Do Incorporated Companies Receive 1099

1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd. We have attached a blank W-9 for your convenience.

The 1099 Decoded The What Who Why How 1099s Small Business Finance Small Business Bookkeeping Business Tax

The 1099 Decoded The What Who Why How 1099s Small Business Finance Small Business Bookkeeping Business Tax

However there are exceptions so understanding the laws pertaining to taxes can help make sure you follow some very important rules.

Do incorporated companies receive 1099. The major exception to the 1099 requirement is payments to corporations. Or Ltd are also exempt from 1099 requirements with the exception of those you pay for medical or health care or law firms that youve hired for legal services Those corporations that have filed a S-Corp election with the IRS. An LLC that is taxed as a corporation files different forms that replace the use of Form 1099-MISC.

You do not need to send 1099-MISCs to corporations. The IRS uses Form 1099-MISC to keep track of how much money or other benefits the LLC has paid an independent contractor subcontractor or other nonemployee. This payment would have been for services performed by a person or company who IS NOT the payors employee.

Most corporations dont get 1099-MISCs Another important point to note. Send a W-9 to the CompanyIndividual - the form has a box for the Company to check if they are incorporated. Instructions to Form 1099-NEC.

This will help save taxpayer dollars and allow you to do a small part in saving the environment. If youre wondering Do LLCs get 1099s the answer depends on the type of business structure. However a few exceptions exist that require a.

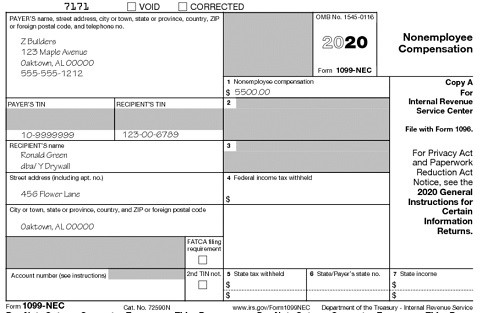

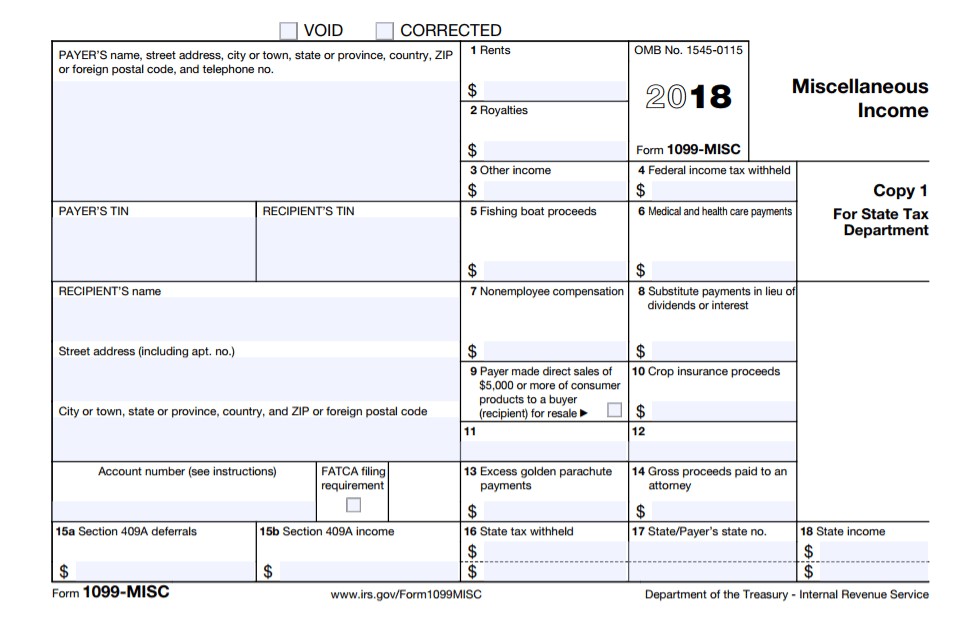

Use form 1099-NEC to report payments to independent contractors. Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each person in the course of your business to whom you have. All you need to do is register for an account create your profile and make the election to receive email notification through My Notifications and you will be removed from the mailing list.

What is form 1099-G 1099. Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return. File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically.

This includes S-Corporations and C-Corporations. In general you dont have to report payments made to corporations including LLCs taxed as corporations but there are some exceptions described above. But not an LLC thats treated as an S-Corporation or C-Corporation.

You dont need to report payments for merchandise telegraphs telephone freight storage and other similar items. If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. You may begin to receive these documents as a.

Required to issue a. A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made. This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs.

You should get the form. Unless your business operates as a financial institution generally you do not have to report payments made to a corporation on Form 1099-MISC. 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures.

Typically youll receive a 1099 because you earned some form of income from a non-employer source. Most payments to incorporated businesses do not require that you issue a 1099. How do you know if they are incorporated.

If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099. 12711 1050 AM. However if an it is taxed as a partnership the IRS requires it to issue Form 1099-MISC.

You do need to send 1099s to single-member limited liability company or LLCs or a one-person Ltd. Provisions under Which Corporations Must Receive 1099s Banks and other financial institutions must send 1099s to private corporations. Businesses will now file Form 1099-NEC for each person in the course of the payors business to whom they paid at least 600 during the year.

My understanding is that in general people who pay more than 600 per year. Most Limited Liability Companies ARE NOT INCORPORATED so you need to issue 1099s to them. Those whos names contain Corporation Company Incorporated Limited Corp Co Inc.

Due to the high level of administrative reporting for corporations the IRS exempts corporations from needing to receive a Form 1099-MISC. In general sole proprietorships may need to file these but corporations do not. There is no need to send 1099-MISCs to corporations.

You will need to provide a 1099 to any vendor who is a. The exception to this rule is with paying attorneys. To a corporation for work performed such as to contractors etc are not.

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Who Should Receive A 1099 Misc Form Affordable Bookkeeping Payroll Payroll Form Bookkeeping

Who Should Receive A 1099 Misc Form Affordable Bookkeeping Payroll Payroll Form Bookkeeping

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Int Software To Create Print And E File Irs Form 1099 Int Letter Of Employment Tax Forms 1099 Tax Form

1099 Int Software To Create Print And E File Irs Form 1099 Int Letter Of Employment Tax Forms 1099 Tax Form

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Tax Benefits Of 1099 Vs W2 Tax Work From Home Companies Tax Preparation

Tax Benefits Of 1099 Vs W2 Tax Work From Home Companies Tax Preparation

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

1099 K What S The Deal With This New Tax Form Small Business Tax Business Tax Tax Forms

1099 K What S The Deal With This New Tax Form Small Business Tax Business Tax Tax Forms