Is There A Way To Get Your W2 Without Contacting Employer

The IRS requires tax preparers to keep a copy of your tax records for up to seven years. If your W-2 isnt available online you can choose to have an email sent to you when it is Once we receive your W-2 its stored securely until you come to get it.

What To Do If You Haven T Received A W 2 Turbotax Tax Tips Videos

What To Do If You Haven T Received A W 2 Turbotax Tax Tips Videos

Some preparers may keep your records for a longer period.

Is there a way to get your w2 without contacting employer. Once you find your employer simply follow the instructions to have an electronic online copy of your W-2 form sent to HR Block. Use your last paycheck stub to give them as much detail as possible. If you cant get in touch with your employer to get a W-2 you can reach out to your local IRS Taxpayer Assistance Center TAC.

These websites have search features that enable you to find your W-2 without hassle and with full security. The IRS will also send you a Form 4852 PDF Substitute for Form W-2 Wage and Tax Statement or Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc along with a letter containing instructions. After February the IRS will contact the employerpayer for you and request the missing or corrected form.

You may be able to obtain your W2 by contacting your payroll administrator. The W-2 forms typically get there by the end of January but there is a way to get a free copy of your W2 online faster than in the mail. The IRS will use your name Social Security number estimate of wages and estimate of federal income tax withheld to try to help you.

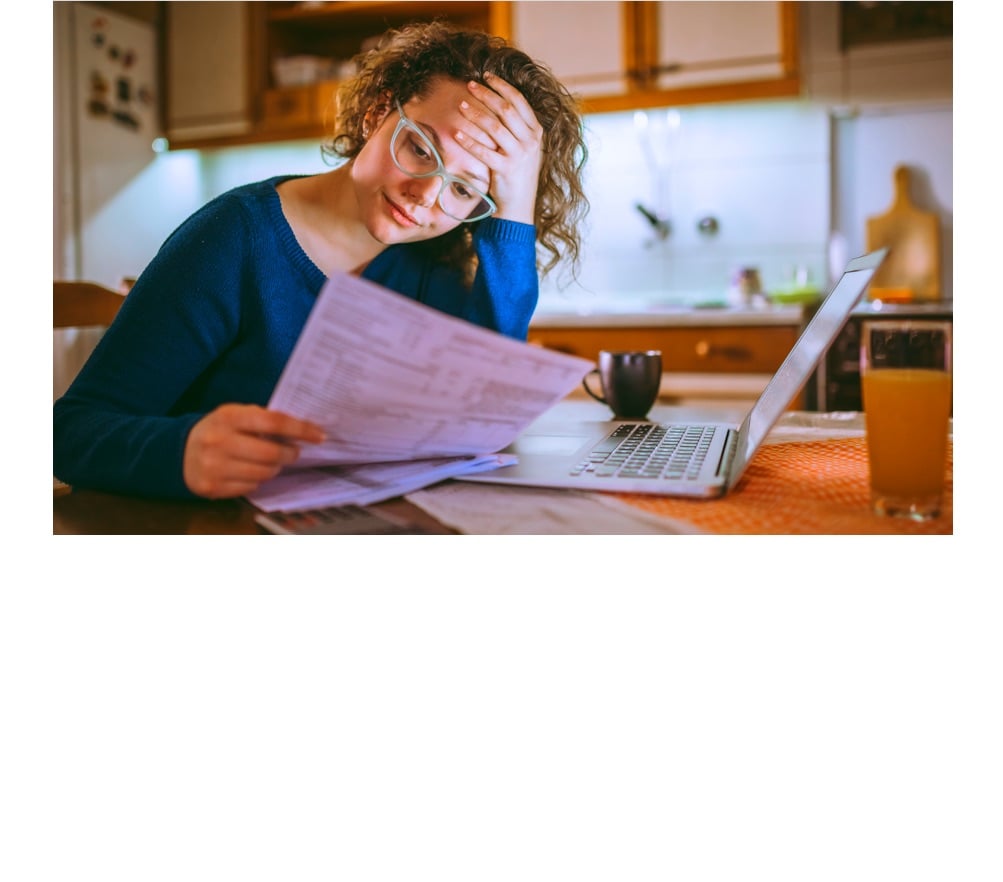

Get a copy of your W2 from a former tax preparer if you prefer not to contact the IRS or dont want to pay the 57 fee. One of the most difficult and frustrating processes you can go through when filing a tax return is to have to wait for your W-2 or any document from a previous employer especially when you desperately need your refund. Before calling them make sure you are prepared to provide them with your name mailing address phone number social security number employers name and address and the dates that you were employed.

Starting in January every year companies mail out W2s to their employees by January 31st the due date set by the IRS. If your former employer is refusing to issue you a W2 you can file an IRS substitute W-2 form on your own Form 4852 using the information from your records. Complete and mail Form 4506 Request for Copy of Tax Return along with the required fee.

You can use this form for. Another way to access your W-2 online is with the help of reputable online tax services like TurboTax and HR Block. If the payroll administrator reports they have already mailed it ask them to confirm the date.

You can file without a W2 if you follow this procedure. How to Get a W-2 From a Previous Employer. While your employer may have a valid reason for the delay such as incomplete records or incorrect personal details you need to know your rights to make sure you get.

Contact your employer to attempt to obtain your W-2. You should first ask your employer to give you a copy of your W-2. W-2s come from your employer and they have until Jan.

You might need to phone email andor snail mail an old employer to make sure they know where to send your W-2. If you cant get your Form W-2 from your employer and you previously attached it to your paper tax return you can order a copy of the entire return from the IRS for a fee. You will also need to verify your current address.

If you still havent received it by February 14 contact the IRS at 1-800-829-1040 and provide as much information regarding your situation as possible. Some employers allow you to import the W-2 through the software but for security reasons you still need information from the actual W-2 to import it. The IRS will then review your information and handle the rest from there.

August 19 2020 Tax Forms. Youll also need this form from any former employer you worked for during the year. If you dont receive the W-2 from your employer by Valentines Day contact the IRS at 800-829-1040 and provide them with your details so they can find your information.

If employers send the form to you be sure they have your correct address. You will need to confirm the necessary details of your employment. 31 to issue it.

You first need to send your employer a registered letter to prove you tried to get your W2. W2 Form How to. You can typically contact them through phone or email.

Signing up with IRS is less convenient than Twitter but anybody with an 8th grade reading level and a web-enabled device can access all of their IRS records for several years in PDF form. Plus they are built to ease every step of the tax filing process. You dont have to contact your former employer to get any forms - W2 1099 1040 - if youre willing to sign up with the Internal Revenue Service site.

What To Do If You Are Missing A W 2 Did You Receive Your W 2 These Documents Are Essential Accounting Services Professional Accounting Bookkeeping Services

What To Do If You Are Missing A W 2 Did You Receive Your W 2 These Documents Are Essential Accounting Services Professional Accounting Bookkeeping Services

A Handy Guide For View My Paycheck Not Working Quickbooks Data Services Paycheck

A Handy Guide For View My Paycheck Not Working Quickbooks Data Services Paycheck

Tips That You Can Check To Compile All Your Employment History Reports Employment Human Resources Resignation

Tips That You Can Check To Compile All Your Employment History Reports Employment Human Resources Resignation

Https Internetnir Blogspot Com 2016 12 What To Do If You Dont Have Your W2 Form Html The W 2 Form Is A Vital Piece Of Info For Most Tax Filers As It Confirms

Https Internetnir Blogspot Com 2016 12 What To Do If You Dont Have Your W2 Form Html The W 2 Form Is A Vital Piece Of Info For Most Tax Filers As It Confirms

Collateral Assignment Life Insurance Policy Sample Form Life Insurance Policy Insurance Policy Life Insurance

Collateral Assignment Life Insurance Policy Sample Form Life Insurance Policy Insurance Policy Life Insurance

Made A Mistake On Your Tax Return 15 Things You Need To Know

Made A Mistake On Your Tax Return 15 Things You Need To Know

How To Get Your W 2 From A Previous Employer

How To Get Your W 2 From A Previous Employer

How To Get Your W2 Form Online For Free 2020 2021

How To Get Your W2 Form Online For Free 2020 2021

When To Expect Your Forms W 2 1099 More In 2016 And What To Do If Your Tax Forms Are Late

When To Expect Your Forms W 2 1099 More In 2016 And What To Do If Your Tax Forms Are Late

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Replacing A Missing W 2 Form H R Block

Replacing A Missing W 2 Form H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

How To Get Your W 2 From A Previous Employer

How To Get Your W 2 From A Previous Employer

Dj Business Kit Disc Jockey Business Forms Dj Business Etsy In 2021 Power Of Attorney Form Dj Business Printables

Dj Business Kit Disc Jockey Business Forms Dj Business Etsy In 2021 Power Of Attorney Form Dj Business Printables

How To Get Your W2 Form Online For Free 2020 2021

How To Get Your W2 Form Online For Free 2020 2021

The Islanders Blog 6 Things We Learned About The Irss Fight Against Fraud And Identity Theft Identity Theft Customer Service Strategy Tax Refund

The Islanders Blog 6 Things We Learned About The Irss Fight Against Fraud And Identity Theft Identity Theft Customer Service Strategy Tax Refund

:max_bytes(150000):strip_icc()/FormW-94-d634d707ffee44839b5a46c998bd71aa.png)