Florida Corporate Income Tax Extension Form

Obtaining an extension will prevent you from being subject to often very large failure-to-file penalties. You must file Florida Form F-7004 to extend your time to file.

Arkansas Tax Forms And Instructions For 2020 Form Ar1000f

Arkansas Tax Forms And Instructions For 2020 Form Ar1000f

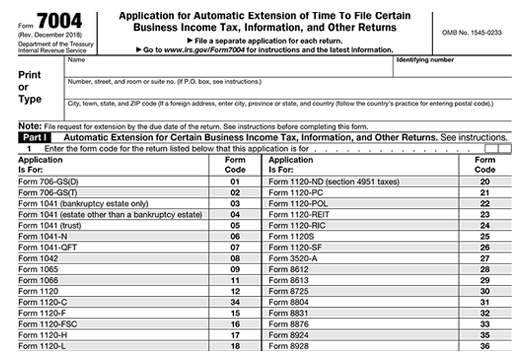

E-filing Form 7004 Application for Automatic Extension to File Certain Business Income Tax Information and Other Returns Form 7004 can be e-filed through the Modernized e-File MeF platform.

Florida corporate income tax extension form. If the entity is a limited partnership or limited liability limited partnership download and complete an amendment form. However there is an extension of form available for corporate businesses in Florida. The F-1120A can be downloaded.

Florida Tentative Income Franchise Tax Return and Application for Extension of Time to File Return F-7004 R. These Where to File addresses are to be used ONLY by TAXPAYERS AND TAX PROFESSIONALS filing individual federal tax returns in Florida during Calendar Year 2021. Mail the form and fee to the Division of Corporations.

The State of Florida will NOT accept an approved Federal tax extension in lieu of the Florida extension application. More about the Florida Form F-1120 Corporate Income Tax TY 2020 We last updated the Florida Corporate IncomeFranchise Tax Return in February 2021 so this is the latest version of Form F-1120 fully updated for tax year 2020. Links are provided for both options.

You can make a Florida extension payment with Form F-7004 or pay electronically via Florida e-Services. Form F-7004 is a Florida Corporate Income Tax form. Pay the estimated tax due on Form F-1120ES for the 1st 2nd 3rd and 4th installments.

Florida Tax Extension Tip. To apply for an extension of time for filing Florida Form F-1065 you must complete Florida Form F-7004 Florida Tentative IncomeFranchise Tax Return and Application for Extension of Time to File Return. If the entity is a corporation or LLC you may file an amended annual report.

Use Form F-7004 Florida Tentative IncomeFranchise Tax Return and Application for Extension of Time to File Return to apply for a Florida C corporation extension. Use Form 7004 to request an automatic 6-month extension of time to file certain business income tax information and other returns. Form 7004 Application for Automatic Extension of Time to File Certain Business Income Tax Information and Other Returns PDF Form 1138 Extension of Time for Payment of Taxes by a Corporation Expecting a Net Operating Loss Carryback PDF.

Instructions for Preparing Form F-1120 for the 2020 tax year. You cannot file your tax return by the original due date. File one of these forms.

File the Florida Corporate Short Form Income Tax Return Form F-1120A File Form F-7004. The F-1120A can be filed electronically. You must file Florida Form F-7004 if you want to obtain a Florida tax extension.

Profit or Non-Profit Corporation. A copy of your federal extension alone will not extend the time for filing your Florida return. Form F-7004 must be filed with payment of.

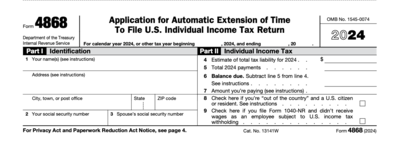

The IRS and most states will grant an automatic 6-month extension of time to file income tax and other types of tax returns which can be obtained by filing the proper extension request form. Write your numbers as shown and enter one number per box. 0117 TC Florida Department of Revenue - Corporate Income Tax Taxable year end.

For corporate income tax payments and filing Florida forms F-1120A Florida Corporate Short Form Income Tax Return F-1120ES DeclarationInstallment of Florida Estimated IncomeFranchise Tax and F-7004 Florida Tentative IncomeFranchise Tax Return and Application for. The state of Florida does not have an income tax and hence there is no need of any extension as far as individual income tax is concerned. Information on e-filing Form 7004 Information about Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns including recent updates related forms and instructions on how to file.

You owe taxes for the current tax year. See Rule 12C-10222 Florida Administrative Code. Welcome to the Florida Corporate Income Tax CIT internet site where you can file the Florida Corporate Extension of Time F-7004 Florida Corporate Short Form Income Tax Return F-1120A or make payments for the Florida Corporate Income Tax Returns F-1120 or F-1120A Florida Corporate Extension of Time F-7004 and the Florida Corporate Estimated Tax Payment F-1120ES.

And you are filing a Form. Use an Automatic Extension form to make a payment if both of the following apply. FEIN M M D D Y Y Name Address CitySt ZIP F-7004 You must write within the boxes.

Florida Corporate IncomeFranchise Tax Return for 2020 tax year. Pay the corporate income tax due on Forms F-1120 and F-1120A. S Corporations must file Florida Form F-1120 by the 1st day of the 4th month after the end of the tax year April 1 for calendar.

If you live in FLORIDA. Electronically Pay with the Department. Florida S Corporation Tax Extension.

This form must be submitted by the original filing deadline of your Florida tax return. All the returns shown on Form 7004 are eligible for an automatic extension of time to file from the due date of the return. Florida Corporate Short Form Income Tax Return.

Pay the tentative tax due on Form F-7004. Corporations and Exempt Organizations.

E File An Irs Tax Extension E File Com

E File An Irs Tax Extension E File Com

Http Floridarevenue Com Forms Library Current F1120af7004 Pdf

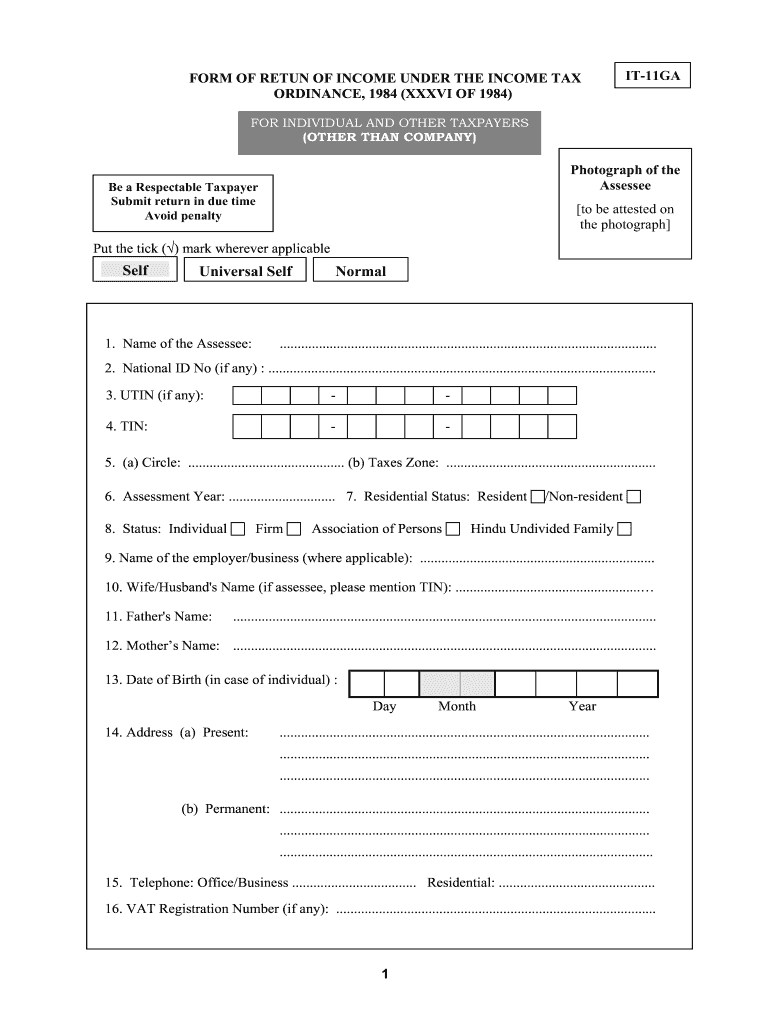

Tax Return Form Fill Online Printable Fillable Blank Pdffiller

Tax Return Form Fill Online Printable Fillable Blank Pdffiller

Find Irs Form 1040 And Instructions Irs Forms Irs Tax Extension

Find Irs Form 1040 And Instructions Irs Forms Irs Tax Extension

New Mexico Tax Forms And Instructions For 2020 Form Pit 1

New Mexico Tax Forms And Instructions For 2020 Form Pit 1

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Free 6 Sample Income Tax Extension Forms In Pdf

Free 6 Sample Income Tax Extension Forms In Pdf

Missouri Tax Forms 2020 Printable State Mo 1040 Form And Mo 1040 Instructions

Missouri Tax Forms 2020 Printable State Mo 1040 Form And Mo 1040 Instructions

Form 1040 Gets A Makeover For 2018 Insights Blum

Form 1040 Gets A Makeover For 2018 Insights Blum

Fla Issues Memo To Businesses Taxes Are Lower Here Http Www Floridarealtors Org Newsandevents Article Cfm P Business Tax Bookkeeping Services Tax Software

Fla Issues Memo To Businesses Taxes Are Lower Here Http Www Floridarealtors Org Newsandevents Article Cfm P Business Tax Bookkeeping Services Tax Software

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Understanding The 1065 Form Scalefactor

Understanding The 1065 Form Scalefactor

Hawaii Tax Forms And Instructions For 2020 Form N 11

Hawaii Tax Forms And Instructions For 2020 Form N 11

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Colorado Tax Forms 2020 Printable State Co 104 Form And Co 104 Instructions

Colorado Tax Forms 2020 Printable State Co 104 Form And Co 104 Instructions

Tennessee Tax Forms 2020 Printable State Tn Inc 250 Form And Tn Inc 250 Instructions

Tennessee Tax Forms 2020 Printable State Tn Inc 250 Form And Tn Inc 250 Instructions

If You Have Any Questions About The New Tax Forms Or Need Assistance Preparing And Filing Your Tax Return Help I Accounting Services Tax Prep Accounting Firms

If You Have Any Questions About The New Tax Forms Or Need Assistance Preparing And Filing Your Tax Return Help I Accounting Services Tax Prep Accounting Firms

Virginia Tax Forms 2020 Printable State Va 760 Form And Va 760 Instructions

Virginia Tax Forms 2020 Printable State Va 760 Form And Va 760 Instructions