Are Banks Lending During Covid 19

As monetary policy easing was coupled with an easing of macroprudential and microprudential measures during the COVID-19 crisis it is important to understand whether the effects on bank lending associated with this combination of measures are larger than the effects associated with. Financial Institution Letter FIL-74-2020.

3 hours agoSP Global Ratings believes the systemic risk for Indian Banks is likely to remain high during the second wave of the COVID-19 pandemic and the high proportion of weak loans.

Are banks lending during covid 19. In our new paper Bank Lending during the COVID-19 Pandemic we examine how the COVID-19 crisis affects the pricing and structure of large corporate loans in the global syndicated loan market. Bank of China has issued the equivalent of 645 million of Covid-19 impact alleviation bonds in Macau to support small businesses. Banks play a key role in helping to alleviate the economic impacts of COVID-19 and have been encouraged to leverage their Community Reinvestment Act CRA activities in their response as described in this interagency guidance from the Federal Deposit Insurance Corporation the Board of Governors of the Federal Reserve System and the Office of the Comptroller of the Currency.

We find a higher increase in total lending growth by banks more exposed to COVID-19 and lockdown policies but only if we include loans provided under the Paycheck Protection Program while there is a reduction in lending growth over time when excluding such loans. The coronavirus crisis is already having a devastating impact on Australias economy with almost 600000 people losing their jobs in April after COVID-19 restrictions forced thousands of businesses to shut down. Amid the financial uncertainty banks and other lenders have changed the way they assess borrowers in some cases making it even more difficult to get.

COVID-19 lending and the role of government support. Overall we consider more than 4000 loans granted from 77 banks to 820 firms in. List Of Banks Offering Relief To Customers Affected By.

Our analysis of this lending market shows that small banks were important contributors to this lending growth. PPP loan applications for small business owners entered the mix in early April. With COVID-19 wreaking havoc on the economy and millions of workers losing their jobs banks expect many to stop paying their credit cards mortgages and other loans.

Aron Clark senior mortgage banker with Dart Bank says that while new applications are still being processed a big hurdle in todays market is job status. This approach will account for needs and preferences across all consumer segments including the older part of the population that is both more vulnerable to COVID-19 and less likely to adopt digital channels. Both overall lending and lending to small businesses and farms grew rapidly during the start of the COVID-19 pandemic in the first six months as firms secured liquid assets to maintain operations.

Additional Loan Accommodations Related to COVID-19 Event August 3 2020 Increasing flexibility for banks to meet the needs of their customers We have encouraged banks to work with all borrowers especially those from industry sectors particularly vulnerable to economic volatility. The balance sheet weakness in smaller businesses would contribute to incremental Non-Performing Loans NPLs according to the SP. Many banks have programs to help customers affected by the COVID-19 pandemic and its economic fallout.

As we enter a national state of economic hibernation banks and lenders are grappling with a sudden influx of relief requests from consumer and business customers. Offer additional credit programs in particular short-term credit extensions or. Banks should continue branch and ATM operations with the appropriate safeguards while encouraging widespread use of remote services.

For example customers may be eligible. In brief The sudden and unknown nature of COVID-19 has triggered a global economic shock and disrupted Australias economy.

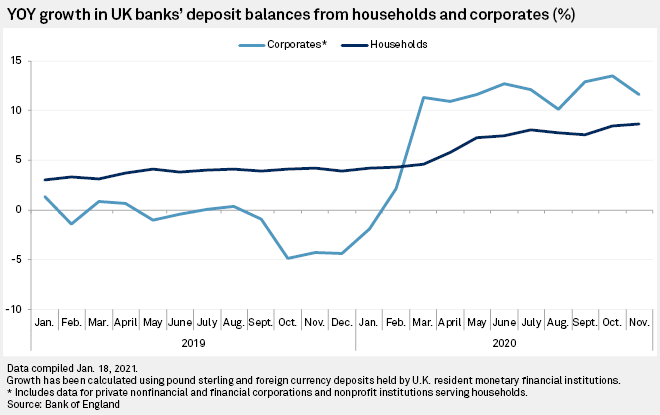

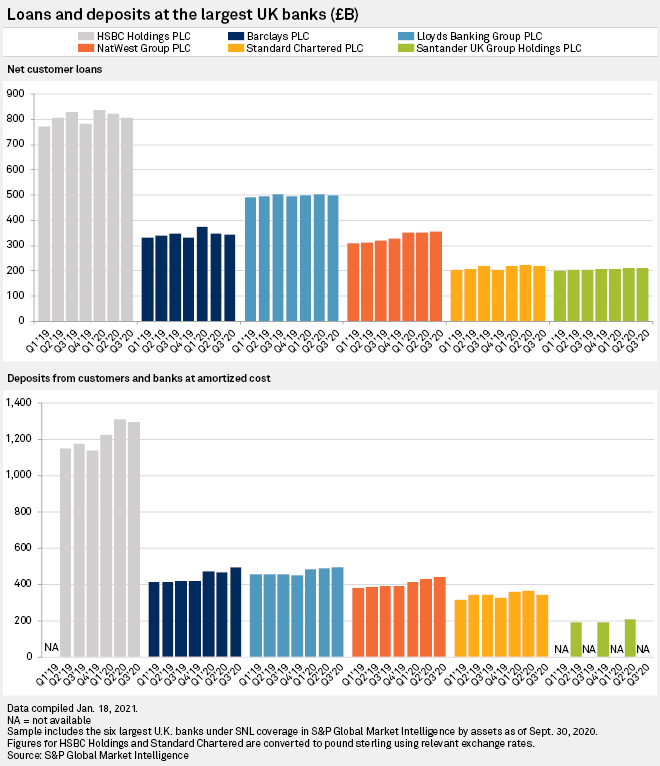

Uk Banks Deposits Rise Amid Pandemic But Margins Likely To Be Squeezed S P Global Market Intelligence

Uk Banks Deposits Rise Amid Pandemic But Margins Likely To Be Squeezed S P Global Market Intelligence

New Data Shows Small Businesses In Communities Of Color Had Unequal Access To Federal Covid 19 Relief

New Data Shows Small Businesses In Communities Of Color Had Unequal Access To Federal Covid 19 Relief

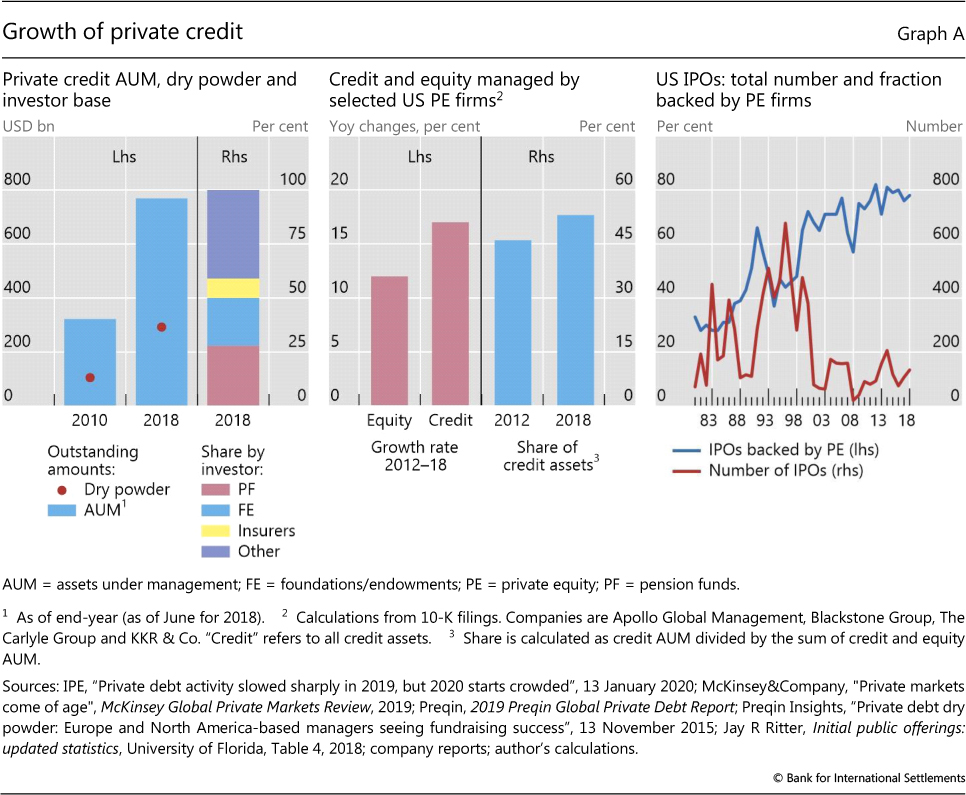

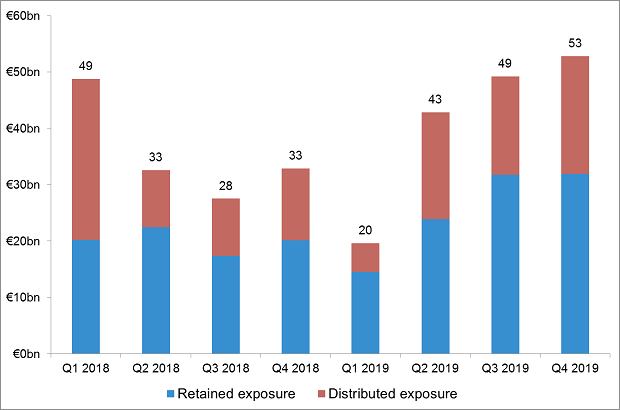

Private Credit Recent Developments And Long Term Trends

Private Credit Recent Developments And Long Term Trends

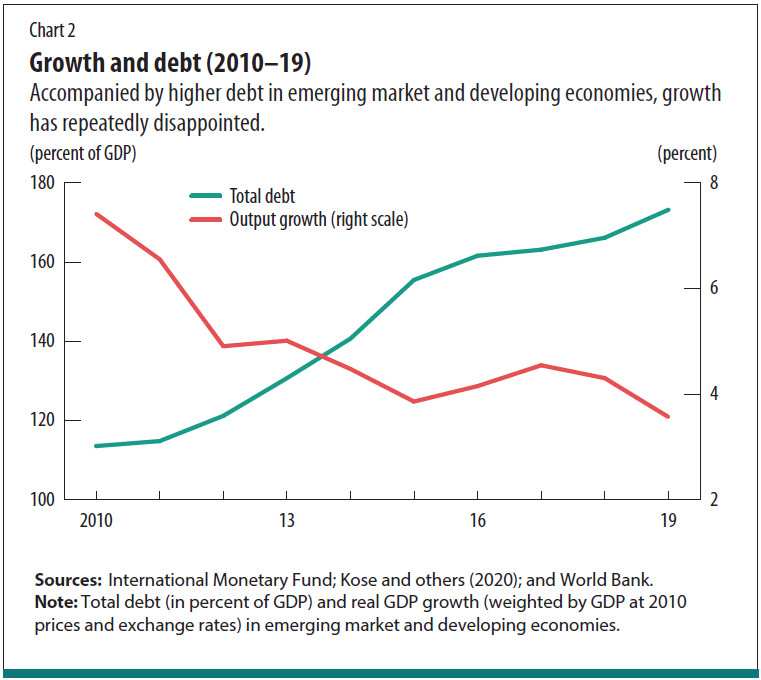

Covid 19 And Debt Crises In Developing Economies Imf F D

Covid 19 And Debt Crises In Developing Economies Imf F D

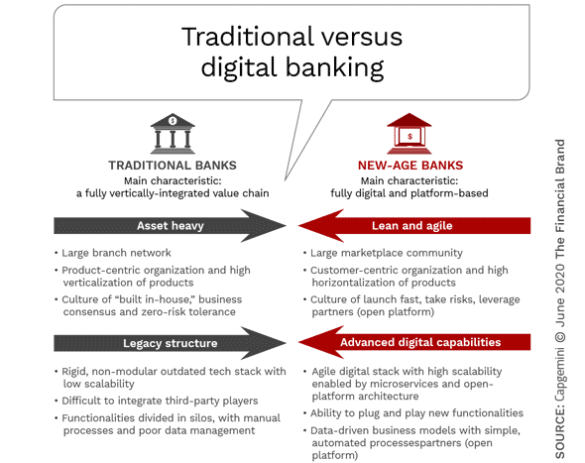

Covid 19 Accelerates Urgency For Digital Banking Transformation

Covid 19 Accelerates Urgency For Digital Banking Transformation

Corporate Debt Market During Covid 19 Pandemic By Les Nemethy And Sergey Glekov Europhoenix

Corporate Debt Market During Covid 19 Pandemic By Les Nemethy And Sergey Glekov Europhoenix

Over 10 Years Later Lessons From The Financial Crisis

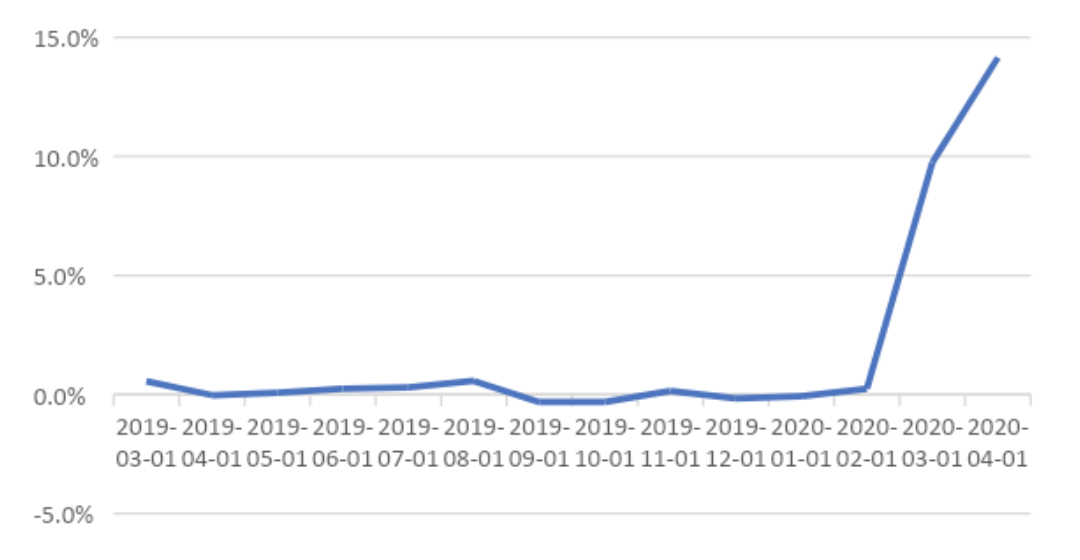

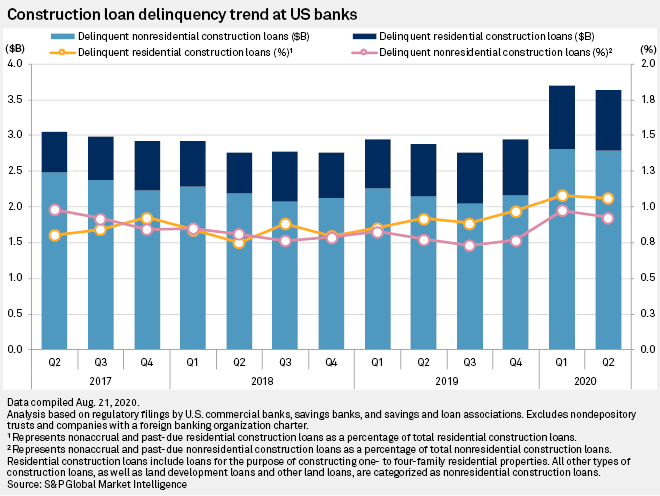

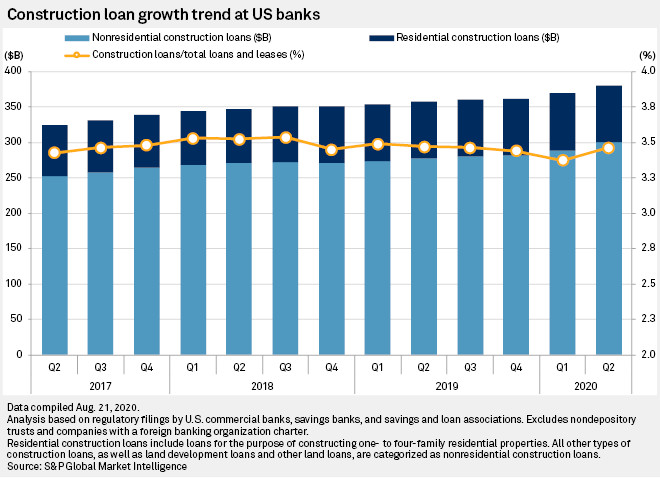

Us Banks Increased Construction Lending In Q2 Even With Delinquencies High S P Global Market Intelligence

Us Banks Increased Construction Lending In Q2 Even With Delinquencies High S P Global Market Intelligence

What S The Ecb Doing In Response To The Covid 19 Crisis

What S The Ecb Doing In Response To The Covid 19 Crisis

Us Banks Increased Construction Lending In Q2 Even With Delinquencies High S P Global Market Intelligence

Us Banks Increased Construction Lending In Q2 Even With Delinquencies High S P Global Market Intelligence

Leveraged Lending Banks Exposed To Risks Amid Covid 19

Leveraged Lending Banks Exposed To Risks Amid Covid 19

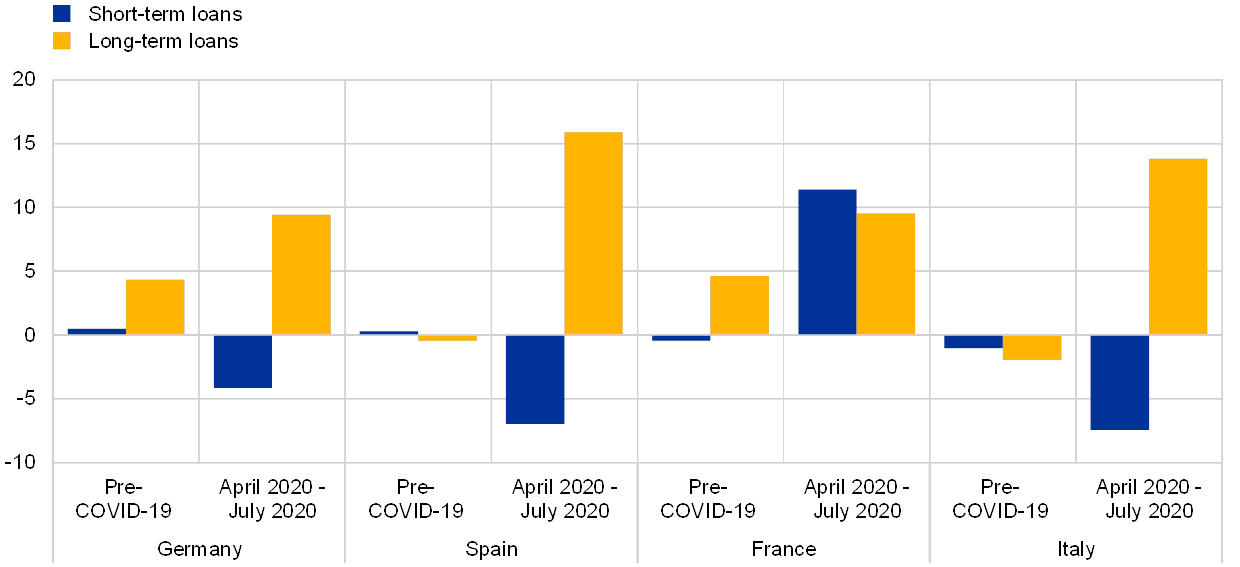

Public Loan Guarantees And Bank Lending In The Covid 19 Period

Public Loan Guarantees And Bank Lending In The Covid 19 Period

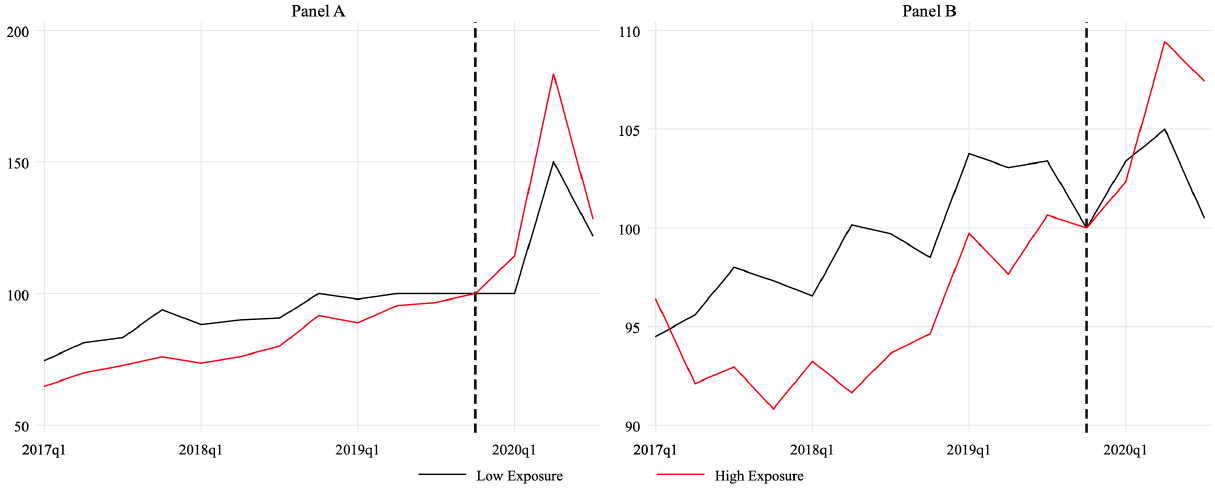

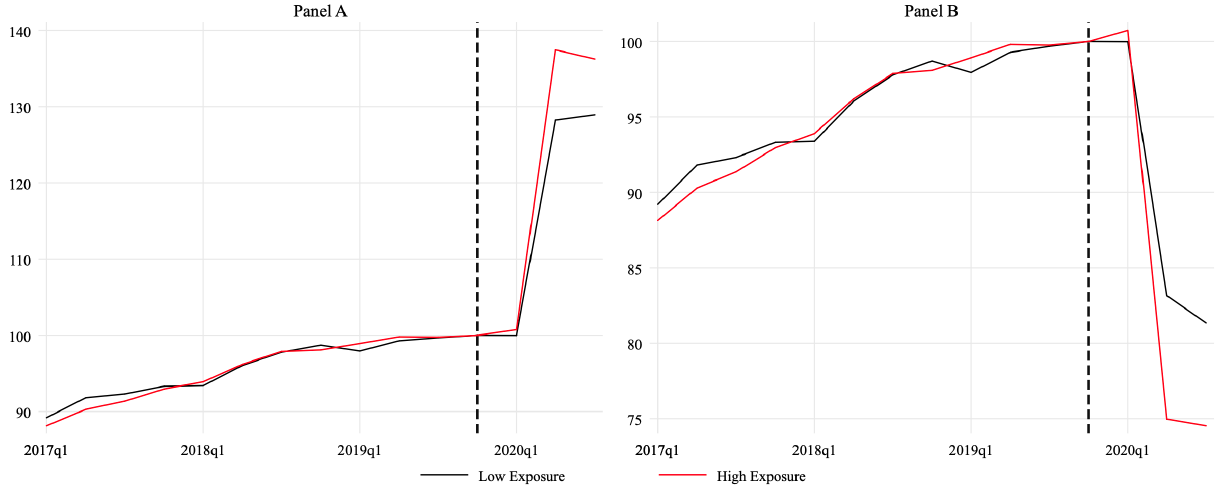

Bank Performance In The Time Of Covid 19 Vox Cepr Policy Portal

Bank Performance In The Time Of Covid 19 Vox Cepr Policy Portal

Public Loan Guarantees And Bank Lending In The Covid 19 Period

Public Loan Guarantees And Bank Lending In The Covid 19 Period

Uk Banks Deposits Rise Amid Pandemic But Margins Likely To Be Squeezed S P Global Market Intelligence

Uk Banks Deposits Rise Amid Pandemic But Margins Likely To Be Squeezed S P Global Market Intelligence

Bank Performance In The Time Of Covid 19 Vox Cepr Policy Portal

Bank Performance In The Time Of Covid 19 Vox Cepr Policy Portal

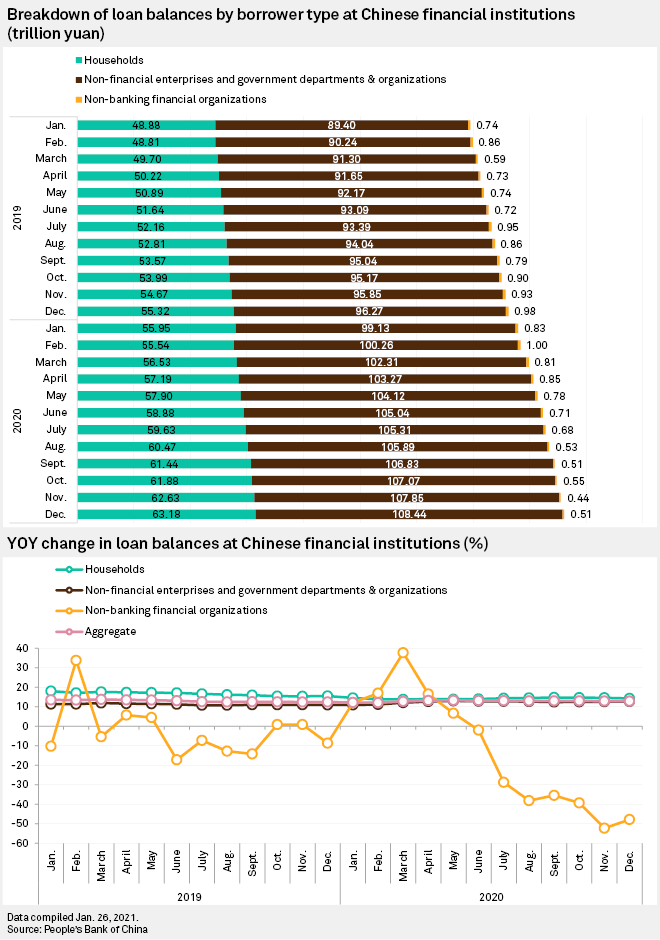

China Bank Loan Growth Set To Slow Further On Tapering Stimulus Lending Curbs S P Global Market Intelligence

China Bank Loan Growth Set To Slow Further On Tapering Stimulus Lending Curbs S P Global Market Intelligence