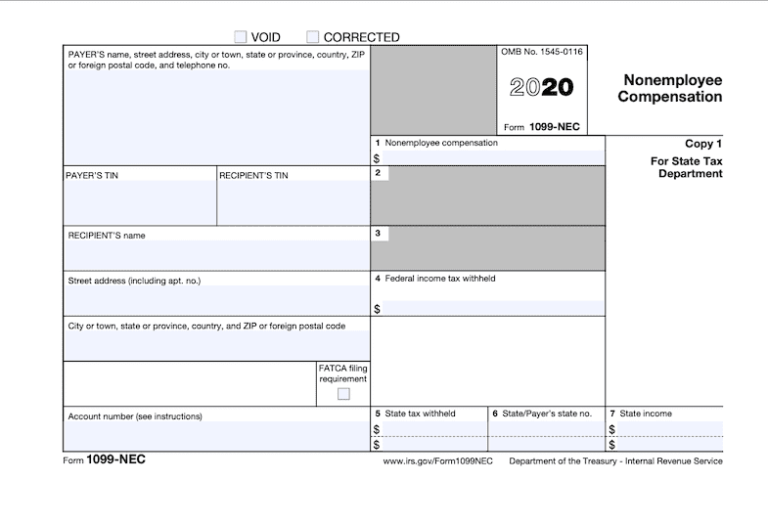

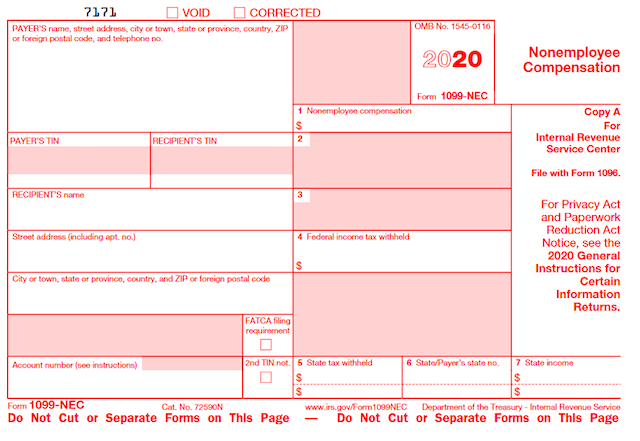

Form 1099-NEC Nonemployee Compensation is a form that solely reports nonemployee compensation.

Do corporations receive a 1099 nec. According to the Society for Human Resource Management SHRM you need to send a 1099-NEC instead of a 1099-MISC if you made a payment To anyone who isnt an employee. If you receive a Form 1099 you cant just ignore it because the IRS wont. The 1099-NEC Nonemployee Income is an informational form that US.

The 1099-NEC is due at the end of January and the 1099-MISC is due at the end of February. Certain payments to corporations. Beginning with tax year 2020 use Form 1099-NEC to report nonemployee compensation.

In general you dont have to issue 1099-NEC forms to C-Corporations and S-Corporations. For services provided as part of your business including to government agencies and. A W-9 is a form that a vendor who is not a corporation provides to you so that you can fill a 1099 for them.

Gross proceeds for legal services are reportable to corporations with a Form 1099-MISC. You do not necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. According to the IRS.

Corporations The major exception to the 1099 requirement is payments to corporations. You do not necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. If - Answered by a verified Tax Professional.

The 1099-NEC Nonemployee Income is an informational form that US. Do you need to issue a 1099-NEC. Its a common belief that businesses dont need to send out 1099-NEC forms to corporations.

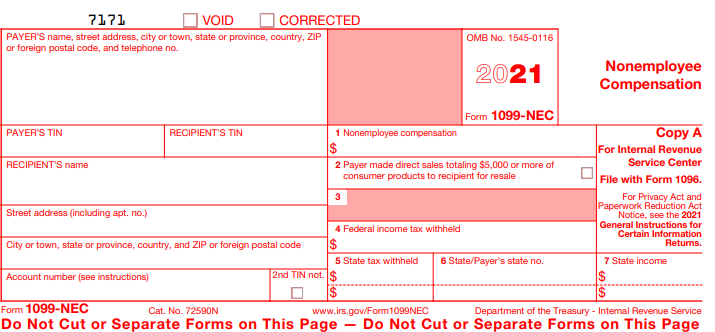

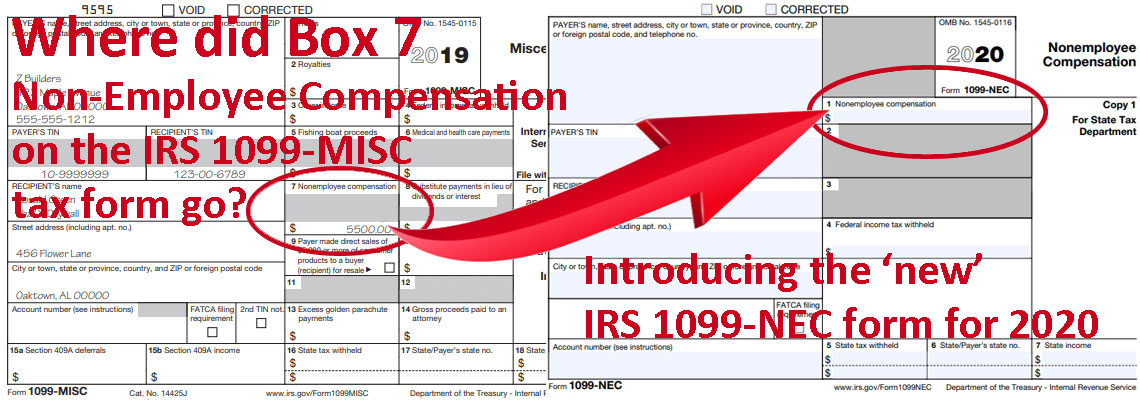

31 but dont assume youre off the hook if. Form 1099-NEC is only replacing the use of Form 1099-MISC for reporting independent contractor payments. We use cookies to give you the best possible experience on our website.

I have a s corporation and I received a form 1099 nec. If you receive income from a source other than earned wages or salaries you may receive a Form 1099-MISC or Form 1099-NEC. The answer is no because the kitchen remodeling was for personal not business reasons.

Most payments to incorporated businesses do not require that you issue a 1099. If we are filing your 1099s for you though then we need your info by January 7th 2021. IRS Has Special Form 1099 Rules for Attorneys.

Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return. Businesses are required to send to people they paid more than 600 for services during the last calendar year. Businesses must send out Forms 1099 by Jan.

Generally the income on these forms is subject to federal and state income tax for the recipient. Corporations would receive a 1099-NEC for payments made for fish purchases attorneys fees or by a federal executive agency for services. And this is true.

Although most payments to corporations are not 1099-MISC and 1099-NEC reportable there are some exceptions. According to the IRS. Do I file that on my personal taxes or business taxes.

This is actually something that was used about 30. And the 1099-NEC is actually not a new form. Businesses are required to send to people they paid more than 600 for services during the last calendar year.

But now businesses will have to use the 1099-NEC form it is short for non-employee compensation. The PATH Act PL. Form 1099-NEC is not a replacement for Form 1099-MISC.

Additionally payments for such things are merchandise storage freight or other similar items do not need to be reported. Typically businesses must report payments and compensations made to nonemployees and certain vendors using 1099 forms. 201 accelerated the due date for filing Form 1099 that includes nonemployee compensation NEC from February 28 to January 31 and eliminated the automatic 30-day extension for forms that include NEC.

It was last used in 1982.

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Irs 1099 Misc Vs 1099 Nec Inform Decisions

What S The Irs Form 1099 Nec Atlantic Payroll Partners

What S The Irs Form 1099 Nec Atlantic Payroll Partners

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Form 1099 Misc Vs Form 1099 Nec How Are They Different

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Irs Update New Form 1099 Nec Alfano Company Llc

Irs Update New Form 1099 Nec Alfano Company Llc

I Received A Form 1099 Nec What Should I Do Godaddy Blog

I Received A Form 1099 Nec What Should I Do Godaddy Blog

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor