Quickbooks How To Send 1099 To Vendor

Select anywhere to refresh the report. Choose Company Preferences tab.

10 Electronic Pay Stub Dragon Fire Defense Quickbooks Simple Budget Certificate Format

10 Electronic Pay Stub Dragon Fire Defense Quickbooks Simple Budget Certificate Format

Click on PrintE-File 1099 Forms.

Quickbooks how to send 1099 to vendor. Map the 1099 accounts and vendors. This tutorial explains how to set up 1099 vendors and print 1099 forms in QuickBooks. This way the system will be triggered to provide a new invite option.

Remove Business ID No. Start asking your Independent Contractorsvendors for 1099s. Click on Edit.

Time to start thinking about the end of the year. - Picked up the 1099-MISC packet from an office supply store. Switch your settings to HD so the image is clear.

Prepping the vendors in QuickBooks Online so they show up on your 1099 Summary Report. QuickBooks Help Questions How to send 1099 to a vendor paid by a credit card. How to prepare and file 1099s with QuickBooks Desktop Go to Vendors and select PrintE-file 1099s.

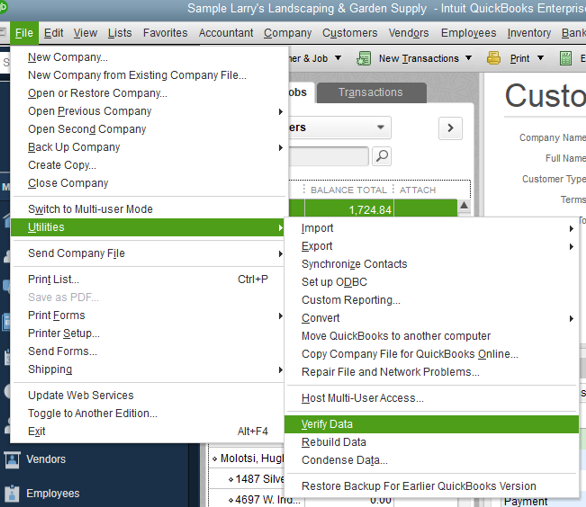

Start QuickBooks and go to Vendors. Remove Business ID No. Open QuickBooks Desktop go to Edit tab and select Preferences.

Click on Get started and select 1099-NEC or 1099-MISC depending upon the type of your contractors. Click Yes to filing 1099-MISC forms option. Enter your contractor information and values for.

Continuing down the window fill out the Address If you have an email address feel free to enter that as well. You can e-file your 1099-MISC Forms right in QBO send copies of 1099s to subcontractors in the mail and submit forms to the IRS. In 2020 the price was 1599 for three contractors and 5 for each additional.

Hover your mouse on Workers click on. Select Expenses Vendors. Make sure your vendors are set up properly.

From the 1099 E-File Service page log in to your or sign up for your account. This can be either SSN or FEIN and select Save. Check Vendor eligible for 1099 Verify the tax.

Turn on the 1099 feature. If you want to sort the report by 1099 vendors. The benefit to filling that out is that ifwhen you file your 1099s through Quickbooks Online Quickbooks will send an electronic copy of the 1099 directly through email to your vendor in addition to mailing a paper copy.

Type in your tax information then click OK. After enough of you asked I created a mini co. Select the Sort drop-down menu.

- Click the Tax Settings tab on the left click the radio button Vendor eligible for 1099 and input the social security or tax ID number into the Vendor Tax ID box Work Before Printing and Filing 1099s - Before you file your 1099s in QuickBooks ensure that youve. Select the Track 1099 checkbox. Fill in Vendor information from the W-9 Form.

Click on 1099 Vendor. The is also an option to print your own forms and send them manually. Select the contractors name.

Check on box Track Payments for 1099 Save. Choose Vendor Details tab. Enter your company information then tap Continue.

From the Sort by drop-down menu select Track 1099. 1 Vote Up Vote Down Jolyne asked 3 years ago I paid a vendor for professional fees by credit card. Select the contractors name.

How do I ca. Select the contractors name. Select Ok to save the settings.

If you submit early the price was 1299. This can be either SSN or FEIN. Find your 1099 eligible vendors in the Vendor Center and double click them to edit.

Verify the names and addresses. Click on the Tax Settings tab and enter the contractors tax identification number or Social Security number if the vendor is a sole proprietor. To change whether you track a vendor for 1099s update the vendor on your vendor list.

Choose 1099 Wizard then select Get Started. On the left panel hover your mouse on Workers and click on Contractors.

How To Pay Multiple Bills Using A Check In Quickbooks Online Quickbooks Online Quickbooks Online

How To Pay Multiple Bills Using A Check In Quickbooks Online Quickbooks Online Quickbooks Online

Change Ein Number In Quickbooks Online Quickbooks Quickbooks Online Online Tutorials

Change Ein Number In Quickbooks Online Quickbooks Quickbooks Online Online Tutorials

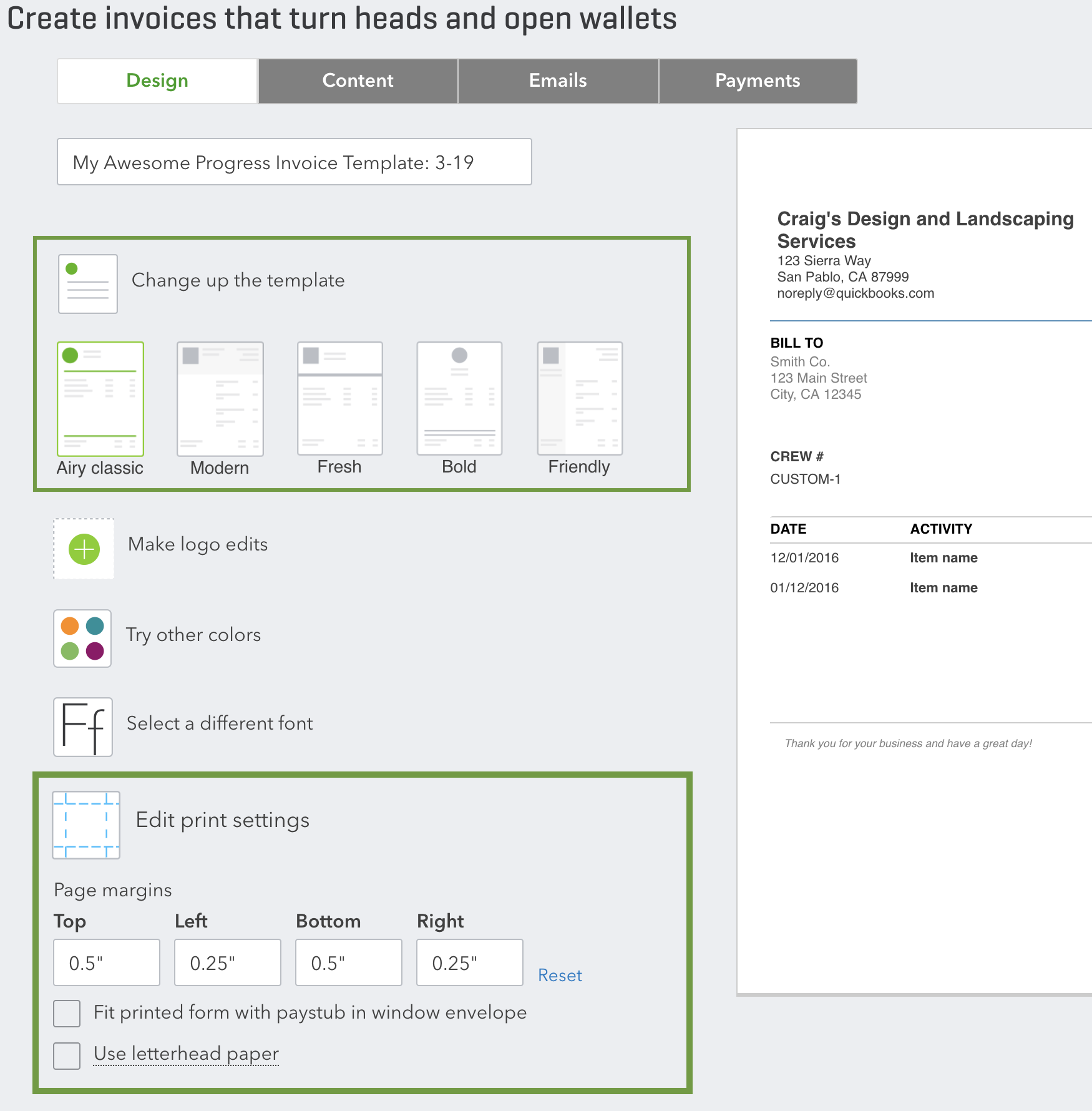

Set Up And Send Progress Invoices In Quickbooks On

Set Up And Send Progress Invoices In Quickbooks On

1099 Forms Made Easy In Quickbooks Quickbooks Make It Simple 1099 Tax Form

1099 Forms Made Easy In Quickbooks Quickbooks Make It Simple 1099 Tax Form

How To Utilize Quickbooks Unscheduled Payroll Checks

How To Utilize Quickbooks Unscheduled Payroll Checks

Qb 941 Printing Error Tax Forms Quickbooks Quickbooks Payroll

Qb 941 Printing Error Tax Forms Quickbooks Quickbooks Payroll

Open The Company File From Which You Created The Accountant S Copy Choose File Accountant S Copy Client Activi Quickbooks How To Use Quickbooks Accounting

Open The Company File From Which You Created The Accountant S Copy Choose File Accountant S Copy Client Activi Quickbooks How To Use Quickbooks Accounting

Explore Our Example Of Payroll Direct Deposit Authorization Form Template Quickbooks Payroll Quickbooks Templates

Explore Our Example Of Payroll Direct Deposit Authorization Form Template Quickbooks Payroll Quickbooks Templates