How To Add To Irs Installment Agreement

You may be able to pay online but first you must create an account. Under the People First Initiative the IRS didnt default agreements.

Payment Plan Letter Template Luxury Can T Pay Irs Installment Agreement New Sample Letter To Letter Templates Lettering Quote Template

Payment Plan Letter Template Luxury Can T Pay Irs Installment Agreement New Sample Letter To Letter Templates Lettering Quote Template

Calculate your monthly payment by taking the amount you owe and dividing by.

How to add to irs installment agreement. Pay Now Pay amount owed in full today. The maximum term for a. This taxpayer-friendly approach will occur instead of defaulting the agreement which can complicate matters for those trying to pay their taxes.

There can only be one installment agreement that includes all of the tax years for which you owe an outstanding tax debt. A new unpaid tax balance due would automatically put your existing installment agreement into default. Need to add taxes owed to current installment plan how can I do that.

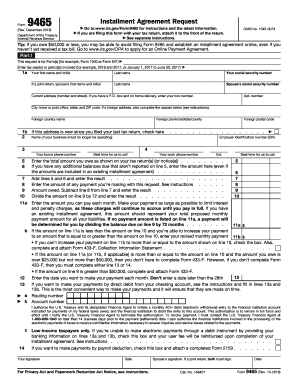

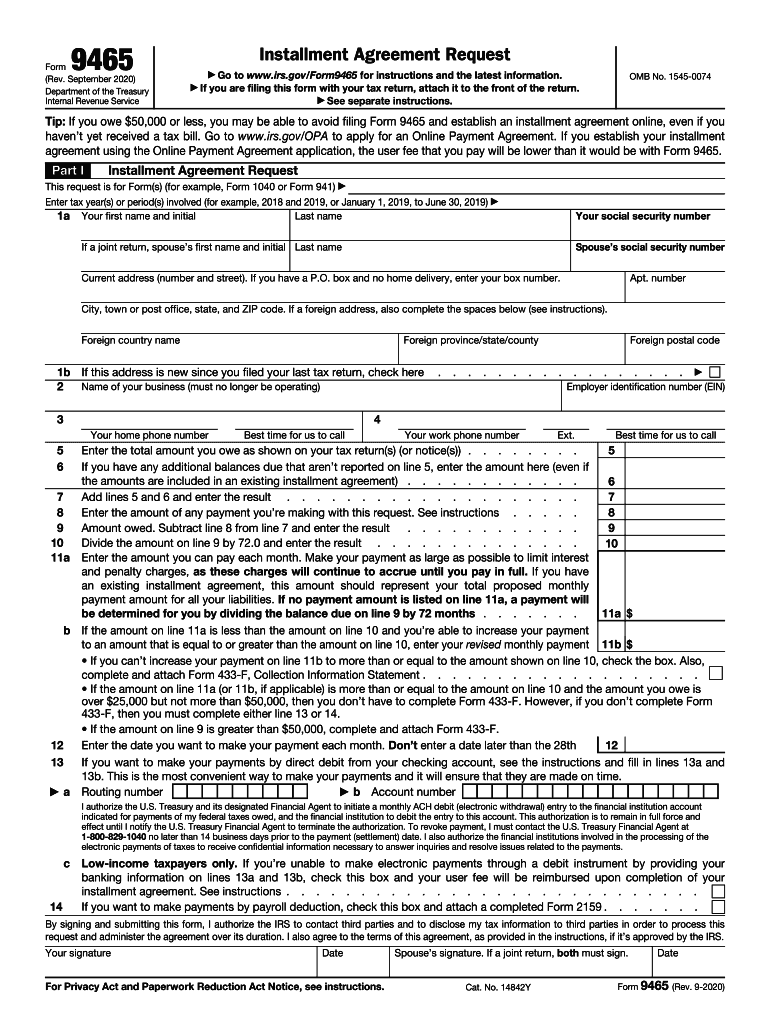

Use Form 9465 to request a monthly installment agreement payment plan if you cant pay the full amount you owe shown on your tax return or on a notice we sent you. Visiting a local IRS office. Make sure you have your return that created the balance due.

Taxpayers who are currently unable to comply with the terms of an Installment Payment Agreement including a Direct Debit Installment Agreement may suspend payments during this period if they prefer. For taxpayers under an existing Installment Agreement payments due between April 1 and July 15 2020 are suspended. You can attach the agreement to your return or fill it out online or mail it in.

Consider partial pay installment agreements as an alternative to an offer in compromise. Even if an individual owes more than 50000 there may still be an option for a relatively easy Installment Agreement. This form collects information about income debts living expenses assets accounts and allows the taxpayer to propose an installment payment amount.

Remember that installment agreements will not last longer than the amount of time the IRS has left to collect. Apply online through the Online Payment Agreement tool or apply by phone or by mail by submitting Form 9465 Installment Agreement Request. Forms online resources and caveats Where and How to Apply Forms to use Requirements St.

Consolidating Tax Balances. Apply for an installment agreement if you received a notice from the IRS and cannot afford to pay the total due. In most cases an applicants unique tax situation and total amount owed will help determine which payment plan is best.

The taxpayer must file Form 433-F Collection Information Statement. It will usually take a few months for the IRS to review a proposed payment plan. When applying through the mail complete Form 9465 Installment Agreement Request or Form 433-D Installment Agreement.

Most installment agreements meet our streamlined installment agreement criteria. They settle and eliminate your tax debt. In these cases and many more an IRS payment plan or installment agreement is the best way forward for all parties and may result in a lower overall payment for the taxpayer.

In 2018 the IRS experimented with an Expanded Streamlined Installment Agreement Expanded Streamlined is available to individual taxpayers who owe between 50001 and 100000. To apply online use the Online Payment Agreement Application OPA on the IRSs website. The IRS will automatically add certain new tax balances to existing Installment Agreements for individual and out of business taxpayers.

Completing Form 9465 with information about both the original agreement balance and the expected new balance. You would then need to contact the IRS and have the existing installment agreement amended to add the new debt. I you owe 50k or less you can go to An official website of the United States government Type installment agreement in the search box.

IRS Installment Agreement or IRS tax payment plan can help income taxpayers pay off their tax debt over a period of time in the form of an installment loan agreement. Calling the IRS at 1-800-829-7650. 1 You can call the phone number on your monthly.

Generally you cannot afford to pay your tax bill but can pay it off in monthly installments over a 72 month or less time frame. This video is about applying for an IRS Installment Agreement. There are two options and both are controlled by the IRS.

Taxpayers who suspended their installment agreement payments between April 1 and July 15 2020 will need to resume their payments by their first due date after July 15. And the time you are in an installment agreement does not give the IRS more time to collect. Typically IRS payment plans take five years or less to complete.

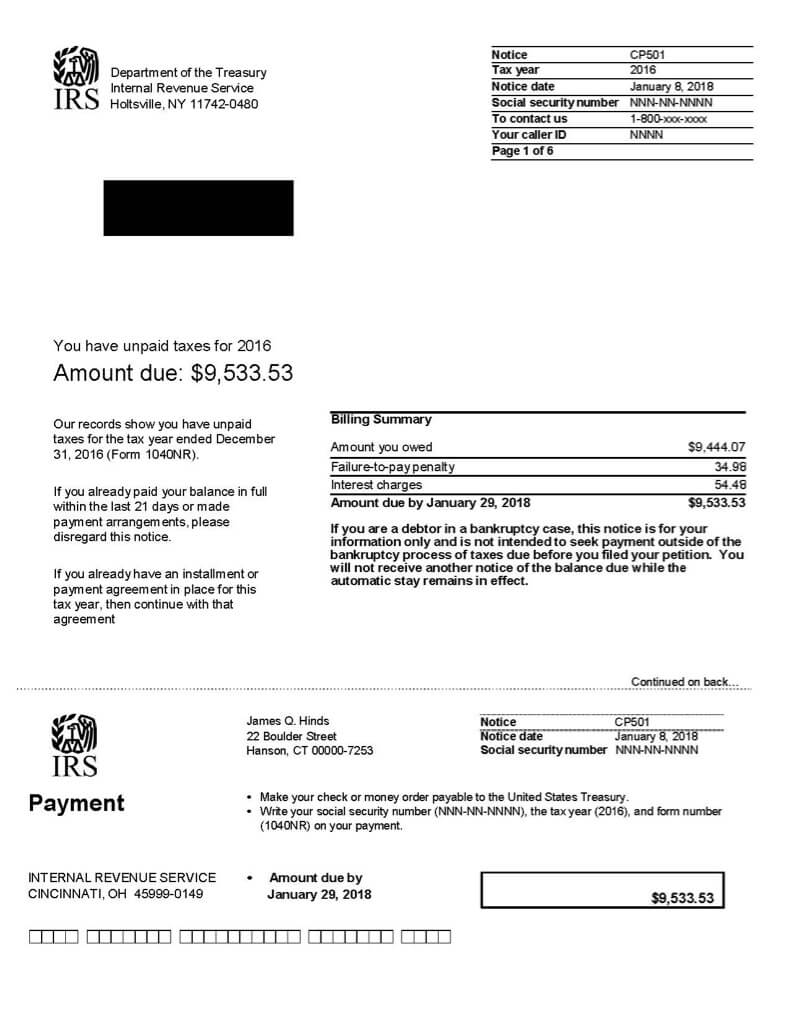

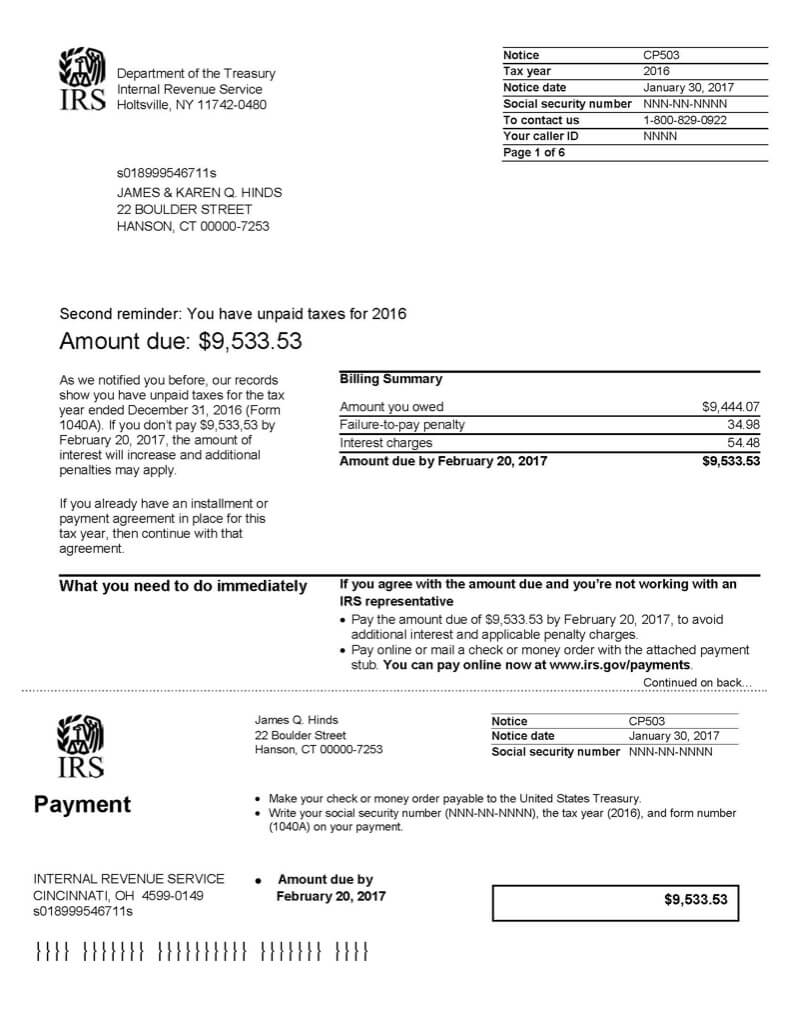

Irs Installment Agreement Setting Up A Tax Payment Plan Debt Com

Irs Installment Agreement Setting Up A Tax Payment Plan Debt Com

How To Setup An Irs Payment Plan Or Installment Agreement

How To Setup An Irs Payment Plan Or Installment Agreement

2020 Form Irs 9465 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 9465 Fill Online Printable Fillable Blank Pdffiller

Https Www Irs Gov Pub Irs Prior I9465 2017 Pdf

Irs Form 9465 Installment Agreement Request

Irs Form 9465 Installment Agreement Request

/9465-700bb91065234917b8d2866f2306afe9.jpg) Form 9465 Installment Agreement Request Definition

Form 9465 Installment Agreement Request Definition

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

3 17 10 Dishonored Check File Dcf And Unidentified Remittance File Urf Internal Revenue Service

3 17 10 Dishonored Check File Dcf And Unidentified Remittance File Urf Internal Revenue Service

How To Set Up An Irs Tax Payment Plan 8 Steps To Consider

How To Set Up An Irs Tax Payment Plan 8 Steps To Consider

Https Www Irs Gov Pub Irs Utl Oc Tax Account Payments Online Pdf

11 Printable Installment Payment Agreement Template Forms Fillable Samples In Pdf Word To Download Pdffiller

11 Printable Installment Payment Agreement Template Forms Fillable Samples In Pdf Word To Download Pdffiller

Https Www Irs Gov Pub Irs News Ir 11 020 Pdf

3 17 10 Dishonored Check File Dcf And Unidentified Remittance File Urf Internal Revenue Service

3 17 10 Dishonored Check File Dcf And Unidentified Remittance File Urf Internal Revenue Service

Https Www Irs Gov Pub Irs Access F433h Accessible Pdf

2020 Form Irs 9465 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 9465 Fill Online Printable Fillable Blank Pdffiller

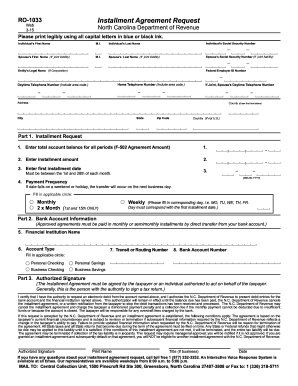

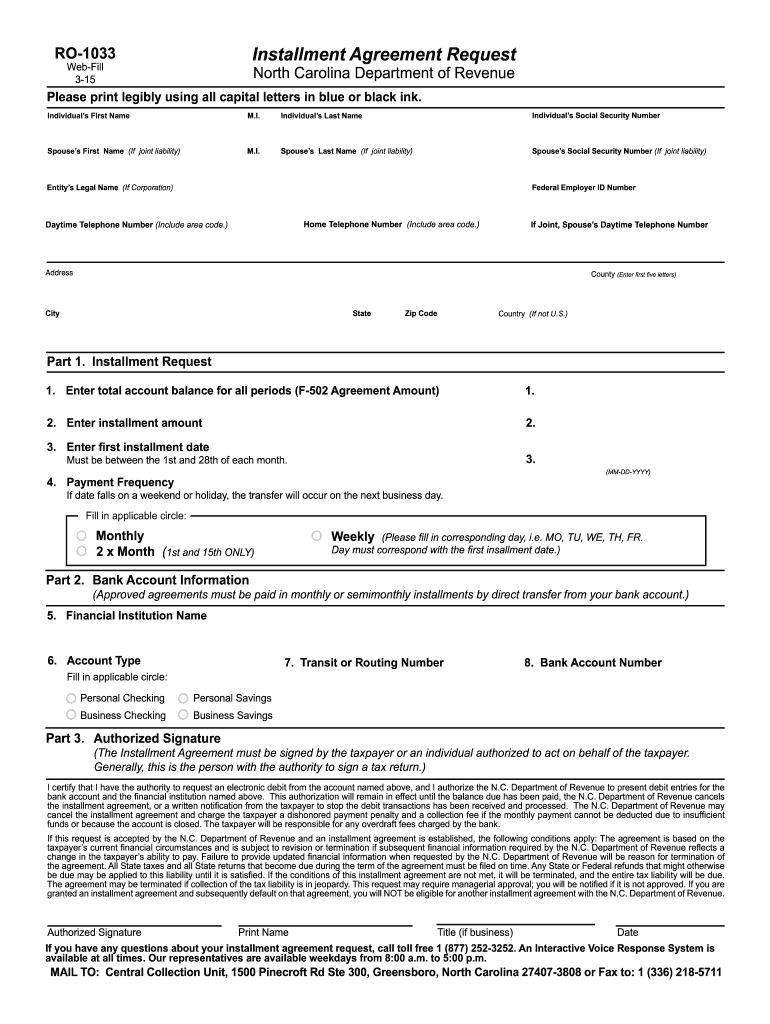

Form 1033 Nc Irs Fill Online Printable Fillable Blank Pdffiller

Form 1033 Nc Irs Fill Online Printable Fillable Blank Pdffiller

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes