How To Use Form 1099-sa

As long as you are using the funds for qualified health expenses these distributions are typically tax free. First your total HSA withdrawal goes on line 14a.

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Confirm and place it by clicking on the symbol and then save the changes.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

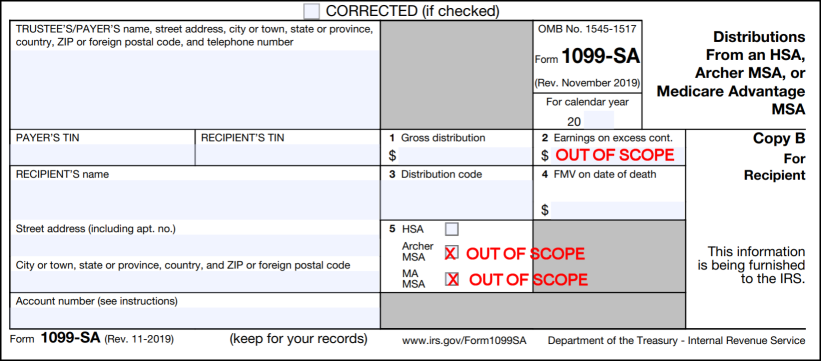

How to use form 1099-sa. Download the resulting document. For more information about the requirement to furnish a Form 1099-SA or acceptable substitute statement to recipients see part M in the current General Instructions for Certain Information Returns. Health Savings Account HSA Archer Medical Savings Account MSA Medicare Advantage MA MSA.

Archer Medical Savings Account Archer MSA. Its best to enter your 1099-SA before you enter your medical expenses so we can properly calculate your medical expense deduction. Form 1099-SA documents your HSA distributions also called withdrawals for 2020.

Health Savings Account HSA You will receive the IRS Form 1099-SA and IRS Form 5498-SA either by mail or electronically based upon your elected delivery preference. Give them a call because you cant do your return without it unless you had no distributions in which case you skip it in the HSA interview in TurboTax. These IRS tax forms are also available in the Member Website.

There are three tax forms associated with health savings accounts HSAs. File Form 8889 or Form 8853 with your Form 1040 or 1040-SR to report a distribution from these accounts even if the distribution isnt taxable. IRS Form 1099-SA is provided for each HSA distribution you made in the current tax year.

Open continue your return in TurboTax if you dont already have it open. You will receive a Form 1099-SA that shows the total amount of your annual distributions ie. Select the area where you want to insert your e-signature and then draw it in the popup window.

The distribution may have been paid directly to a medical service provider or to the account holder. Please use the information in your 1099-SA form available online to fill out IRS tax form 8889. Select Jump To 1099-SA.

If you should have been sent a 1099 but were not you can generally use Form 4852 as a substitute. The 1099-SA is similarly used to report distributions but its for distributions from Health Savings Accounts HSA Archer MSAs or Medicare Advantage MSAs. The payer isnt required to compute the taxable amount of any distribution.

Enter the amount from box 2 in Income earned on the excess contributions withdrawn 1099-SA box 2. Your tax preparer will use your 1099-SA W-2 and other documents as necessary to complete and submit IRS Form 8889 with your annual tax return. Truncating Recipients TIN on Payee Statements.

IRS Form 1099-SA 5498-SA and IRS Form 8889. Box 5 shows the type of account that is reported on the Form 1099-SA. If you made an excess HSA contribution in 2019 and withdrew that excess contribution by the 2020 tax return filing deadline earnings from that excess HSA contribution are shown here they will also be in Box 1.

Form 8889 is used to calculate your HSA deduction amount and report distributions. The 1099-SA is an important form when you report distributions from special accounts to pay medical expenses. View solution in original post.

Youll only receive this form if you made withdrawals from your HSA in 2020. How to use Form 1099-SA for your taxes. Form 1099-SA is used to show distributions from.

It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return. Heres how to understand your Form 1099-SA for the 2020 tax year. Inside your program search for 1099-SA.

A separate return must be filed for each plan type. If you did then that bank or financial institution owes you a form 1099-SA. 1 which indicates normal tax-free distributions.

If you are required to file Form 1099-SA you must provide a statement to the recipient. Money you used reported in box 1. However you should report the missing form to the IRS and ask for their guidance on how to proceed.

You can enter the information on the appropriate 1099 screen even if you do not have an actual paper form. If you see code 1 you wont owe anything extra. A Social Security 1099 or 1042S Benefit Statement also called an SSA-1099 or SSA-1042S is a tax form that shows the total amount of benefits you received from Social Security in the previous year.

File Form 1099-SA to report distributions made from a. Shows the total amount of withdrawals from your HSA in 2020 including HSA rollovers but not HSA transfers. IRS Form 1099-SA This form is sent to you at the end of January already filled out by your HSA custodian and should be used to help you complete your IRS Form 8889.

Then you can refer to Box 3 on IRS Form 1099-SA to see if your withdrawal was allowed. Health savings account HSA. Provided you only use the funds to pay qualified medical expenses box 3 should show the distribution code No.

Lacerte reports this amount as Other Income on Form 1040. Form 8889 is the only one you need to submit with your taxes. 0 1 1402 Reply.

When you distribute money from your HSA your tax return has one extra hoop to jump through Form 8889. Medicare Advantage Medical Savings Account MA MSA. Enter any other applicable information.

The form contains specific information that must be reported correctly and may or may. If you want to share the 2012 1099 sa form with other parties you can send the file by e-mail.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

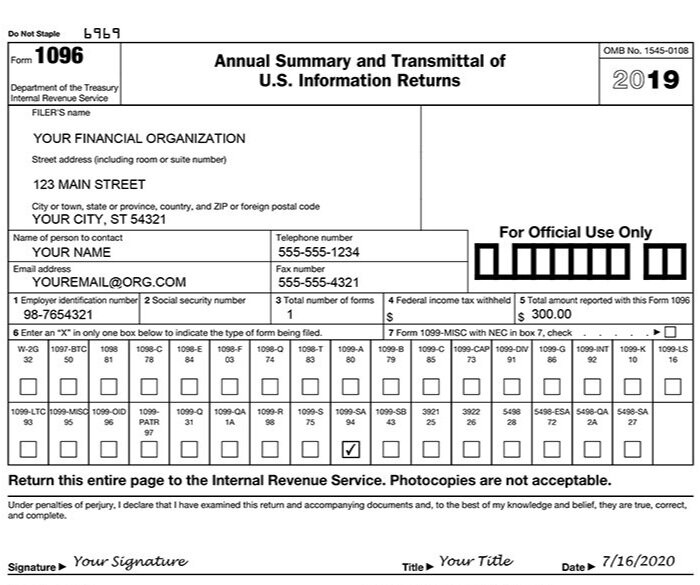

Correcting Your Hsa Reporting Two Steps Two Forms Ascensus

Correcting Your Hsa Reporting Two Steps Two Forms Ascensus

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

1099 Sa 2018 Public Documents 1099 Pro Wiki

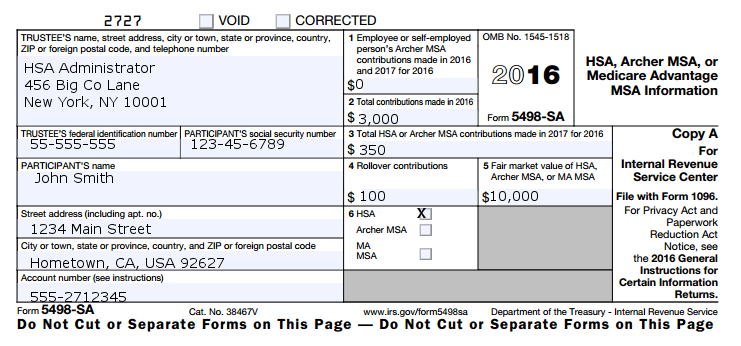

5498 Ira Esa Sa Contribution Information Where Do I Enter Data From A Form 5498 There Is No 5498 Screen And Ordinarily The 5498 Would Not Be Used In Data Entry For A Return There Are A Variety Of 5498 Forms 5498 Ira Contribution Information 5498

5498 Ira Esa Sa Contribution Information Where Do I Enter Data From A Form 5498 There Is No 5498 Screen And Ordinarily The 5498 Would Not Be Used In Data Entry For A Return There Are A Variety Of 5498 Forms 5498 Ira Contribution Information 5498

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

1099 Sa Software To Create Print E File Irs Form 1099 Sa

1099 Sa Software To Create Print E File Irs Form 1099 Sa

Sample Form 1099 Sa Vincegray2014

Sample Form 1099 Sa Vincegray2014

Form 1099 Tax Return Vincegray2014

Form 1099 Tax Return Vincegray2014

5498 Sa Software To Create Print E File Irs Form 5498 Sa

5498 Sa Software To Create Print E File Irs Form 5498 Sa

What Is Hsa Tax Form 5498 Sa Hsa Edge

What Is Hsa Tax Form 5498 Sa Hsa Edge

Irs Form 1099 R Box 7 Distribution Codes Ascensus

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition