The Most Common Form Of Business Ownership In The United States Is The Partnership

The cost varies according to size and complexity. There are two basics forms of partnerships.

A Corporation Is More Credible Than A Sole Proprietorship Or Partnership Incorporated Business Starting A Business Sole Proprietorship

A Corporation Is More Credible Than A Sole Proprietorship Or Partnership Incorporated Business Starting A Business Sole Proprietorship

Form 8990 Limitation on Business Interest Expense Under Section 163j Forms for Individuals in Partnerships.

The most common form of business ownership in the united states is the partnership. If you are an individual in a partnership you may need to file the forms below. Setting up a partnership is more complex than setting up a sole proprietorship but its still relatively easy and inexpensive. For example the big four public accounting firms are partnerships.

Selecting Among the Types of Business Ownership Sole proprietorship. A limited partnership consists of at least one general partner actively involved in the business and one limited partner who has invested in the business and seeks to realize a portion of the profits but is not actively involved in the operational decision making. Common Ownership The assets of a co-operative business are held in trust for the benefit of present and future members of the business.

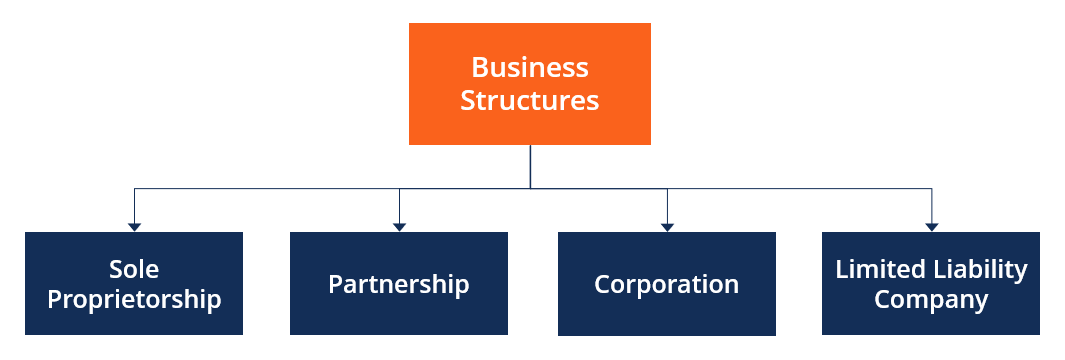

In the United States most business enterprises are organized as sole proprietorships partnerships or corporations. Sole proprietorship partnership or corporation. A General Partnership is composed of 2 or more persons usually not a married couple who agree to contribute money labor or skill to a business.

An unincorporated business owned by one person is called a sole proprietorship. Its possible to form a simple partnership without the help of a lawyer or an accountant though its usually a good idea to get professional advice. Members decide how the profits are distributed.

LLCs provides limited liability and are taxed as a partnership or sole proprietorship depending on the number of members. Form 965-A Individual Report of Net 965 Tax Liability. The most common forms of business enterprises in use in the United States are the sole proprietorship general partnership limited liability company.

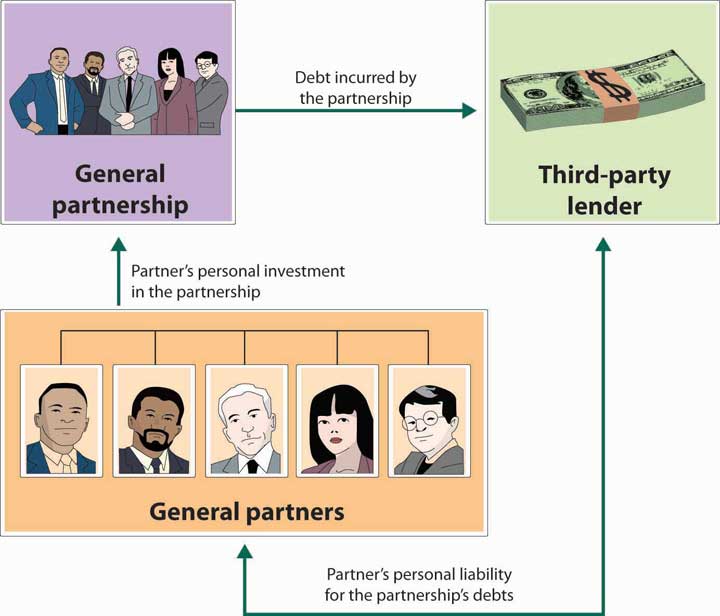

Each partner shares the profits losses and management of the business and each partner is personally and equally liable for debts of the partnership. Generally accepted accounting principles can be applied to the financial statements of all three forms of organization. The corporationpartnershipand sole proprietorship are the three most common forms of business ownership in the United States.

Sole proprietorship Master limited partnership S corporation Corporations A sole proprietorship is an easy form of business ownership to form with limited start-up expenses unlimited liability and no special taxes meaning the profits from the business are taxed at the individual owners personal income tax rate. A form of ownership that is growing in popularity in the United States. Legal and tax considerations enter into selecting a business structure.

A business that is owned and operated by two or more people -- and the least used form of business organization in the United States. The most common forms of business are the sole proprietorship partnership corporation and S corporation. About 10 percent of US businesses are partnerships and though the vast majority are small some are quite large.

Business ownership can take one of three legal forms. They can be shared between the members reinvested in the business. This section will examine the first two forms of business ownershipsole proprietor-.

Chapter 35 ownershipdocx - The major forms of business organizations in the United States include the sole proprietorship the partnership the Chapter 35 ownershipdocx - The major forms of business. The most common and the simplest type of business ownership is the sole proprietorship. It is important to select the most appropriate form of ownership that best suits your needs and the needs of your business.

Form 965-A Individual Report of Net 965 Tax Liability. Partnership A partnership or general partnership is a business owned jointly by two or more people. A Limited Liability Company LLC is a business structure allowed by state statute.

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Eins Business Licenses Llc S Corps Seller S Permits Operating Agreements The List G Small Business Design Email Marketing Design Creating A Business Plan

Eins Business Licenses Llc S Corps Seller S Permits Operating Agreements The List G Small Business Design Email Marketing Design Creating A Business Plan

Which Business Structure Is Best For You Part 9a Limited Partnerships General And Limited Partner Business Structure Limited Partnership Investing Money

Which Business Structure Is Best For You Part 9a Limited Partnerships General And Limited Partner Business Structure Limited Partnership Investing Money

Comparison Chart Of Business Entities Startingyourbusiness Com Business Sole Proprietorship Comparison

Comparison Chart Of Business Entities Startingyourbusiness Com Business Sole Proprietorship Comparison

Chapter 8 Business Organizations Forms Of Business Organizations 1 Sole Proprietorship 2 Partnership 3 Corporation Ppt Download

Chapter 8 Business Organizations Forms Of Business Organizations 1 Sole Proprietorship 2 Partnership 3 Corporation Ppt Download

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Business Landscape 1000 American Business Landscaping Business Cards Business Structure

Business Landscape 1000 American Business Landscaping Business Cards Business Structure

Sole Proprietorship And Partnership Ppt Video Online Download

Sole Proprietorship And Partnership Ppt Video Online Download

Hr Business Partnership Model Human Resources Business Partner Human Resource Management

Hr Business Partnership Model Human Resources Business Partner Human Resource Management

Doula Business Entity Types One Size Does Not Fit All Doula Business Doula Business

Doula Business Entity Types One Size Does Not Fit All Doula Business Doula Business

Agreement Between Owner And Contractor Smart Business Box In 2021 Agreement Smart Business Contractors

Agreement Between Owner And Contractor Smart Business Box In 2021 Agreement Smart Business Contractors

Types Of Business Structures Sole Proprietorship Llc More

Types Of Business Structures Sole Proprietorship Llc More

Business Structure Overview Forms How They Work

Business Structure Overview Forms How They Work

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion