How Do You Determine Which Vendors Receive A 1099

For the sale of a main home you usually will NOT receive a 1099-S. If you designate a supplier as a 1099 vendor the system will print a Form 1099 for the supplier as part of the 1099 batch processing that follows the end of the calendar year.

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

There is no longer a home gain rollover exclusion.

How do you determine which vendors receive a 1099. 2 whether or not the personbusiness is a corporation. You dont need to issue 1099s for payment made for personal purposes. Place a check in the filter row to filter the list to show only those Suppliers that are set up to receive 1099s.

And 3 whether your payments to the personbusiness exceed the 600 reporting threshold. How to Determine Who Receives a 1099. Use Form W-2 for all payments to employees including business travel allowances and expense reimbursements.

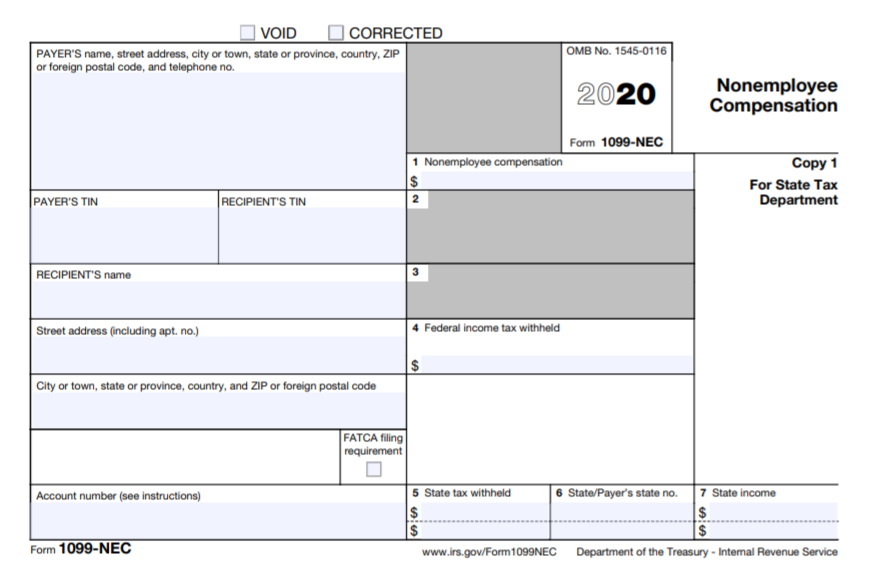

The company then sends the resulting 1099 form to the supplier. When you hire a non-employee you must get a W-9 form from them reporting this and other identifying information youll need to complete Form 1099-NEC. It depends on the type of business you do and the type of vendors youre dealing with.

If you did not receive a 1099-S for the sale of your home and you meet the requirements of the home gain exclusion then you will not have to report this home sale of your income tax return. You will need to provide a 1099 to any vendor who is a. LLC and has not taken the S Corp election LLP.

The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least 600 in rents services including parts and materials prizes and awards or other income payments. If a partnership or an individual then you need to prepare a 1099. If You Pay A Vendor More Than 600 Or 10 In Royalties A 1099-MISC is the form any business sends anyone they pay to do a service who isnt an employee such as those loyal workers who signed a W-2 at the start of their contract and already get their taxes removed from their paychecks.

Use form 1099-NEC to report payments to independent contractors. How to Determine Who Receives a 1099 by Chris Newton Demand Media. A person is engaged in business if he or she operates for profit.

Who Gets a 1099. The first step in determining this is to establish the relationship between the service provider and the company. A 1099 vendor is a designation listed in each of the records in the vendor master file that is part of an accounting software package.

If the provider is not a standard employee and they earned at least 600 in services during the year a 1099 form is required. The next big question is if you paid the vendor 600 or more during the. Before issuing a 1099-MISC you should determine.

1 whether the person is legally an employee or an independent contractor. Taxpayer ID Numbers for Form 1099-NEC. 1099 forms only report the payment of services.

So whether you bought oce supplies or airplanes vendors who sold you a physical product do not need to receive a 1099-MISC form at year-end. While the 1099-NEC is taking the place of a 1099-MISC with box 7 data beginning with calendar year 2020 the 1099-MISC form is still in use for other purposes for example for rents payments to attorneys and fishing boat proceeds. Less-reputable vendors might not be around when you need their information at tax time.

Generally if the vendor is a corporation you do NOT need to file a 1099. Once you have this list of vendors figured out even if there are still some youre unsure of figure out HOW you have paid them. Include the column titled Is 1099 the Federal Tax ID column and the various Business Address columns on your list.

Persons engaged in a trade or business must file Form 1099 MISC when certain payments are made. What is a 1099 Vendor. 1099 forms are typically due in February.

Thus personal payments arent reportable. Here are some guidelines to help determine if a vendor needs to be set up as a 1099 vendor. Review it for any non-corporate vendors and lawyers that were paid over 600.

For any accounting system run a report on purchases by vendor. Dont use Form 1099-MISC to report payments to employees. Did you pay your vendor.

If in doubt and there are only a few cases you are wondering about then the best approach would be to err on the side of caution and send the 1099. Below that threshold you do not need to report the payment. If you had designated your vendors as potential 1099 contractors when you set them up these reports would show you which vendors were paid more than 600 during the year.

Next we will create a list of Payments to these Suppliers to determine the dollar amount required to. If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. You must have a valid tax ID number for a non-employee before you prepare Form 1099-NEC.

1099 Rules Regulations Who must file. Who Should Not Receive a 1099-MISC. Document your efforts to obtain a completed W-9 form by keeping notes of the attempts you made.

To determine whether you need.

Performing 1099 Year End Reporting

Performing 1099 Year End Reporting

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Stimulus Check Frequently Asked Questions Amy Northard Cpa The Accountant For Creatives This Or That Questions Business Tax Deductions Small Business Tax

Stimulus Check Frequently Asked Questions Amy Northard Cpa The Accountant For Creatives This Or That Questions Business Tax Deductions Small Business Tax

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Why Are Clients Asking For A W 9 And What The Heck Is It The Smart Keep Inc Small Business Tax Small Business Bookkeeping Small Business Finance

Why Are Clients Asking For A W 9 And What The Heck Is It The Smart Keep Inc Small Business Tax Small Business Bookkeeping Small Business Finance

How To Set Up A Small Business Accounting System Small Business Accounting Small Business Business Account

How To Set Up A Small Business Accounting System Small Business Accounting Small Business Business Account

Patient Financial Responsibility Form Template Beautiful What Is Irs Form W 9 And How Should You Fill It Out Irs Forms Financial Responsibility Types Of Taxes

Patient Financial Responsibility Form Template Beautiful What Is Irs Form W 9 And How Should You Fill It Out Irs Forms Financial Responsibility Types Of Taxes

Nysscpa Org The Web Site Of The New York State Society Of Cpas Accounting Financial Advisory Accounting And Finance

Nysscpa Org The Web Site Of The New York State Society Of Cpas Accounting Financial Advisory Accounting And Finance

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

W2 Forms Google Search Tax Forms W2 Forms Tax Time

W2 Forms Google Search Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Who Needs To File 1099 S For Taxes Megan Naasz Entrepreneur Resources Crop Insurance Business Tips

Who Needs To File 1099 S For Taxes Megan Naasz Entrepreneur Resources Crop Insurance Business Tips

How To File Taxes The Easy And Organized Way Filing Taxes Tax Organization Tax Checklist

How To File Taxes The Easy And Organized Way Filing Taxes Tax Organization Tax Checklist

The Complete Guide To Bookkeeping For Small Business Owners Small Business Organization Small Business Finance Small Business Bookkeeping

The Complete Guide To Bookkeeping For Small Business Owners Small Business Organization Small Business Finance Small Business Bookkeeping

By Far This Is A Common Call We Get In Support And Even Though We See So Many It Is A Hard One To Solve That Is Why You Call M

By Far This Is A Common Call We Get In Support And Even Though We See So Many It Is A Hard One To Solve That Is Why You Call M

Perfect For Tracking Expenditures Great For Direct Sales Consultants For Keeping Your Business Expense Business Organization Business Organization Printables

Perfect For Tracking Expenditures Great For Direct Sales Consultants For Keeping Your Business Expense Business Organization Business Organization Printables