How To Get 1099 Form From Unemployment Nj

We send these forms by mail when the amount of interest paid is more than 10. If you received unemployment compensation from a union private voluntary fund or as a state employee you might not get a 1099-G.

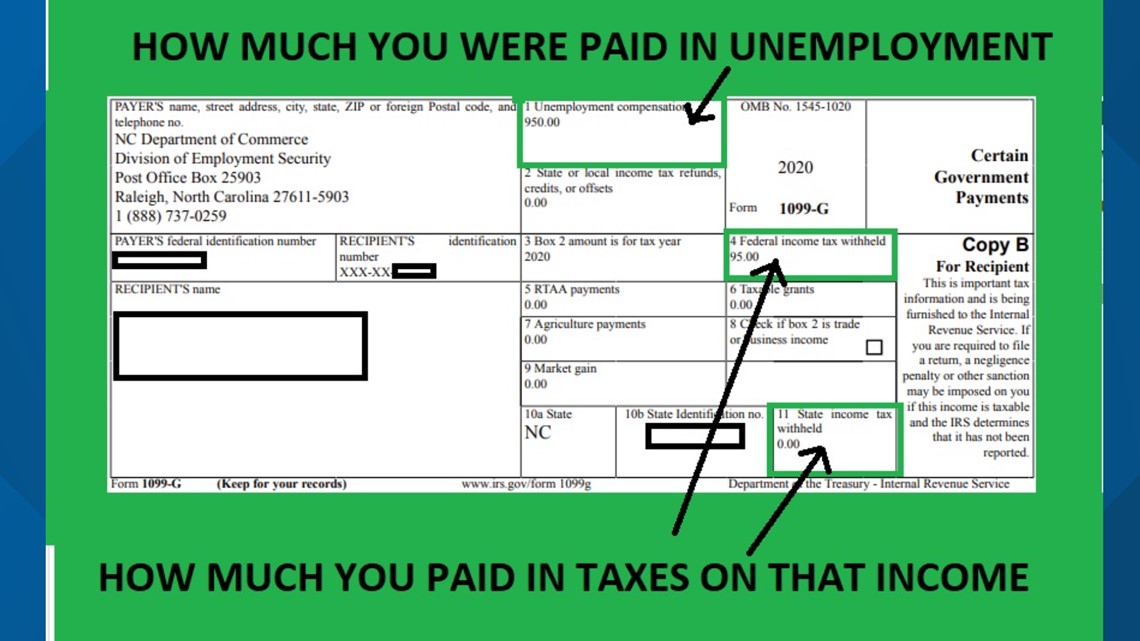

Unemployment Benefits Are Taxable Look For A 1099 G Form Wqad Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Wqad Com

If you haven t received your 1099 g copy in the mail by jan.

How to get 1099 form from unemployment nj. We provide the IRS with a copy of this information. And extended unemployment benefits through Sept. Open or continue your tax return in TurboTax online.

Heres how you enter the unemployment. Form 1099G is now available in Uplink for the most recent tax year. DWD securely stores 1099-G forms online for all claimants to access and print for their records.

The 1099 g form will be available to download from your online dashboard in january. Anyone currently receiving unemployment. Your local office will be able to send a replacement copy in the mail.

After each calendar year during which you get Unemployment Insurance benefits we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld. Claimants statements are available online for the past six years which is helpful if claimants need to file amended tax returns. You can access your Form 1099G information on your Correspondence page in Uplink account.

How to get a 1099 g form from unemployment nj. Individuals who collect these benefits will receive a 1099 form directly from the Department of Labor and Workforce Development listing the taxable income and any withholding. In this case your best option is to contact the nj state unemployment board to have them either send or re send the 1099 g form that reports unemployment.

To determine if you are required to report this information on a federal income tax return see the federal income tax instructions contact the IRS or contact your tax professional. We do not mail these forms. After each calendar year during which you get Unemployment Insurance benefits we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld.

If you disagree with any of the information provided on your 1099-G tax form you should complete the Request for 1099-G Review. Search for unemployment compensation and select the Jump to link. Click here for the Request for Change in Withholding Status form.

If you received any of the following benefits in 2020 you need to log in to your account to download a 1099-G form for your 2020 tax return. This information is also sent to the IRS. Family Leave Insurance benefits Family Leave During Unemployment Insurance benefits.

Form 1099-G for New Jersey Income Tax refunds is only accessible online. I need info on my 1099-G form from NJ Unemployment. Call your local unemployment office to request a copy of your 1099-G by mail or fax.

This will make sure that any adjustment checks determinations tax statements 1099-G and informational notices go to the right place. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. We mailed you a paper Form 1099G if you have opted into paper mailing or are a telephone filer.

You may contact the Benefit Payment Control Unit via telephone at 410-767-2404 use prompts 1 1 4 1 4 to obtain a computer printout of repayments made to the Division of Unemployment. The 1099-G form will be available to download from your online dashboard in January. Call your local unemployment office to request a copy of your 1099 g by mail or fax.

If you havent received your 1099-G copy in the mail by Jan. You dont need to include a copy of the form with your income tax return. Do not use this form to report an address change while you are collecting Unemployment Insurance benefits.

Furnish a copy of form 1099 g or an acceptable substitute statement to each recipient except as explained later under box 2. I have the monetary information I just need info on the payers - Answered by a verified Tax Professional. On the Did you receive unemployment or paid family leave benefits in 2020.

PO Box 046 Trenton New Jersey 08646-0046 or send correspondence electronically through our NJ ONRS system. You may send the form back to NYSDOL via your online account by fax or by mail. Then you will be able to file a complete and accurate tax return.

Once NYSDOL receives your completed Request for 1099-G Review form it will be reviewed and we will send you an amended 1099-G tax form. Where can I get my 1099-G tax form for 2020 If you want to know how to get your 1099-G information or have questions about the numbers on your form we can help. Follow the instructions on the bottom of the form.

31 there is a chance your copy was lost in transit. NJ workers currently claiming federal benefits will receive an additional 25 weeks. Form 1099-INT Interest Income statements are not available online.

We use cookies to give you the best possible experience on our website. Only use this form to tell us about an address change after you stop collecting benefits. Temporary Disability benefits and Unemployment Insurance benefits are not subject to the New Jersey state income tax.

Form 1099-G Income Tax Statement showing the amount of Unemployment Insurance benefits paid and amount of federal income tax withheld will be in January following the calendar year in which you received benefits. If you need a copy of your 1099-INT Write to. To view and print your statement login below.

Call your local unemployment office to request a copy of your 1099 g by mail or fax. If you only repaid benefits received from prior benefit years you will not receive a 1099-G.

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Ma Form 1099 G 1099 Form 2021 Printable

Ma Form 1099 G 1099 Form 2021 Printable

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

What Barber Shop Owners Need To Know About The W 9 And 1099 Tax Forms Barber Accountant

What Barber Shop Owners Need To Know About The W 9 And 1099 Tax Forms Barber Accountant

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

Nj 1099 Form Download Vincegray2014

Nj 1099 Form Download Vincegray2014

Didn T Receive A Form 1099 Don T Ask

Didn T Receive A Form 1099 Don T Ask

What Is A 1099 Form 1099 Form 1099 Form Know How

What Is A 1099 Form 1099 Form 1099 Form Know How

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits